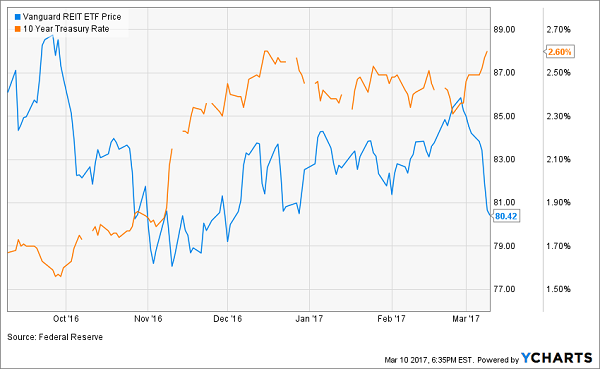

The yield on the benchmark, 10-year U.S. Treasury note has moved above 3% in May, which is the highest it’s been since 2011.

This is notable to REIT investors for multiple reasons. First, higher interest rates (both short-term and long-term) mean that bank CD’s and other lower-risk income investments are offering higher competitive yields.

Of equal note, is the fact that rising long-term interest rates are now factoring into higher discount rates for fundamental valuation models. In other words, investors will now require higher dividends to justify current valuations and be compensated for the rise in rates.

I believe that investors consistently reward growth in stocks, even with more income-oriented groups like REITs.…

Read more

Recent Comments