As folks who are always on the hunt for high-yield investments, we love 8%+ paying closed-end funds (CEFs).

CEFs, of course, are renowned for those high payouts—and the vast majority pay monthly. No “regular” stocks offer such a potent payout combo.

Best part is, many CEFs are on sale now: Of the 422 tracked by the CEF Connect screener, 372 currently trade at discounts to net asset value (NAV, or the value of their underlying assets).

That’s a great place to start our search for top-notch CEFs because a discount to NAV is basically free money: it lets us pick up, say, red-hot tech stocks like Texas Instruments (TXN), Amazon.com (AMZN), Meta Platforms (META) and the AI darling NVIDIA (NVDA) for less than we’d pay if we bought them on the open market: I’m talking as low as 85 cents on the dollar here.

That’s because of the 15% discount on the Neuberger Berman Next Generation Connectivity Fund (NBXG), which holds all three stocks.

And the dividends! Of the three stocks we just mentioned, only Texas Instruments has a rich payout history. The others yield exactly 0%.

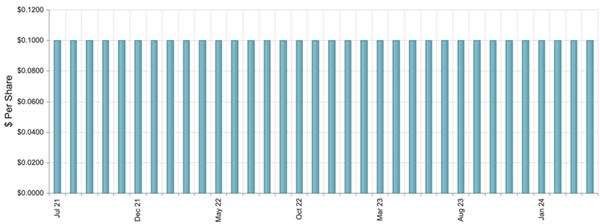

But if you buy through NBXG, you don’t have to worry about that: You get an outsized 10.4% dividend instead. What’s more, that payout rolls out monthly and it’s held steady since NBXG rolled down the skids in May 2021:

A Reliable 10.4% Yield From … Tech Stocks!?

Source: CEF Connect

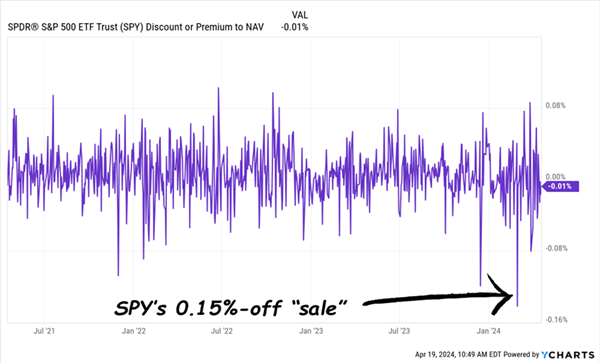

Discounts to NAV only exist with CEFs. Mutual funds and ETFs issue shares whenever they want, fixed each day at NAV. This is why the popular SPDR S&P 500 ETF Trust (SPY) is never cheap:

SPY’s Biggest Discount Is … 0.15%!?

When It Comes to CEF Discounts, Context Is Everything

Unlike mutual funds and ETFs, CEFs have mostly fixed share counts, with their funds trading like stocks. As a result, their shares and per-share NAVs often trade at different levels—and usually at a discount.

But there’s one more piece to the story here, as simply buying a CEF with a deep discount and calling it a day is a recipe of ho-hum (at best!) returns. That’s because, just like some stocks are always cheap (or are cheap for a reason) some CEFs’ discounts never change.

So we need to dig deeper and make sure management, or at least a strong macro trend working in the fund’s favor, can close the CEF “discount window.”

That includes not only looking at the current discount to NAV, but also the current discount in relation to its history.

To see what I’m getting at, consider the AllianceBernstein Global High Income Fund (AWF), a holding in my Contrarian Income Report high-yield investing service.

AWF plays on a far different field than NBXG: It focuses on high-yield corporate bonds and invests in everything from US Treasuries to South African bonds to mortgage-backed securities. It doesn’t mess around with highly graded issues. Less than 5% of its portfolio is in AAA-, AA- and A-rated debt. That’s exactly what we want because it’s easier for management to find value in the junk-bond aisle.

The fund is a savvy play on coming Fed rate cuts. When they (finally!) arrive, the dollar will decline. It always does. And that will light a fire under overseas bonds.

“But Brett,” first-level investors fret. “The inflation boogeyman is back…”

I don’t think so. And even if I’m wrong, it’s only a matter of time before I’m right. Here’s why.

The Fed decides the Fed funds rate, while the bond market determines long-term rates, based on inflation expectations. The Fed may hold short-term rates “higher for longer” now. So what? The more resolute the Fed is, the faster the economy cools, the sooner short rates drop.

Why? A slowdown will cool wage hikes and all the things that boost inflation. Long rates will slump as inflation expectations soften.

That, in turn, will drive down the buck, which, again, is great for overseas bonds. Foreign countries and companies often borrow in US dollars, rather than their own currency. But they still have to service the debt in their own currency, or buy US dollars to do it, and a burlier dollar makes that more difficult.

Thus, lower rates, and with them a lower dollar, are great for overseas bonds.

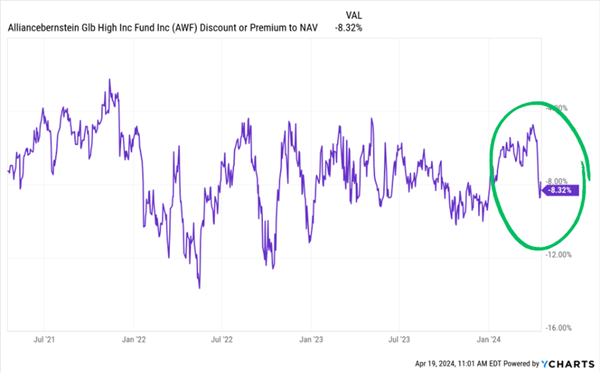

But that’s the future. In the here and now, Fed rate cuts look like they’ll be a bit longer to arrive here in the US. That, and the resulting rally in the greenback we’ve seen in the last couple of months, have pushed AWF’s discount down to 8.3%.

As you can see below, the fund’s discount has been half that (and less) many times in the past—and every dip has been a buying opportunity:

AWF’s “Discount Window” Slides Open Again

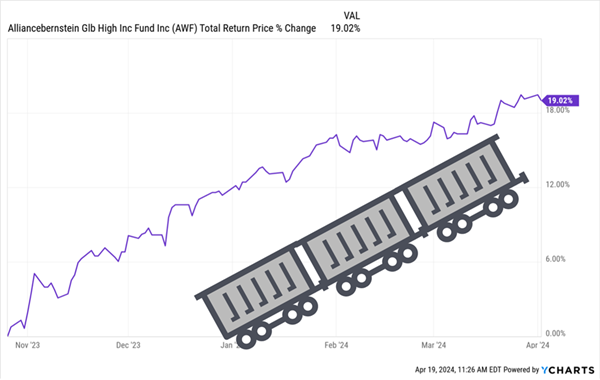

You can see the relationship between AWF’s discount and its return if you look back at October 2023, the last time inflation fears ran rampant.

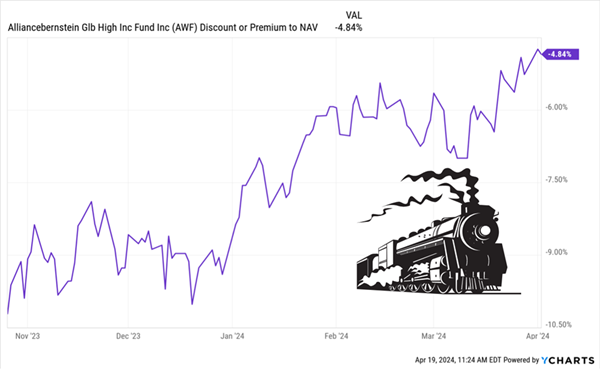

Back then, the fund’s discount slumped to 10.2%, not far from where it is now. From then until April 1, just before this latest panic started, it shrank by more than half, to 4.7%:

AWF’s “Discount Train” Leaves the Station …

That drove the price higher in lockstep, to the tune of about 15%. And when you include AWF’s (monthly paid) dividend, which yields 7.8% today, you get a 19% total return in just over five months.

… Pulling Its Return Along for the Ride

This, by the way, highlights another danger of CEFs—judging them by price returns alone. That’s an easy mistake to make because popular screeners like Yahoo Finance and Google Finance only show price returns.

But because CEFs give us so much of our income as dividends, we have to look at total-return charts to properly judge their performance.

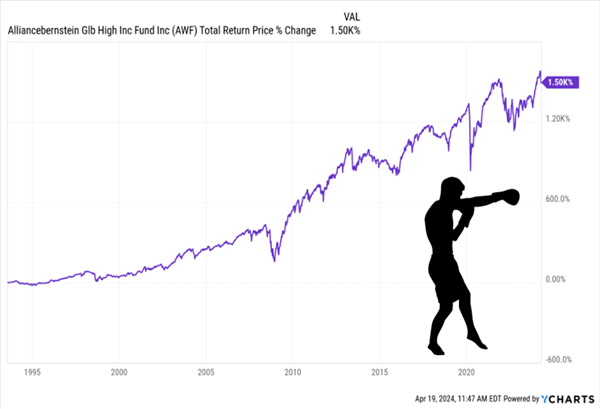

But I’m getting off track here. A couple last words on AWF, which has not only performed well in the short-term but in the long, too, with a 1,500% total return since inception back in 1993.

Global Champ Puts Up Big Numbers

That’s entirely thanks to the expertise and deep connections of the fund’s management team—absolutely vital in the bond world. And with the discount’s recent drop down to that 8.3% level we talked about earlier, we have a nice “second chance” to get in, and profit from those deep connections.

Beyond Bonds: This Complete “Monthly Payer Portfolio” Pays 8%

AWF is the kind of high-yield CEF we need in our income portfolios, but it’s not enough on its own. We need a broad base of CEFs to go along with this overseas-bond champ.

That’s exactly what you get in my “8%+ Monthly Payer Portfolio.” It’s a balanced collection of CEFs from across the economy, including top-quality bonds, stocks, real estate investment trusts (REITs) and more.

And I keep a constant watch on it, curating it for you in real-time so we’re always well-positioned, no matter what the economy and markets throw at us.

Recent Comments