By now you’ve read the headlines about CEOs sounding the foghorn about getting employees back to the office.

“WFH doesn’t work for those who want to hustle”

– Jamie Dimon, CEO JP Morgan

“Be back by Labor Day or “we’ll have a different kind of conversation”

– James Gorman, CEO, Morgan Stanley

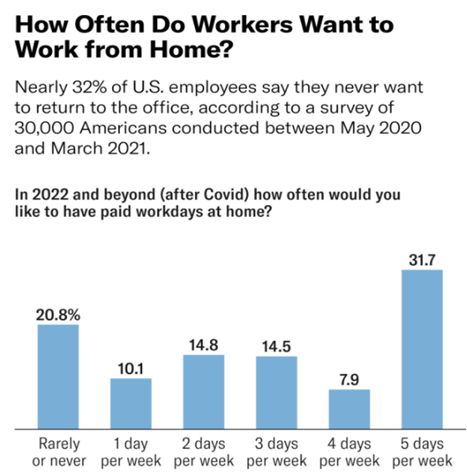

The only problem? Employees don’t want to go back to the office.

Source: HBR

So, the big question: Who wins? The employer or the employees? And how does this impact any potential investments in the Office REIT space which is right smack dab in the middle of this whole tug o’ war.

I think ultimately the employees win and that a more hybrid-oriented approach takes over. The benefits to a WFH work situation are too hard to ignore and anyone that doesn’t offer some flexibility is going to lose big time.

Imagine spending a year and a half completely changing your work routines only to have someone tell you that it was time to revert back to the old way of doing things.

“But we work better together as a team (in the office)” they say. “And face time is important in order to get ahead”…or that hilarious one about how “water cooler talk is great to build the culture needed to move the business forward”. Blah.

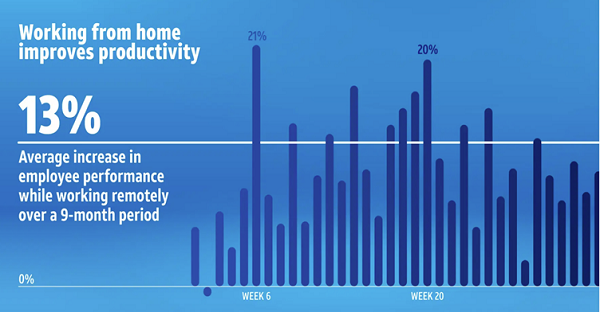

Workers have shown that they are even more productive while working from home than they are when in the office, especially after building successful habits over time.

Source: Quartz

So if workers are happy and more productive – why are CEOs making the big push to get workers back in the office?

While we could argue about some industries just being behind the times (finance especially), I think it comes down to one big important factor.

Companies have invested BILLIONS of dollars in outfitting offices to make their employees happy. And they’ve committed to expensive, long-term leases. To abruptly change course would be detrimental to their bottom line and what they view as an affront to their culture.

Any wonder why Apple, whose massive Apple Park cost an estimated $5 Billion, is so hesitant to adjust its WFH policy?

Source: Arne Müseler

So, knowing that the entire “work in the office” landscape that we’ve known forever has the potential to be permanently impaired, can we still invest in Office REITS?

I think some Office REITS still offer attractive value here both from an income and capital return story. Despite some of the headlines, the facts say that CEOs aren’t looking to downsize: a recent KPMG CEO study said that only 17% of respondents planned to downsize their company’s footprint.

Given where we’ve come from, I‘ll take 17% all day long.

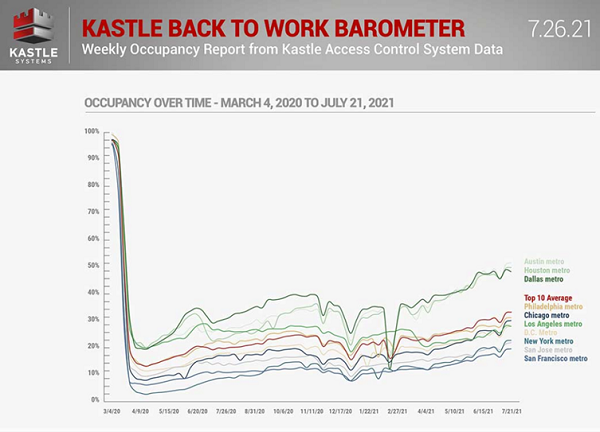

And the trends in occupancy are definitely improving. The Kastle Systems 10 city Back to Work Barometer measured a 34.8% occupancy rate the week ending July 21st.

Thus, the key to now investing in Office REITs is in finding those with high quality, one-of-a-kind properties in geographies or industries where leases should see limited disruption.

Here are three REITs that I think can buck the WFH Trends:

REIT Pick No. 1: A 51% Dividend Grower With Top Tier Properties

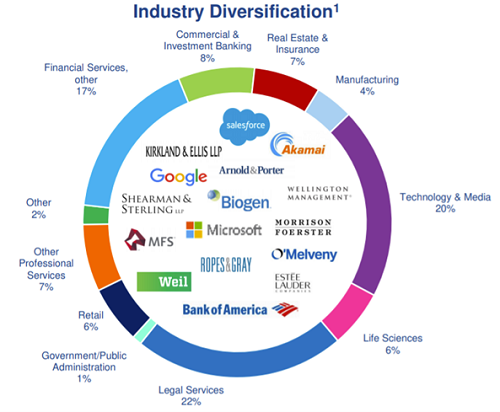

Boston Properties (BXP) is one of my favorite office REITS, namely due to its collection of high profile office properties – which are limited in concentration in any one geography or industry.

The majority of BXP’s properties are what we would call Class A (or top tier) Urban areas Some of its flagship properties include the Salesforce Tower in San Francisco, the Prudential Center in Boston and Kendall Center in Cambridge, MA.

The company has rebounded from pandemic lows but still trades well below the early 2020 levels.

Management has continued to acquire attractive office property throughout the pandemic with some recent notables including Safeco Plaza, an 800,000 square-foot Class A office building in Seattle, and Shady Grove Bio+Tech Campus, consisting of seven buildings totaling approximately 435,000 square feet in the Shady Grove area of Rockville, Maryland.

I really like the company’s diversity across industries, with no significant concentration in any one area. There is also limited concentration across any one client, as Salesforce has the biggest exposure in the portfolio, at roughly 3.5% of overall lease obligations.

Source: Boston Properties Investor Presentation

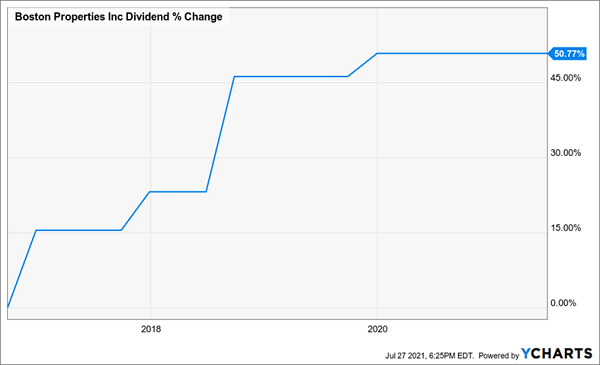

For dividend investors, it is a great choice, and you get the best of both worlds: a strong yield (3.4%) and superb payout growth. Over the last five years, BXP’s dividend has surged 51%.

REIT Pick No. 2: This Life Sciences Office REIT Should Keep Winning

While I like BXP for its industry diversity, I like Alexandria Real Estate (ARE) because of its industry concentration. ARE is entirely focused on the life sciences industry, building what it calls ‘clusters’ of high-quality office properties in areas close to “world-renowned academic institutions”. This leads to a portfolio focused primarily on the Boston, New York, Bay Area, and Maryland areas.

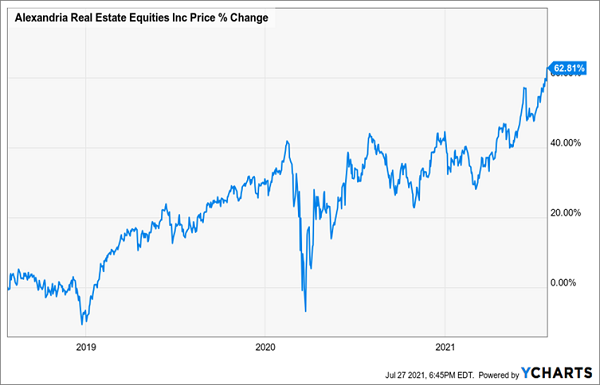

While ARE did experience a ‘COVID dip’ similar to others in the office REIT space, it has since rebounded well above pre-pandemic highs. This is just proof that the life sciences space is probably the one industry that has a high likelihood of staving off any further WFH pressures.

Recent results showed revenue jumped 17% year over year; per-share funds from operations (FFO; the best measure of REIT performance) spiked 9%; and management noted 98% occupancy, an amazing feat in a space where WFH has clobbered other non-life sciences based competitors.

While there is a risk to consider in a REIT that is heavily focused on the biotech space, its portfolio of tenants is a who’s who among life sciences innovators, including Novartis (NVS), Moderna (MRNA), Bristol-Myers (BMY), Merck (MRK) and Pfizer (PFE).

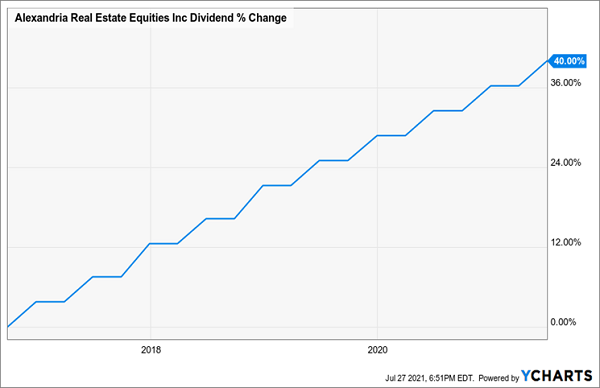

And for dividend investors, there’s more to love. ARE offers a 2.2% dividend yield and has posted an impressive 40% dividend growth over the past five years.

And while its current valuation at 24x forward FFO is a bit on the high side versus industry competitors (roughly 1.2x the industry average), I think the premium is well warranted given the high demand for space in its geographic locations and the surging dividend.

REIT Pick No. 3: This Southern Belt Office REIT Has The Right Trends In Its Favor

The pandemic smackdown on the broader office REIT space has had one of the biggest effects on the New York City and California metro areas, where vacancies have shown a significant drop and a slow recovery.

Corporate relocations and expansion opportunities away from these core markets have led to the likes of Tesla (TSLA), Google (GOOG), and Airbnb (ABNB) finding new office space in areas such as Austin and Atlanta.

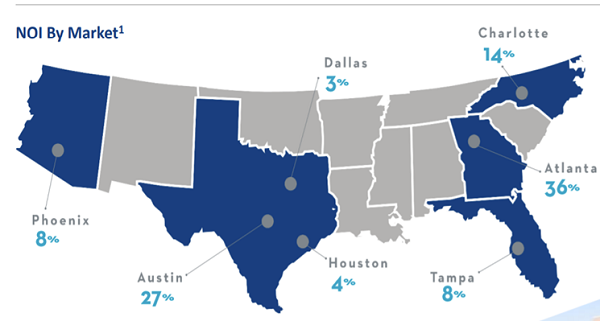

Enter Cousins Properties (CUZ) which owns office space across seven Sun Belt markets, including Tampa and Dallas. The REIT currently generates 36% of its net operating income (NOI) from Atlanta and 27% from Austin — where it controls a significant portion of the class A office market.

Source: Cousins Properties Website

Current tenants include Facebook (FB), Amazon (AMZN) and Expedia (EXPE).

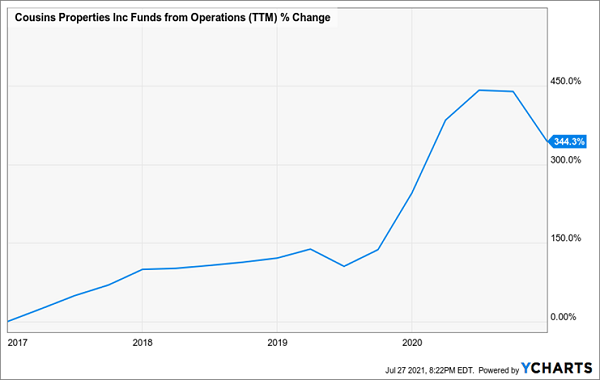

Management has done an excellent job to date growing the company with FFO, or funds from operations more than tripling from 2017 to 2020.

More recent numbers show a decline in occupancy rates at 89.3% below pre-pandemic averages of 91.5%, business has been impacted, but not to the extent of other markets. For example, Manhattan office vacancy rates were over 16% in the first quarter.

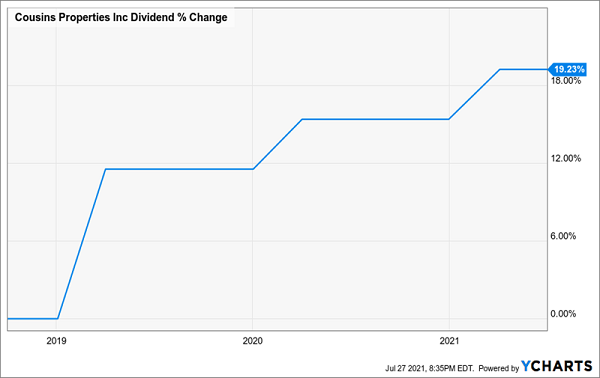

CUZ also pays an attractive 3% dividend yield and has provided roughly 20% dividend growth over the past three years.

CUZ trades at 14x forward FFO estimates, below the office REIT group average of 17.8x.

I think ultimately investors are going to recognize the disconnect and bid up shares of CUZ.

And while I really like these Office REITS for both capital appreciation and dividend growth, if you want dividend superstars with juicier yields, Chief Strategist Brett Owens has you covered there with his 7% Monthly Dividend Portfolio.

As the name says, the stocks and funds in his portfolio pay out a 7% average dividend today, and your payouts come to you every 30 (or 31) days, like clockwork!

That matches up perfectly with your bills. And if you invest, say, a $500K nest egg, you’ll pull in a tidy $2,916 a month. That’s an incredible payout in today’s world, and it could easily be enough to let you retire on dividends alone!

Don’t miss this unique income opportunity. Get the full story on this breakthrough portfolio—including the names, tickers, and his complete research on every stock and fund inside—right here.

Recent Comments