A three-day holiday may be just what the U.S. stock market needs. Investors turned more defensive in the last week of trading before Summer kicks off on Monday with the Memorial Day holiday.

Traders bought bonds this week, pushing rates lower, while selling stocks. The trade war between China and the U.S. heated up again and investors were spooked by reports of slower growth in Europe. UK Prime Minister Theresa May also said on Friday that she will step down in June, after failing to execute a Brexit strategy in the past three years.

Elsewhere, crude oil posted its worst one-day performance for 2019 on Thursday, though remains 25% higher year-to-date.

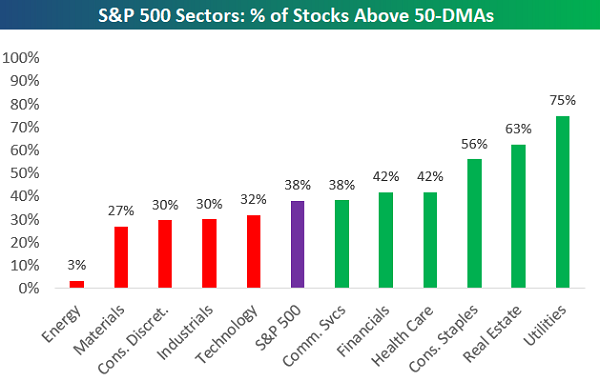

To put in perspective what kind of week it was, the Dow Jones Utilities Average set new record highs this week. Real Estate names have also been strong lately, on the back of lower interest rates. The following chart from the Bespoke Investment Group shows just how well these generally higher-yielding, defensive groups are faring, relative to beaten-down sectors, like Energy and Materials:

Source: Bespoke Investment Group

Retail Sector Driving Individual Moves

Many investors were looking to the Retail sector to deliver decent earnings this week, but the majority of names missed the mark.

Kohl’s (KSS) was one such firm that disappointed the market, sending shares down 12% in one day. Urban Outfitters (URBN) was another 10% earnings-related decliner, while L Brands (LB) provided a rare ray of sunshine in the group. The operator of Victoria’s Secret and Bath and Body Works stores gained 13% the day following strong quarterly results.

Elsewhere, Qualcomm (QCOM) fell 11% a day after receiving a negative ruling in a federal anti-trust case.

Short Holiday Week

In a holiday-shortened week, Costco (COST), Dell (DELL) and Gap (GPS) are all scheduled to report quarterly results next Thursday. On the economic front, we’ll also get a revision to the reading of first-quarter GDP growth. The initial reading last month printed a solid 3.2%.

The U.S. markets will be closed on Monday for the Memorial Day holiday. As the unofficial start of Summer, look for trading volume to be relatively low next week. With a lot of professional investors at the beach, savvy market watchers will keep an eye out for increased volatility that can accompany light trading volume. Contrarian investors realize that volatility often works in your favor, allowing the opportunity to buy/sell at optimal prices and boost long-term performance.

Another thing that Contrarian investors understand is that dividends work in all types of markets. They augment growth in bullish periods and provide a cushion when the bears roar.

But the one time when dividends really pay off, is when interest rates are headed lower, like we’re seeing now.

Chairman Jerome Powell and the rest of the FOMC shifted course in late 2018; a few months ago investors were figuring on multiple interest rate hikes for this year, while the market is now factoring in a 78% probability of rate cut in 2019. This dovish outlook was confirmed by the minutes of the latest Fed meeting that were released on Wednesday.

The trick is knowing which dividends to choose. For example, Qualcomm dropped 11% in one day this week, wiping out nearly three years worth of payouts.

The good news is, there’s a better way.

My colleague Brett Owens has created a portfolio of dividend-payers that have held up well in the recent market sell-off and also provide the kind of yield that’s sorely lacking in this low interest rate environment.

Brett would like to share this “pullback-proof” portfolio of 5 stocks with you, names with an average dividend yield north of 7%.

These are exactly the kind of stocks you want to own now, especially if you’re retired or looking to supplement your income.

The 5 stocks that Brett has found reward investors with dividends that are 2x to 3x higher than what cash and bonds are currently paying in this era of paltry interest rates. 7% yields that will be paid, whether the S&P 500 goes up another 5%, falls 5% or remains flat through the Dog Days of Summer.

In addition to the dividend income, Brett sees potential price upside from these 5 “Steady Eddie” picks. The best part is that these payouts are growing! Consider his top pick of this quintet, a REIT paying an incredible 8.5% dividend that’s DOUBLED in just the last four years.

Want to see more? Our entire 5-stock “pullback proof” portfolio is waiting for you now. Click here to get full details on these “must-have” retirement plays: names, tickers, buy-under prices and the full story on how they generate their outsized dividends.

Recent Comments