If there’s one trap I’ve seen investors fall into time and time again, it’s “chasing yield”: getting pulled in by a high dividend yield and not digging deeper to see if that payout is really sustainable.

An asset class that’s collapsed in 2020—and is now on the verge of vanishing completely—is a classic example of the dangers of getting distracted by a high current yield.

The investments in question are called exchange-traded notes (ETNs), some of which held out the promise of mid-double-digit yields. Unfortunately, these funds—which some folks disastrously confuse with their bigger brothers, exchange traded funds (ETFs)—came with a catch that’s now sending their values to zero.

Let’s take a closer look at this cautionary tale and see what it tells us about some of the traps lurking out there in dividend-land.

ETNs Are Not the Same as ETFs

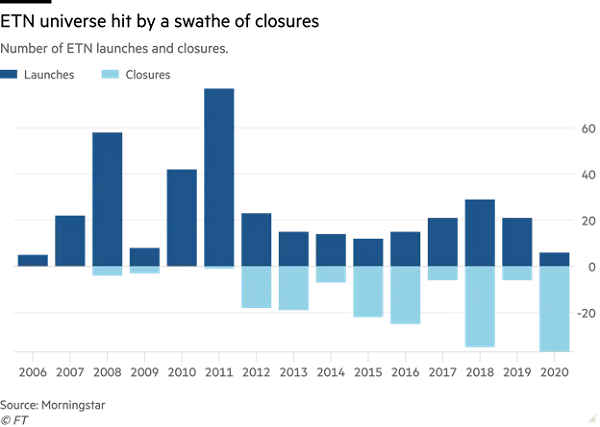

The first difference between ETNs and ETFs is that there are far fewer ETNs out there than ETFs—just a couple hundred ETNs at the start of this year—but, as the chart below shows, that number is dwindling as the amount of assets in ETNs has fallen to its lowest level in a decade.

Source: Financial Times

That’s partly because ETNs are underperforming, but it’s also because many are shutting down.

Source: Financial Times

So far in 2020, 37 ETNs have shut down, or a whopping 17% of the total.

The Financial Times is the latest to report on this phenomenon (and I first warned about ETNs two years ago). Earlier this year, The Wall Street Journal did an in-depth report of some retirees who lost their savings in ETNs, which are issued by big banks such as Credit Suisse (CS) and UBS (UBS).

Trouble is, most investors don’t read the fine print when they buy ETNs—and that causes them to miss ETNs’ biggest problem: they’re structured in a way that lets the banks that issue them shut them down if their value falls too low; this clause is usually buried in the ETN’s disclaimers.

Here’s how I explained it back in 2018, when I was writing about the now-defunct VelocityShares Daily Inverse VIX Short-Term ETN (XIV):

“Credit Suisse is shutting the fund down. They can do this because it’s an ETN and not an ETF, and an ETN doesn’t hold the assets it’s betting against. The ETN was a credit product—essentially, shareholders of XIV were giving Credit Suisse a loan, and the value of that loan was based on a theoretical but nonexistent basket of VIX futures the ETN didn’t actually hold.

When the VIX spiked in early February, those futures became worthless, so Credit Suisse shut the ETN down, locking in investors’ 96% losses.”

Fast-forward to today, and the ETNs that remain are in rough shape.

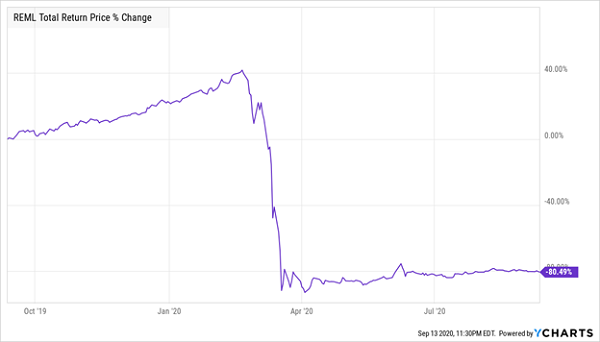

Let’s take as an example Credit Suisse’s X-Links Monthly Pay 2xLeveraged Mortgage REIT ETN (REML), which pays an 18% yield. That means you could invest $167,000 in this fund and get a middle-class income stream paid to you monthly. A more seductive offer is hard to find. But this is the opposite of seductive.

Massive Losses for Another ETN

Part of the problem is that REML invests in REITs that use leverage to offer mortgages to property owners, then leverages its investment in these leveraged companies! And REML is one of Credit Suisse’s better performing ETNs.

How to Avoid Yield Traps Like ETNs

So what’s our takeaway here?

First, and most important, when we see a double-digit yield, we need to dig deeper and see exactly why that yield exists. Another thing to bear in mind is that if a double-digit yield is sustainable, it likely won’t stay in the double digits for long: investors will discover it and bid its price up, thereby bidding its yield down (because yields move in opposition to prices). The key is to get into a fund when these dividends are overlooked (locking in your high yield) and then hold while the market discovers it and bids its price higher (generating capital gains).

This “high-yield-with-price-gains” scenario happens all the time with my favorite high-yield investments: closed-end funds (CEFs). Take, for example, a CEF called the PIMCO Income Strategy Fund II (PFN), which currently yields 10.6%.

A Big Yield From a Stable Payer

PFN is a corporate-bond fund that has had a stable payout for over a decade, which is how it’s delivered a 9.1% annualized total return over that period. Most of the time, the fund yields around 8% to 9%. But as you can see in the chart above, PFN yielded more than 10% in late 2018 and mid-2019 and is doing so again now as investors oversold the fund in the spring and are slowly correcting their mistake.

Investors’ shift back into PFN is happening in slow motion in 2020, but it is happening. This is why you could snap up PFN now for a sustainable 10% yield—and then, when PFN’s yield falls to around 8%, like it did a couple years ago, you could sell it for a profit and move on to the next fund.

Plus, PFN is a CEF, not an ETN, so PIMCO can’t cancel it just because the market panicked, which means this is a fund you could trust your money with for years to come.

BUY Alert: These 4 Disrespected CEFs Yield 9.4% (and Are Set to Soar)

Disasters like ETNs are exactly why I recommend sticking with CEFs for the part of your portfolio you devote to high-yield investments. As I just mentioned, these funds can’t be closed on a whim, and they pay some of the highest, safest dividends in investing.

Case in point: my top 4 CEFs to buy now. They pay a 9.4% average dividend and boast whip-smart management teams that have nicely positioned them for gains in the new world we find ourselves in, too.

PLUS these 4 funds all trade at totally undeserved discounts to NAV (CEF-speak for saying they trade for much less than the value of the stocks and bonds in their portfolios).

That gives us no less than 3 ways to get paid:

- From these funds’ huge 9.4% dividends. (That’s more than 5 times what the average S&P 500 stock pays!)

- A jump in the value of their well-crafted portfolios, and …

- Even more upside as their discounts to NAV shrink, throwing an updraft under their share prices as they do.

The bottom line? My proven CEF-picking system is forecasting 20%+ price upside in the next 12 months, even if the market only gains slightly from here. And even if these 4 stout income plays simply trade sideways, we’ll still collect their amazing 9.4% cash payouts!

Now is the time to buy these 4 funds, and I don’t want you to miss out. Click here for the full story on each of them—names, tickers, dividend histories, my latest review of their management teams and everything else you need to know before you buy.

Recent Comments