We’ve just been handed a unique opportunity to grab 7.9%+ dividends—and price upside, too.

Now it does involve some risk, and you’ll have to be quick to reap the biggest gains (and dividends). But there’s one unsung fund that can help you cancel out that risk—and grab a huge payout, too. More on that at the end of this article.

A Contrarian High-Yield REIT Strategy for Huge Cash Payouts

First up, the opportunity we’re going to dive into today revolves around real estate investment trusts (REITs) that invest in shopping malls and other retail properties.

If you’ve been reading columns written by me and my colleague Brett Owens, you know we’ve been critical of retail REITs, which were being decimated by Amazon.com (AMZN), eBay (EBAY) and other online giants before the pandemic hit.

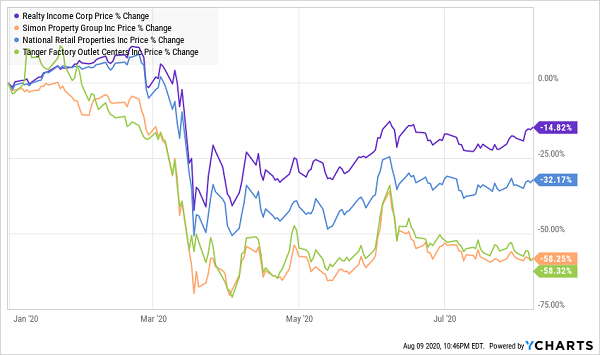

That call was on the money: while the S&P 500 is now positive on the year, major REITs that invest in retail property, like Realty Income (O), Simon Property Group (SPG), National Retail Properties (NNN) and Tanger Factory Outlet Centers (SKT) are still on the mat.

Retail REITs Finally Break

This plunge has set up some high yields in the retail-REIT space. Simon, for example, yields 7.9%. And Realty Income pays 4.5%, which is near multi-year highs for the self-anointed “monthly dividend company.”

But there’s a low-key catalyst that could soon start driving these REITs’ beleaguered shares higher. That, in turn, would push their dividend yields lower (as you calculate yield by dividing the yearly payout into the current share price). So if you have some cash available for more speculative investments, this could be the time to start floating some of those funds into this beaten-up sector.

Let me explain why.

Retail REITs in Normal Times

First, let’s back up. REITs are basically “pass-through” investments: management collects the rent, keeps enough money to pay for maintenance, possibly expansion, and to keep the lights on, then hands the rest to us as dividends.

The lockdowns, of course, put a serious damper on these dividends. Tanger, for example, suspended its payout in May. And if retailers can’t pay rent, there’s good reason to think retail-REIT dividends won’t be back to normal soon. That’s mainly why retail REITs have plummeted—income-hungry investors jumped ship.

But there’s a quiet shift happening here that few people know about: essentially, retail REITs have realized they can’t beat Amazon, so they’re joining it.

A Quiet Trend Develops

As great as e-commerce is, it loses its appeal when you have to wait days to get your order. This is why Amazon started offering same-day delivery in 2015. Since then, it’s expanded this option, which is a main reason why Amazon customers remain loyal.

But how does same-day delivery work?

Amazon can’t transport goods faster than anyone else, as it has the same infrastructure limitations (speed limits on highways, for example). So it relies on a network of storage depots to get around this. In other words, Amazon needs space near where people live. And that’s where most retail REITs have their properties located.

This shift is already in the works: in the last few days, we’ve seen reports of Amazon beginning talks to take over massive spaces once used by Sears and other retail giants of yore. That includes a report in the Wall Street Journal of Amazon meeting with Simon, with an aim to convert some of the mall owner’s department-store locations into Amazon distribution hubs.

The obvious way to buy into this shift is through Simon Property shares. But Simon isn’t your only avenue: many other retail REITs could also be solid options for Amazon.

The bottom line? If these reports are accurate and deals get done, this period could be remembered as a golden age for contrarian REIT investors.

My Top REIT CEF Yields 11% Now. It’s an URGENT Buy.

Remember earlier, when I said there was one unsung fund that lets us minimize the risks in this opportunity, and pays us a huge dividend, too?

That would be one of the 5 income powerhouses in my exclusive 5-fund CEF “instant portfolio,” which I’ll show you when you click right here. This 5-fund combo hands you an outsized 8% average dividend … and it sets you up for double-digit gains in the next 12 months, too!

I specifically want to draw your attention to Pick No. 4, which holds some of America’s steadiest REITs, trades at a ridiculous discount (setting it up for fast 20%+ price upside) and pays you an incredible 11% dividend, too!

This fund also nicely hedges your retail exposure, as just 6% of its portfolio is dedicated to the space. But you’re still getting upside from the fast-growing e-commerce business through its holdings of industrial properties (mainly warehouses) and data centers.

This fund really is an investment unicorn, poised to give you fast price gains and huge dividends—in just one buy.

It’s not supposed to exist, but, well, here it is!

Full details on this REIT pick, plus the other 4 funds in my NEW 8%-yielding CEF portfolio, are waiting for you now. Click here to get the lowdown on all 5 of these dividend machines, including names, tickers, complete dividend histories and much more.

Recent Comments