Usually in a bear market like this, something is working somewhere. But I think you’ll agree that since the beginning of 2022, that “something” has been tough to nail down.

Treasuries are down some 23% on the year. And we know where the stock market has been.

Cash, of course, will always free you from stock- or bond-market volatility. But staying in cash too long leaves you exposed to today’s high inflation. And of course, cash pays zero dividends—and that’s just not an option for those of us looking to fund our retirements on dividends alone. That strategy largely allows you to tune out market volatility, which is why it’s a goal we aim for at my CEF Insider advisory.

Right now, for example, we’re recommending that you continue to hold top-quality high yielders, like the closed-end funds (CEFs) in the portfolio of CEF Insider, which yield north of 8%, on average, with the vast majority of our picks paying dividends monthly.

And despite all the uncertainty, there are some interesting new dividend ideas out there, too, including one fund that yields a rich 12.7% now—and its value rises with rates. And make no mistake, rates are likely to keep rising.

We’re going to delve more deeply into this asset class, and our specific 12.7%-yielding ticker, below. First, let’s dive into today’s rate situation, which is critical to understanding why this fund could be a good addition to your portfolio now.

Floating-Rate Loans Love an Aggressive Fed

While we know that the Federal Reserve is going to raise rates further, as I write this, traders on the Fed futures market now predict rates will rise faster than previously expected, with higher expectations for a 75-basis-point hike at the Fed’s September meeting.

That brings us around to a truly underappreciated asset class: floating-rate loans, which rise in value when rates head upward.

The reason why is simple; these loans have variable interest rates, so when rates rise, so does their income, and thus their value on the secondary market (yes, floating-rate loans are bought and sold on the open market, like stocks, but it’s a much smaller market, usually full of big Wall Street banks).

It isn’t easy to buy individual floating-rate loans, but there is a fund that not only houses a bundle of them, getting you diversification and a hedge against the Fed, but boasts that startling 11.6% yield we discussed off the top.

It’s called the Saba Capital Income & Opportunities Fund (BRW), and it’s a CEF that puts at least 80% of its capital into floating-rate loans at all times. In a tough year for all assets, BRW has defied gravity and eked out a small profit for 2022, up about 1% as of this writing. But that’s not what’s really exciting about the fund.

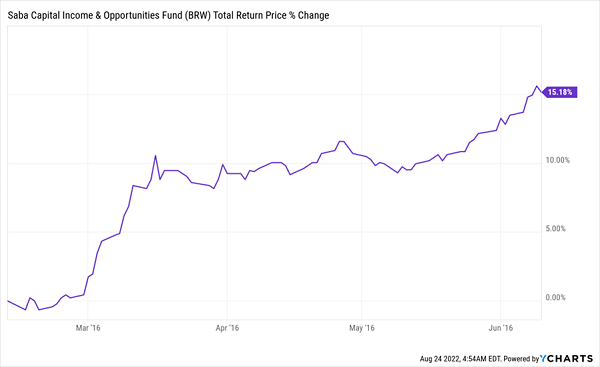

Usually, shortly after the Fed starts raising interest rates, a fund like BRW soars. In fact, it did precisely that back in 2016. A few months after the Fed started raising interest rates in that hiking cycle, it posted a 15% return in just four short months.

The Fed Hikes, BRW Soars

Looking at the chart, and listening to the Fed strongly hint at more aggressive rate hikes, today feels a lot like mid-2016—a time when scooping up BRW resulted in strong profits. I expect history to repeat (or at least rhyme) this time around.

There’s an added bonus: the discount to net asset value (NAV, or the value of the bonds in BRW’s portfolio). That’s unusually cheap, and makes it possible to get floating-rate-loan exposure at sale prices. Of course, when other investors realize just how well-positioned floating-rate loans are, that discount is likely to dwindle to nothing. While we wait for that to happen, we can collect BRW’s healthy 12.7% yield.

Yours Now: Instant Access to 18 More Overlooked Income Ideas Yielding 8%+

Off-the-radar contrarian plays like BRW are our stock-in-trade at CEF Insider, and right now we’ve got a portfolio full of funds that are well suited for this Fed-driven market.

The 18 buy-rated funds in our portfolio yield 8.7% now, and two-thirds of these bargain-priced plays pay dividends monthly, too.

You get instant access to this entire portfolio with a free trial to CEF Insider. And I want to invite you to “kick the tires” on the service with no risk and no obligation today.

Here’s how this invitation works: click here and I’ll give you my full CEF investing strategy in a special Investor Bulletin. You’ll also get access to a Special Report outlining my 4 top CEFs to buy now and that invitation to try the full CEF Insider service, including our entire 18-buy CEF portfolio.

Recent Comments