Most vanilla investors like to buy stocks that are well-liked by Wall Street analysts.

This strategy, my contrarian friend, we know is a recipe for disaster.

Why? Well, firms that are already popular with stock jocks have nowhere to go but down. Discarded names, on the other hand, are where the action is because these are the next “analyst upgrade” candidates.

These prices have little downside and lots of upside!

It is difficult to find these out-of-favor plays because most analysts wear rose-colored glasses. They know how their bread gets buttered, and that’s with a bullish outlook.

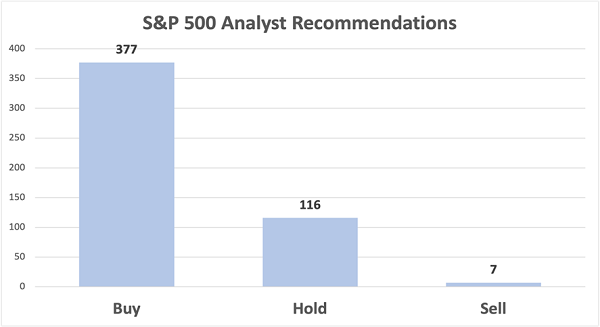

Which is why a Sell rating is so darned interesting to us. Hated names are unicorns in the modern market—even in year two of this bear market!

Seven—count ‘em, seven!—companies in the S&P 500 have sad Sell ratings today:

Source: S&P Global Market Intelligence

This seven, of course, is where we want to look. Imagine what happens when these stocks get upgraded to mere Holds! It will be a party of epic proportions.

If there’s anything I like more than an upgrade from the analyst outhouse to the penthouse, it’s a big dividend. So, let’s combine our two favorite contrarian income strategies today.

Today we have seven massive dividends between 7.8% and 14.6%. Wall Street hates them all! Let’s have a look.

REITs

Wall Street dreads real estate investment trusts (REITs) at the moment, and who can blame them? Jerome Powell’s aggressive interest-rate streak has crushed the sector. Even with higher dividends than the stock-market-at-large, real estate is soundly underperforming the broader market through this bear turn.

REITs Are Getting Wrecked

But has the pros’ pessimism gone overboard?

Likely not with Vornado Realty Trust (VNO, 8.0% yield)—an office-and-retail property giant whose portfolio is concentrated in New York City but also holds assets in Chicago and San Francisco. VNO has absorbed a 1-2 blow of WFH—companies needing less office space, and retail buildings suffering lower foot traffic, because workers are typing away at home—which has cut shares by more than half since the bear market started.

That’s not the only cut Vornado shareholders have suffered. You might remember in January that I said VNO and a few other office REITs could be in danger of a dividend cut. Well, just a week or so later …

“Vornado Realty Trust (NYSE:VNO) announced today that its Board of Trustees has declared a reduced quarterly dividend of $.375 per share. The decrease is in recognition of the current state of the economy and capital markets and is reflective of Vornado’s reduced projected 2023 taxable income, primarily due to higher interest expense.”

That roughly 30% cut to the payout will put Vornado in better financial shape to survive these troubled times, but despite the still-high yield of 8%, a recent cut is a nonstarter for anyone serious about long-term income. So here, I agree with Wall Street, which has just 3 Buys versus 6 Holds and 5 Sells on the stock.

I’m also on board with the lone wolf covering Alexander’s (ALX, 8.9%), a smaller NYC-based REIT with a handful of office and retail properties, as well as an apartment tower. It not only faces the same pressures as VNO—it’s actually managed by Vornado Realty Trust! The only Wall Street rating on ALX is a single sell, but that itself is pretty telling—very little coverage from the major research firms admittedly makes it easy for great values to go undiscovered, but it’s also a worrisome sign that a stock is simply not worth the time. I was down on Alexander’s last summer, and it still looks sickly.

Brandywine Realty Trust (BDN, 13.4% yield) boasts 163 properties with an odd geographical breakdown that includes Philadelphia, the greater Washington, D.C., area, and Austin, Texas. That’s it. Brandywine deals in office buildings, too, but also mixed-use developments, co-working spaces, and research and lab properties. Most of the pros covering BDN are on the fence—the stock has one Buy and two Sells, but four Holds—and tight dividend coverage is a concern. What’s to like here? For one, on the most recent conference call, management stuck by its ability to finance its sky-high dividend. It’s also undervalued based on several metrics, including funds from operations (FFO) and funds available for distribution (FAD).

We can escape the East Coast bias with Hudson Pacific Properties (HPP, 11.3% yield), which leases out office and studio properties up and down the West Coast, from L.A. all the way up to Vancouver. Like with BDN, analysts are largely on the fence—the pros have no buys, but just two sells, versus a whopping 11 Holds. Hudson’s office issues mirror the rest, but it’s also potentially facing a short-term labor-strike hit to its studio business. But asset sales are helping shore up liquidity, and HPP could redevelop an old NFL site as residential, which would help diversify the portfolio.

For Office Properties Income Trust (OPI, 14.6% yield), the red flags are right in the name. This is another office-space REIT, and it’s the most diversified of the bunch, with 160 properties across the U.S.

OPI has 3 Sells against just one Buy, reflecting the mood in office REITs, but while I wouldn’t snap up this stock, some investors wouldn’t bet against it either. Office Properties Income Trust is built differently—a majority of its tenants are investment-grade, many of them are actually government entities, most of its properties are based in suburbs (not cities experiencing a mass exodus), and it boasts a high occupancy rate of 96%. But many local, state and federal employees are still working from home and may not return to the office. Leases are an easy decision: they may be broken early or, at minimum, not renewed.

Non-REITs

Wall Street’s dour outlook isn’t just restricted to the real estate sector.

Consider Prospect Capital (PSEC, 9.7% yield), from the similarly high-yield business development company (BDC) industry. BDCs are a small pond, but PSEC is a decidedly big fish. It has funded more than 400 investments in its nearly two decades of publicly traded life, and it currently boasts some $7.9 billion invested in 130 companies across 37 industries.

Wall Street has largely given up on this name; the pair of analyst holdouts split a Hold and a Sell between them. It’s no wonder why: The stock is a long-term underperformer and PSEC has cut its dividend twice since 2014.

There have been glimmers—net interest income (NII) is trending up of late, and as a result, its dividend coverage is widening. So at the least, this high-single-digit yield is looking safer than it has for some time. Still, PSEC is weighed by high management fees, paid to the same management team that has led most of the underperforming. And while I’d normally get excited about a deep 27% discount to NAV, that’s par for the course for PSEC—this stock is perpetually undervalued, with a payoff seemingly always just out of Tantalus’ reach.

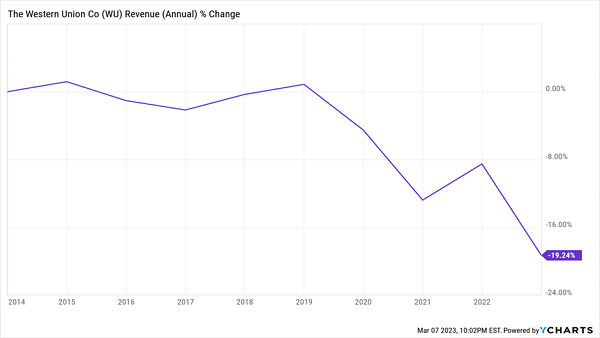

Don’t think regular stocks have been left out. Western Union (WU, 7.8% yield) gets a thumbs-down from Wall Street, too, with two Buys not coming close to offsetting 10 Holds and eight Sells.

Can’t imagine why.

This Is What Secular Decline Looks Like

Technology has come hard and fast for Western Union. PayPal (PYPL), Wise and a host of others have been taking bigger bites out of WU’s lunch each year, causing revenues to bleed from this once-great payments (and telegrams!) giant.

But while Western Union is absolutely down, it’s not necessarily out. The bottom line has actually been trending higher for a couple of years, and the company’s 23.5-cent quarterly dividend accounts for just 40% of profits. One thing that could turn the tide is its heavy investments in the digital business. “Omnichannel” users are particularly lucrative, so growing that cohort could help slow the bleeding.

Give Me 4 Minutes, I’ll 4X Your Retirement Income

Western Union, like a few of these other names, have the potential to put up a surprising earnings report or two and trigger that virtuous cycle of upgrades and price gains—at least for a short while.

But the problem is, most of these companies are walking directly into gale-force headwinds to their core businesses. So while they might be primed for a short-term ride, we can’t depend on them for our biggest goal:

Building those self-sustaining retirement savings.

If we want a cozy, comfortable retirement without bleeding your nest egg dry, we need to be able to plan around our income with laser precision. Which is why we only hold dependable payers in our “Perfect Income” portfolio.

What makes these dividend holdings “perfect”?

- They pay you consistently, predictably and reliably.

- They’re built to survive—even thrive—in market crashes.

- They;re set to deliver double-digit returns, with safe, secure investments.

- They take just a few minutes every month to “manage.”

- They DON’T involve day trading, buying on margin or any other risky strategy.

- They DON’T involve gambling on penny stocks, Bitcoin or buying puts and calls.

Getting each and every one of these things from any single holding might sound impossible. But it’s par for the course for every position in my “Perfect Income” portfolio.

Let me show you the stocks and funds you need to stabilize your retirement. But more importantly, let me teach you more about this incredible strategy itself and make you a better investor in the process!

Take control of your financial legacy today. Click here for my newly updated briefing on the Perfect Income Portfolio!

Recent Comments