Not many people know this, but you can actually “magnify” the return of a regular stock—just by holding it through a closed-end fund (CEF)!

That’s in addition to getting a much bigger dividend than the typical S&P 500 stock dribbles out: 7%+ payouts are, of course, common in the CEF space.

So how does our CEF “gain magnifier” work?

It comes down to what at first blush seems to be a rather obscure fact: CEFs (which trade on the market, just like stocks or ETFs), generally have a fixed number of shares for the entirety of their lives. That means their market price can be different from their per-share net asset values (NAV, or the value of the stocks they hold in their portfolios).

And when you buy a fund that’s trading at an unusual discount, your gains are magnified because, as the discount disappears and flips to a premium, it amplifies the gains the portfolio makes on its own.

Our CEF “Gain Magnifier” in Action

Let’s look at this with a favorite CEF of ours at my CEF Insider service: the BlackRock Science and Technology Trust (BST). It’s a good example because while it’s classed as a tech fund, it mainly holds the biggest companies in the S&P 500, including Apple (AAPL), Microsoft (MSFT) and Mastercard (MA), so it’s more reflective of the index as a whole than most tech CEFs.

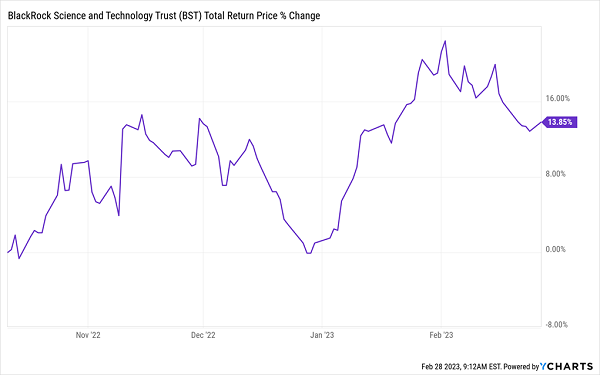

Since the market bottomed on October 11, 2022, BST has returned a healthy 13.9%, part of which was driven by its portfolio of quality S&P 500 names:

BST Gets a Boost From Its Portfolio …

Before we go further, let’s note that this fund yields 9.5% and pays dividends monthly, so anyone who bought in October has already collected a healthy portion of the total return above in cash, to the tune of about $80 a month for every $10,000 invested.

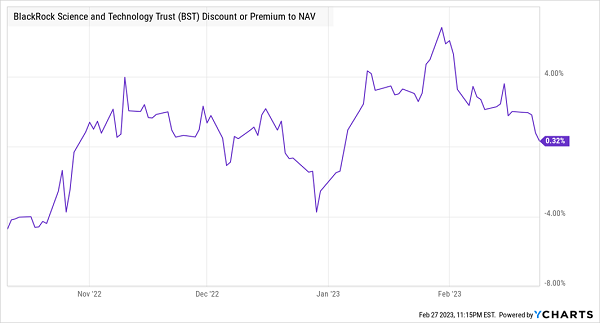

And there’s more going on here than just portfolio gains. Part of this strong return was driven by the fund’s disappearing discount: since October 11, its discount has gone from around 5% to roughly par (it even spiked as high as 6.8% in late January):

… And the End of Its Discount

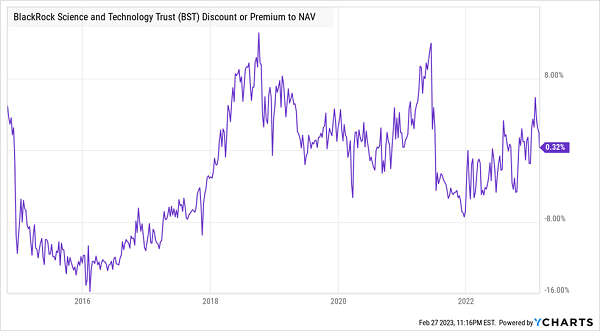

This isn’t the first time BST’s discount has flipped to a premium: as you can see below, the fund traded at or well above par for most of 2019, 2020 and 2021:

BST’s Regular Premiums Are Key to Its Gains

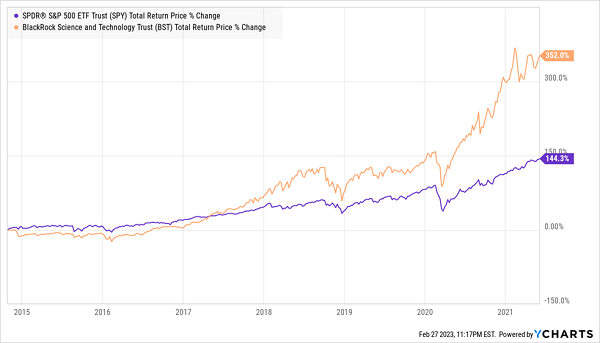

Those premiums were a big part of the reason why the fund strongly outperformed the market in those years. From its IPO in 2014 to 2022, BST returned 352%, as the discount it had from 2014 onwards quickly vanished in 2018.

BST Rides Its Discount to a 352% Total Return

This chart shows us something else that few people consider about CEF discounts: they can tell us when a fund is getting pricey and it’s a good time to take profits. But at a 0.32% premium, that’s not the case with BST today, even though the fund doesn’t trade at a discount currently.

For another way to understand how discounts affect our gains, consider this:

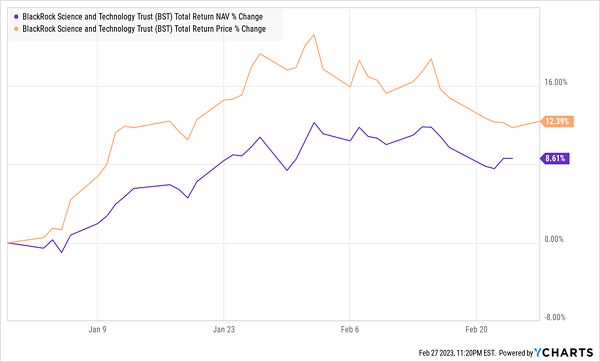

Market Price Outperforms NAV in 2023

I often tell people that CEFs compound returns, which might sound a little confusing, but that’s what you’re seeing in this chart. The value of BST’s portfolio (or its NAV, in other words) has risen 8.6% in 2023, but its market price is up 12.4%. That’s because the fund started at less than a 3% discount and is now trading at a small premium again.

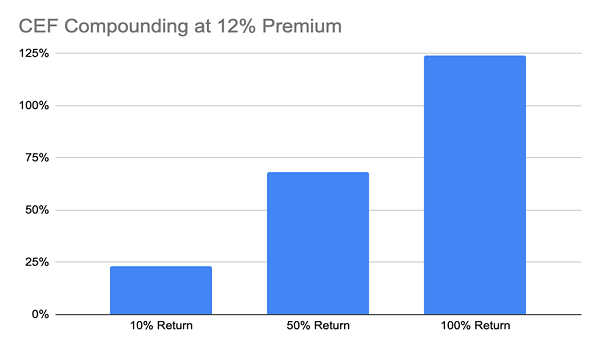

Let’s say the market goes up a further 10% for 2023 (a conservative assumption compared to those of most Wall Street bank economists), and BST’s NAV rises the same amount. Now let’s assume BST’s premium rises to the 12% high we’ve seen previously. In that case, its market price would rise 23%, or more than double the market’s gain.

Source: CEF Insider

And if we hold BST longer and the market goes up 50% while BST’s premium peaks, our return could actually be 68%, a full 18 percentage points higher than the market. If the market doubles? We’re actually up 124%. And you’re collecting a 9.5% income stream while you wait.

This Could Drop a Cool $3,917 Into Your Portfolio Every Month

The benefits of CEFs don’t stop at discounts. Here’s something else most folks don’t realize: the bulk of these funds pay dividends monthly, just like BST.

Monthly dividends are terrific because they give us our dividend cash faster than quarterly payers do, so we can reinvest it faster, too. Plus monthly dividends nicely align with our bills.

To help you zero in on the very best monthly paying CEFs for your portfolio, I’ve released a new Special Report entitled, simply, “5 ‘Must-Own’ Monthly Dividend Funds Yielding 9.4%.”

The 5 funds inside are the key to retiring on dividends alone (which, let’s be honest, is the dream sequence for all investors!). Invest, say, $500K in these 5 proven income plays and you’d generate $47,000 a year in dividends—or $3,917 every month!

Recent Comments