Every now and then in income investing, we get a sweet setup where a “boring” high yielder absolutely soars—practically overnight.

I recently saw such a scenario play out with a closed-end fund (CEF) called the BlackRock Municipal Income Fund (MUI). I bring it up now because what happened with MUI has a lot to teach us about how we can get stock-like gains from a so-called “boring” income play like this.

Despite its sleepy-sounding name, MUI is what I consider a “triple threat” investment because it can pay us in three different ways:

- Its dividend, which yields a high 5.5% and has been remarkably stable, even throughout the low-rate 2010s.

- Its tax advantages: Since it’s a municipal-bond fund, MUI’s dividend is tax-free for most Americans. So if you’re in the top tax bracket, that 5.5% could equal an 8.7% payout from “regular” stocks and funds.

- Its closing discount to net asset value (NAV). These markdowns only exist with CEFs: When we buy these funds at unusually large discounts, we can ride along as these deals vanish, driving the price higher as they do.

This is all par for the course for municipal-bond CEFs, and these three points neatly sum up why rich folks—who always have one eye on their tax bills—love these funds.

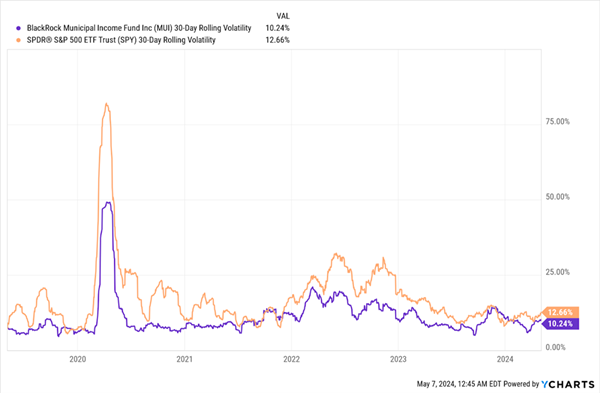

They—and we—also love the fact that muni bonds (which are mainly issued by state and local governments to fund infrastructure projects) are low on the volatility scale, making them a nice cornerstone for our portfolios.

“Munis” Deliver High, Tax-Free Income and Lower Volatility

As you can see above, MUI, in purple, has had less volatility than the S&P 500 for years. But as you can also see, every now and then MUI is more volatile, like late last year. Those tend to be good times to double down, adding to your position when MUI’s income stream is unusually cheap.

How MUI’s “Tender Offer” Slashed Its Discount, Ignited Its Shares

And as I mentioned off the top, every now and then a special situation pops up that can take out a CEF’s discount practically overnight, sending the fund’s market price (and our gains!) higher, too.

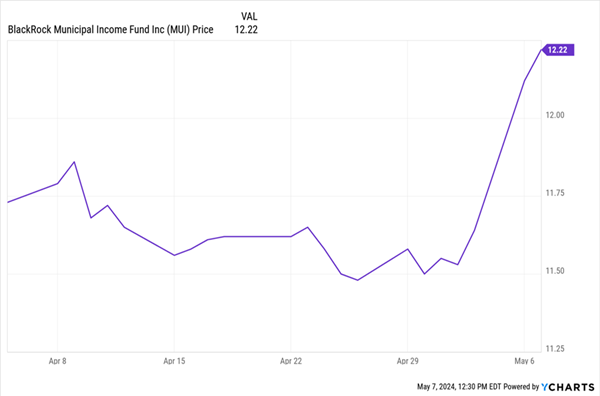

From the morning of Friday, May 3, to the close of trading on Monday, May 6, MUI’s market price shot up 6%—a monster move for a (normally) stable muni fund. The reason? BlackRock announced that it’s converting MUI into a private unlisted fund.

MUI Buyout Ignites Its Shares

While this is a bit complicated, the key point here is that before BlackRock announced the plan, MUI traded at about an 11% discount. As part of the conversion, BlackRock will buy half of MUI’s shares at a 2% discount. That amounts to an instant 10% capital gain for existing MUI shareholders.

CEFs do things like this (it’s called a tender offer) every so often. And now, thanks to BlackRock’s offer, MUI holders who bought at a deep discount can sell at close to the actual market value of the fund’s assets. And they were getting that big (and tax-free) income stream the entire time they held MUI, too.

That does mean that MUI isn’t an attractive buy for the rest of us. But if you’re a long-term investor in the fund, do hang on for a bit longer, unless you need the cash now.

BlackRock’s offer to buy back MUI’s assets for 98 cents on the dollar is a fair (and pretty standard) price for getting cash out of a fund ASAP. It’s helped narrow MUI’s discount, which was 16% at the end of 2023, to just 7.6% as I write this, as BlackRock has shown decisive action in getting investors who want to sell near par the chance to do so.

However, when MUI becomes an unlisted CEF, its market price won’t fluctuate daily, making it less volatile than it currently is. It will also make selling the fund harder, of course, so if you aren’t in for the long term, best to sell now (or better yet, subscribe to the rights offering and sell for 98 cents on the dollar).

Beware the CEF With the “Never-Ending” Discount

This buyout also means the risk of buying assets at a discount that doesn’t disappear in the short term is lower, because future rights offerings for the unlisted fund should help investors get a better price. But that will be more dependent on BlackRock offering those tender offers in the future.

But that risk is much less of an issue than the eternal discounts we see in some CEFs,

like the SRH Total Return Fund (STEW), which essentially turns Warren Buffett’s value-investing approach—and shares of Berkshire Hathaway (BRK.A), a top holding—into an income stream. That strategy hasn’t excited investors, which is why the fund has a long-term average discount of 17.6%. (And its current discount is actually lower than that, at 21.6%).

But not to worry: There are plenty of other CEFs that do have discounts that narrow regularly, so we have lots of other shots at an MUI-style gain-and-high-dividend setup. And when I say those dividends are high, I mean it: The average CEF yields 8.1% as I write this, and many CEFs send payouts our way monthly, too.

4 More Monster Yields Set to Pop on a “Special Situation” Like MUI’s

In fact, I’ve issued urgent buy calls on 4 other CEFs now that are set up to deliver “MUI-style” upside. And while this quartet doesn’t offer the same tax benefits, their average yield is so high (10.2% as I write this), you’ll be further ahead regardless.

As I write this, these 4 funds trade at deep discounts, which is why my baseline forecast is for 20%+ price gains in the next 12 months, to go along with their 10.2% payouts.

But all four are ripe for the sort of special situation we saw with MUI, which would drive those gains faster.

Recent Comments