After a record hot start in the first two months of 2019, U.S. stocks cooled off during the first week of March.

Slower economic growth prospects around the globe this week caused global investors to take some risk off the table and shift buying into bonds.

On Monday, China lowered its 2019 GDP growth expectation to 6%-6.5%. The country’s economy grew 6.6% in 2018, which was its slowest rate in three almost decades. Later in the week, China said that exports fell more than 20% in February, marking the worst performance in nearly three years.

On Thursday, the ECB reinstated its targeted long-term refinancing operation (TLTRO), to help stimulate economic growth in the region. Despite several years of low and nearly negative interest rates, GDP estimates have been coming down in recent months for Europe’s leading economies.

Back at home, the February jobs report on Friday laid an egg. Only 20,000 non-farm payrolls were added in the U.S. last month, compared with expectations for 180,000 new jobs. This disappointing result follows two months with big upside surprises, so the underlying trend remains unclear.

Quiet on the Earnings Front

Kroger (KR) was a big earnings-related mover this week, falling 10% a day after quarterly revenue and profit both fell short of expectations.

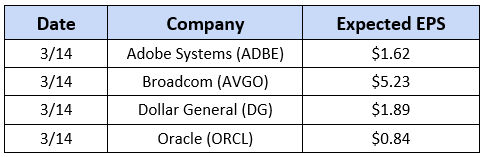

Looking ahead to next week, the earnings calendar is relatively light, save for a cluster of notable names reporting on March 14. It’s worth noting that each of the four companies are expected to post positive profit growth this quarter.

Bull Market Turns 10

March 6 marked the 10-year anniversary of the market bottom during the Financial Crisis. Howard Silverblatt of Standard and Poor’s marked the occasion by calculating that over $20 trillion of investor wealth (including $3.3 trillion of dividends) was created over the ensuing Bull market, which works out to a 17.7% annualized total return.

There’s an old investing adage that “Bull markets don’t die of old age” and we’re not calling in the coroner yet on this one, but there are a couple of interesting market indicators we noticed this week that suggest gains could be harder to come by in the near term.

First, the Dow Jones Transportation Index, generally seen as leading indicator, recently dropped 10 straight sessions. That’s the longest streak in a decade, tying a previous record.

In addition, the Chartcraft Investors Intelligence survey of newsletter writers has seen bullish sentiment increase nine straight weeks, to 52.9%.

This figure is noteworthy for a couple of reasons. For one, that’s the longest consecutive streak for increased bullishness in over 20 years. For another, this reading is seen as a contrarian indicator, with levels over 50% indicating a “sell” signal.

The current Bull Market will end at some point, but speculating about the exact expiration date can cause unnecessary worry for the average investor.

Besides, if you’re nearing retirement or already retired, all you really care about is generating consistent income and protecting your hard-earned nest egg– not whether a company misses earnings expectations by a few pennies, or if global economic growth is keeping up with market valuations.

The good news is: there’s a better way. My colleague Brett Owens has created an “8% No-Withdrawal Portfolio” that generates steady income and impressive capital gains.

Thanks to his work, you no longer have to settle for low bond yields, or stocks like Kroger that can fall as much in one day as they pay in five years of dividends.

Wall Street has tried to address this issue with structured products, such as single premium immediate annuities (SPIAs). But just like the casinos don’t pay for all the glitz and glamour because gamblers usually win, the big financial service firms charge hefty fees to provide you with that steady income.

Instead, Brett’s system could hand you $40,000 a year on every $500,000 invested (in an up market or down one) with under-appreciated income plays like:

- Closed-End Funds (CEFs)– We’ll share our top three CEF picks with you, each of which pay a monthly dividend. Many of these trade at a discount to net asset value.

- Preferred Stocks – Brett lets you know two of the best active managers in this space to invest alongside with.

- Recession-Proof REITs – discover two REITs that actually benefit from higher interest rates today.

That’s 7 contrarian investment picks just to get started. Click here for instant access to the full 8%, No-Withdrawal portfolio.

Recent Comments