The “short long-term government bonds” trade must be in contention as one that’s extracted the most money from otherwise smart traders and investors over the past five years. Interest rates just CAN’T go any lower from here – right? We heard this in 2008, and we’re hearing it again today – with bond yields at their lowest levels in 50 years. How much is left in this mega-bull move? Technician Carl Swenlin takes a look at the bond bull…

Bonds Soar

by Carl Swenlin

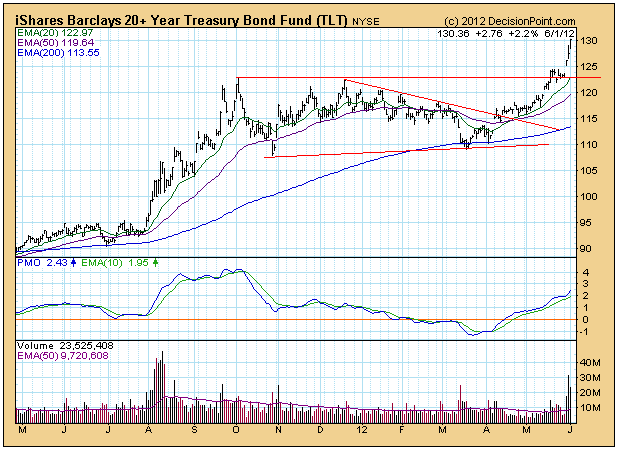

The actual “soaring” for bonds began last July when bonds began an advance of about 33% in two months. After a five-month period of consolidation, another up leg advanced prices about 18% off the bottom of the trading range, making a total advance of about 41% since last July.

(This is a recent excerpt from the blog for Decision Point subscribers.)

This surge was a big surprise to most people, including us, because we wondered why anybody would want to lend money to a country so deep in debt and which was borrowing 42 cents of every dollar it spent. The answer is that the U.S. is the least pathetic of the world’s debtor nations. I have this picture of the sinking Titantic where one end of the ship is lower in the water than the other end, and people are moving toward relative safety on the high end of the ship. The trouble is that we’re all in the same boat and the whole ship will ultimately be under water. It reminds me of an old pilot’s joke. Question: What is the first indication that you have flown into the side of a mountain? Answer: You lose pitot-static pressure. (The pitot tube is that pointy thing that sticks out of the nose of the airplane, and would be the first part of the airplane to make contact with the mountain.) But I digress.

This week TLT punched through the top of a long-term rising trend channel and moved to new, all-time highs. We can see on the weekly chart that price movement is nearly vertical. The PMO is rising and has plenty of room before it reaches the overbought level of its trading range. The picture is very positive, but another period of consolidation will probably begin soon.

Click to enlarge.

As for the upside potential of bonds, let’s take a look at interest rates, which, of course, move in the opposite direction of bonds. In 2009 rates hit their lowest point in over 50 years, and that low is now close to being challenged. We think that rates have the potential to dip down to 2% (the low in the 1940s) and possibly lower. With that in mind, we would guesstimate that bond prices have the potential to move around 20% higher.

Click to enlarge.

* * * * * * * * * * * * * * * * * * * * *

Technical analysis is a windsock, not a crystal ball.

* * * * * * * * * * * * * * * * * * * * *

Carl Swenlin is a self-taught technical analyst, who has been involved in market analysis since 1981. A pioneer in the creation of online technical resources, he is president and founder of DecisionPoint.com, a premier technical analysis website specializing in stock market timing, market indicators, charting, and focused research reports. Mr. Swenlin is a Member of the Market Technicians Association.

Recent Comments