Today’s market is ideal for us to grab stock-focused closed-end funds (CEFs) paying outsized 10%+ dividends. Here are three (of many!) reasons why:

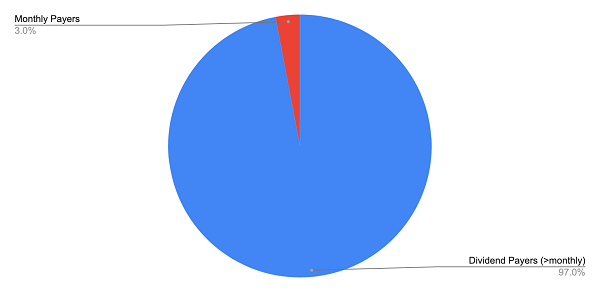

- CEFs’ dividend yields are through the roof: As I just mentioned, many equity CEFs pay double-digit yields today. And as members of my CEF Insider service know, most of these sturdy income plays pay dividends monthly.

- Deep discounts are everywhere: Of the 447 or so CEFs out there, the average fund trades at a 9.6% discount to net asset value (NAV). That’s near levels we saw in the darkest days of the pandemic! It’s totally overdone, which is why …

- Equity-CEF discounts have upward momentum.

Recent Comments