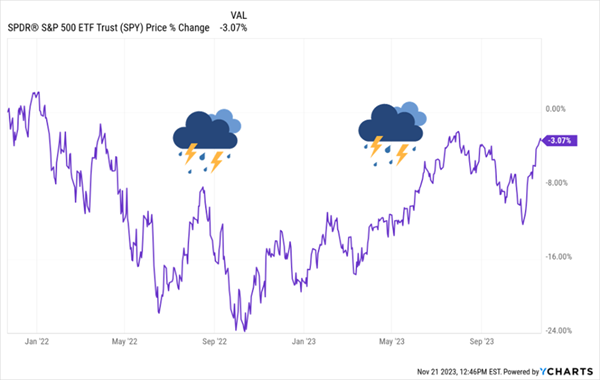

Look, our dividends—and the profits that power them—are set to soar in ’24. So it’s prime time for us to shift our returns away from whipsawing share-price action like this:

A Brutal 2 Years—Capped With a Loss

This is the wild ride folks who bought an S&P 500 index fund have been on over the last two years. And what “thanks” did they get for riding that particular roller-coaster?

A loss! They’re still in the red.

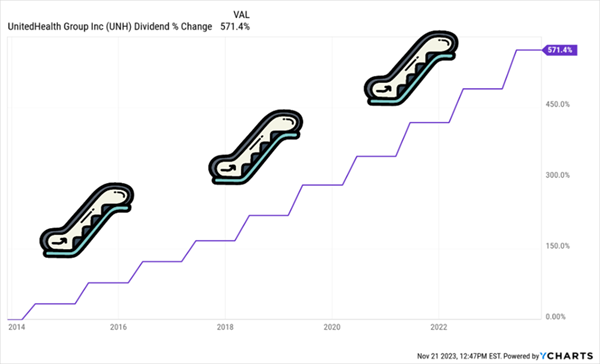

Instead, we’re going to shift our profits toward the smooth and steady hum of dividend growth. Check out this sweet “dividend escalator” from insurer UnitedHealth Group (UNH)—more on UNH in a second—showing the company’s incredible 571% payout growth in the past decade:

The Dividend Staircase We’ll Climb—Starting in ’24

Why Dividends Are Primed for Growth

The upshot here is that almost nobody makes the connection between dividends and share prices. But they should, especially now, because it’s simple to shift more of your return to dividends, and away from volatile share prices, these days.

Consider the looming pop in corporate profits I mentioned a second ago. According to a November 20 forecast from Yardeni Research, S&P 500 companies will see average profit growth of 11% this year, while FactSet has analysts predicting 11.6% growth.

That increase will certainly lead to more dividend hikes for us. But we want to stay clear of misers like Coca-Cola Co. (KO) whose meager one- or two-cent-a-year raises frankly aren’t enough for us to bother logging into our brokerage accounts.

Here are two things we’ll demand from any dividend grower we buy this year:

- Accelerating payout growth: If profits are popping, then dividends must, as well. We simply won’t put up with companies that don’t “share the wealth” with us. Plus, as we’ll see in a second, a rising dividend drives up share prices, a phenomenon I refer to as the “Dividend Magnet.” Rising payouts also boost our yield on cost—or the yield on a buy made now, in other words.

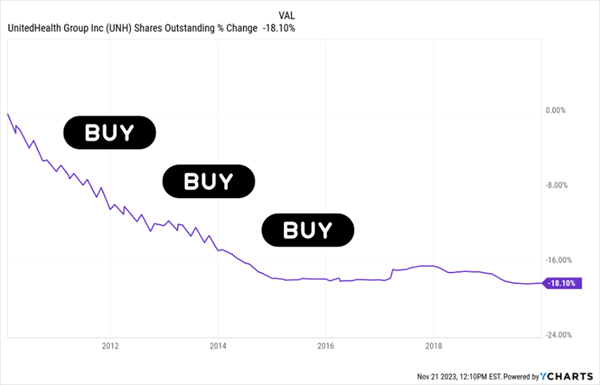

- A healthy share-buyback program, particularly one that was active in the 2022 meltdown. That’s a sign management not only knows the value of buybacks but how critical it is to time them when their stock is cheap.

Bonus points if we can find stocks with “medium-sized” current yields—say 3% to 5%—so our growing payouts can quickly build up our yield on cost.

Buying a stock with this heady mix can lead to serious gains indeed—as we’ve seen over and over again in my Hidden Yields dividend-growth advisory.

UNH: A Prescription for Buyback- and Dividend-Powered Profits

Here’s an example of how these ingredients can blend to give share prices a big boost—especially when you hang on for a period of years and through all market weather.

Back in January 2020, just as word broke of a new virus spreading beyond China, I issued a buy call on UNH in Hidden Yields.

It was the kind of dividend grower we love, growing earnings at a 10% average yearly rate over the preceding decade and sending a healthy chunk of those profits out as dividends: In the 10 years before our buy, UNH’s quarterly payout popped from just $0.03 to $1.08—a 3,500% jump!

Sure, the stock usually only sports a current yield of 1% to 1.5%, but this is a case where you have to look beyond current yield to a company’s dividend-growth history. Let’s say, for example, you bought UNH in early 2010, five years before we launched Hidden Yields.

By now, your yield on cost would be 23%, thanks to that four-digit payout growth.

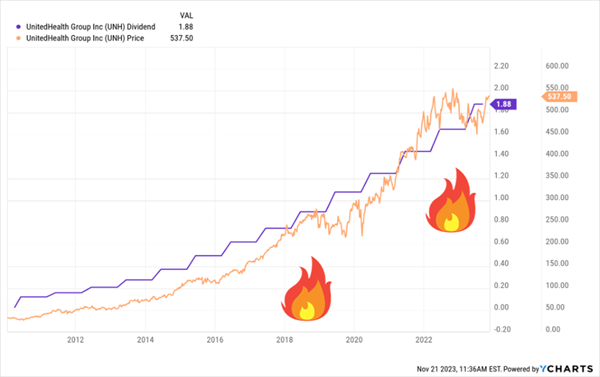

Imagine getting nearly a quarter of your buy as dividends every year. And check out how the share price jumps with every dividend hike. We’ll come back to that in a second:

UNH’s En Fuego Dividend Conjures a 23% Yield, Elevates the Stock

The key driver of UNH’s business continues to be its Optum division, which management had the foresight to found in 2011. Optum provides pharmacy benefits, runs clinics and supplies data analytics and other cutting-edge tech to streamline healthcare.

Business was (and is) booming. In the third quarter of 2023, Optum’s revenue soared 22%; it accounts for more than UnitedHealth Group’s total sales.

Share buybacks? Check. UNH had taken 18% of its shares off the market in the decade before our buy, boosting earnings per share and, indirectly, the dividend, as buybacks leave the firm with fewer shares on which to pay out.

A Decline We Love to See in Our Dividend Stocks

That was enough for us. We bought UNH for Hidden Yields in January 2020 and held it for just under three years, taking profits in December 2022.

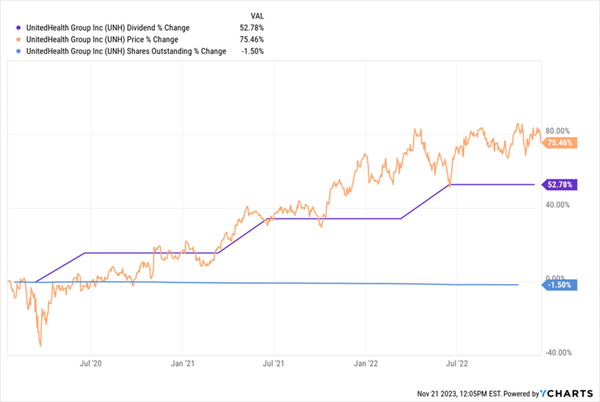

In that time, management juiced the dividend by 53%, driving the share price up in lockstep—and resulting in an 83% total return (with dividends included).

Buybacks and Dividend Growth Powered UNH to a Fast Gain

And as you can see in blue above, UNH took another 1.5% of its shares off the market during our holding period. While that may not sound like much, it’s commendable at a time when many firms were turfing their buybacks and dividend hikes—and some, like the Walt Disney Co. (DIS) eliminated dividends altogether.

All of this is why we re-added UNH to Hidden Yields in February 2023, and we’ve added an additional 8.5% return on the stock since, as of this writing. And with dividends and buybacks likely to pick up with profits in 2024, we’ll get plenty more opportunities to track down the next UNHs, as well.

The Dividend Magnet: The Key to Our Next 23%+ Yielder

As we just showed with UNH, a fast-rising dividend really is the key to big profits in stocks. A surging payout does 2 critical things non-dividend-payers just can’t match:

- Grows our yield on cost, with the best of the best dividend growers getting us to 23%+ payouts over time, and …

- Pulls the share price higher, sending our total returns soaring!

UNH is a perfect example, but I’ve built a full 5-stock portfolio of these “dividend accelerators” I want to share with you now. One throws off a dividend that yields 7% and has grown 36% in the last five years.

The capper? This stock boasts a P/E ratio below four. Four! That’s as cheap as they come. And it’s a deal that can’t last.

Another is a 6.1%-paying smartphone play that’s hiked its payout a fit 49% in the last five years.

I could go on, but the best way for you to learn about these stocks is to read about them yourself. Click here and I’ll share more about my proven Dividend Magnet strategy and give you the opportunity to download a FREE Special Report naming my 5 top dividend-growth picks now.

Recent Comments