We were inching forward on a busy road in suburban Boston. I looked out our window and asked my friend how much of the retail strip to our right he’d short (if he could).

Joey works for a real estate hedge fund in New York, by the way.

“All of it,” he replied without hesitation.

He paused.

“Sell it all.”

I nodded in agreement. Death by Amazon before our very eyes!

Now you and I don’t normally chat about brick and mortar stores because, quite frankly, who cares about retail stocks. They don’t pay big dividends unless they’re in big trouble, like Macy’s (M) (and its 7.6% mirage yield) right now.

But we do follow their landlords – the real estate investment trusts (REITs) who are required by law to dish most of their income as dividends to us. And if Macy’s is in trouble, that’s trouble for whoever is collecting their rent checks.

That’s why you can’t buy just any REIT – or any index or fund. Take the Vanguard REIT ETF (VNQ) – 18.9% of its holdings are retail REITs. Those are the worst REITs you could own right now.

That 18.9% is sitting right in the path of Amazon.com (AMZN), which is eating big retailers like Macy’s (M), L Brands (LB) and Guess (GES) alive! If these chains are in permanent trouble (which they are), that’s a big problem for their landlords.

Let’s review the rest of the retail landscape as it pertains to real estate. And while we’re at it, let’s pay special attention to REITs that are actually benefiting from the big change in shopping habits.

But First, Sell Retail REITs

As an investment, I don’t like retail REITs. At all.

This is going to be the worst year ever for retail store closures, with 2017 primed to smash 2008’s record of 6,163 store closings. Here are some of this year’s members already in the dubious triple-digit (100+) closure club year-to-date:

- Teavana (379 closed stores)

- J.C. Penney (138)

- Gymboree (350)

- Ascena (268)

- Michael Kors (100)

- Payless (512)

- Bebe (180)

- Rue21 (400)

- RadioShack (1000)

As these tenants turn out the lights for the last time, do you envy any of their landlords?

I don’t!

Beyond a short-term trade, I’m not sure any retail REITs – no matter how cheap – truly belong in a “no withdrawal” retirement portfolio (where you live off dividend alone and never sell any stock to to fund your personal income needs).

After all, the entire point of living off dividends is to take the stress out of stock market investing. And these firms will be scrambling as long as the internet continues to eat their tenants alive.

With delivery services just beginning to take off, I’m not even sure supermarkets are safe. There are countless Uber and Lyft drivers cruising this country looking for someone, or something, to drive from here to there.

Buy Instead: Select Industrial REITs (Like Warehouses)

In the industrial REIT space, fundamentals vary greatly by, well, industry. I’m most bullish on distribution centers and warehouses thanks to the boom in internet shopping and e-commerce.

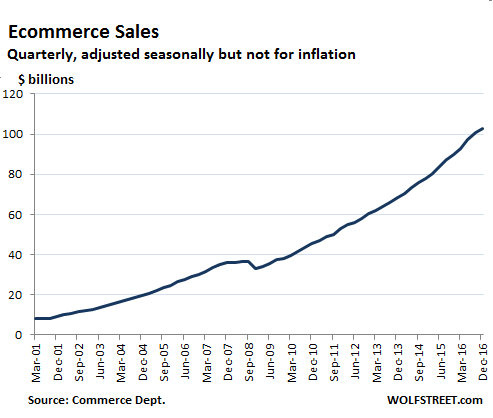

This trend has been gaining steam since the Internet went mainstream. While the Great Recession flattened many business models, warehouse demand has enjoyed a non-stop boom since 2000 thanks to online shopping:

E-Commerce Sales Booming in America

Think about the number of deliveries you receive every week these days. Each package starts in a warehouse somewhere.

The Economist reports that online sellers (including Amazon) will need 2.3 billion square feet of new warehousing to fulfill their increasing order volume. And these firms want their warehouses to be close to big cities (where most of the online orders must be shipped to).

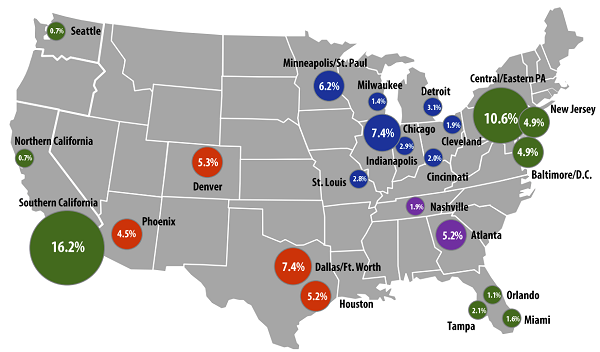

Which means, we want to own warehouses in metro areas like these:

Good Places to Own Warehouses

(Now there are plenty of brick and mortar retail spaces becoming available in these same areas. But they can’t easily be converted into warehouses. It’s like putting in a new restaurant, but on a much larger scale – if the space was used for something else previously, then you have a lot of work to do.)

We’ll talk about the company that actually owns the valuable properties I highlighted above in a minute. This is the firm that builds new warehouse locations, and converts existing facilities into distribution centers.

It’s the best undercover bargain in the sector today because it recently transitioned its own portfolio from industrial buildings into a warehouse powerhouse. First, let’s talk about why investors who buy this stock will double their money every three years.

The Secret to 25%+ Dividend Growth in REITs

When selecting REITs, focus on FFO growth. This single metric is what drives dividend gains (which in turn are the single factor that drive stock prices higher).

Funds from operations (FFO) represents the amount of cash a REIT actually generates from its operations. It’s where our dividend originates – which makes it the building block for everything else in the REIT world.

If FFO is stagnant, a firm can only increase its payout by increasing its payout ratio. And this isn’t sustainable over time.

Rising FFO on a per share basis, on the other hand, will basically force management to raise its dividend. And that’s what ultimately drives the stock price higher, because dividend growth is all that matters for REITs. Figure out where the dividend is going, and you know where the stock price is heading.

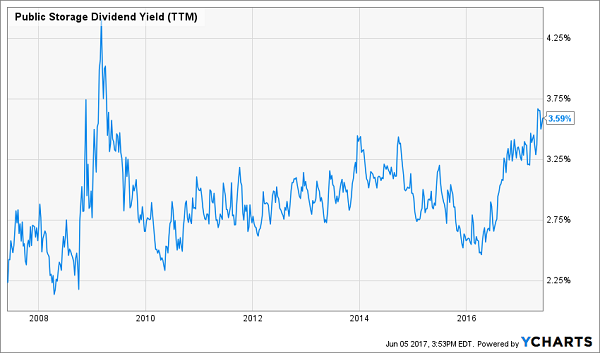

Reason Being, Yields are Consistent Over Time

REIT yields tend to be quite steady over time. For example, blue chip self-storage name Public Storage (PSA) usually pays somewhere between 2.5% and 3.5% (absent a financial crisis):

PSA Pays the Same, More or Less

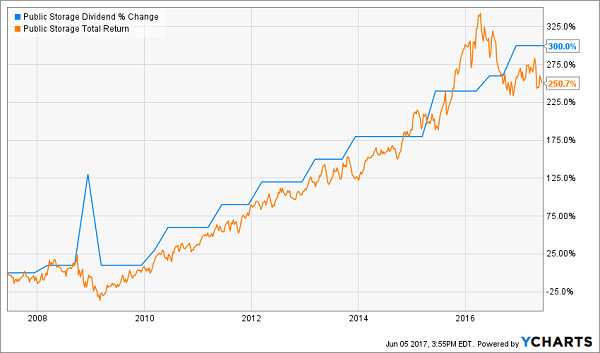

But be careful – just because the current yield goes nowhere doesn’t mean the stock price goes nowhere. In fact, it’s quite the opposite.

Over the last ten years, PSA has increased its dividend by an impressive 300%. Its stock has followed suit, delivering 250% total returns to shareholders!

PSA’s Dividend Drives its Stock Higher

Retail landlord giant GGP (GGP), on the other hand, pays just half the dividend today that it did during its 2007 salad days. The net result? A 47% price loss (-30% even with dividends) for investors over the last decade:

Dividend Down, Stock Down

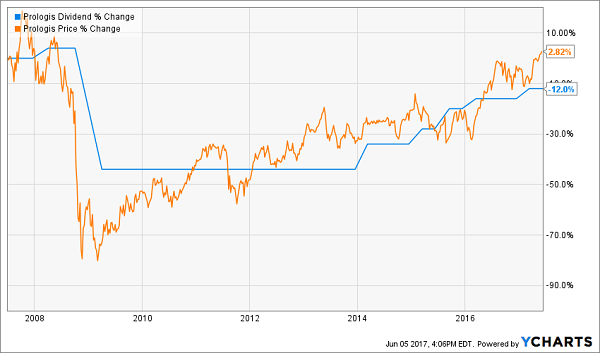

Meanwhile industrial landlord Prologis (PLD) pays about the same dividend it did a decade ago. Its share price has also tracked its dividend – perfectly sideways:

Dividend Sideways, Stock Sideways

REITs can be excellent yield vehicles. But why not buy them for growth too? It is possible to have your dividend and enjoy price upside to boot – and it all starts with rising FFO.

My 7 Favorite Stocks for 25%+ Dividend Growth (Every Year!)

My favorite REIT today owns all of the warehouses I highlighted on the map earlier. They are basically Jeff Bezos’ landlord!

He needs the warehouse space, and is happy to pay higher and higher rents to secure it. That’s why this firm has been able to raise its dividend by 25%+ annually over the last five years.

At this rate, its payout doubles every three years. Which means its stock price also doubles every three years.

Thanks to this mega-trend in online shopping, they should be able to keep raising their rent (and acquiring more and more warehouses) for years to come. Which means shareholders will continue to bank 100%+ gains every few years.

And this company is just one example. I have six more dividend growers dominating similar business niches that are also poised to deliver 12%+ annual profits to their investors for the foreseeable future.

My dividend growth strategy is such a “slam dunk” for investing returns that there’s no reason to collect more current yields than you need right now. If you can “forego” some amount of income today, I would encourage you to consider investing that capital into dividend growers.

It’s a simple three-step process:

Step 1. You invest a set amount of money into one of these “hidden yield” stocks and immediately start getting regular returns on the order of 3%, 4%, or maybe more.

That alone is better than you can get from just about any other conservative investment right now.

Step 2. Over time, your dividend payments go up so you’re eventually earning 8%, 9%, or 10% a year on your original investment.

That should not only keep pace with inflation or rising interest rates, it should stay ahead of them.

Step 3. As your income is rising, other investors are also bidding up the price of your shares to keep pace with the increasing yields.

This combination of rising dividends and capital appreciation is what gives you the potential to earn 12% or more on average with almost no effort or active investing at all.

Which “hidden yield” stocks should you buy today? Well you know me – I’ve got two growth REITs plus five more great payout growers for a total of seven best buys that should safely double your money every three to five years.

It’s a simple formula – their dividends are doubling every three to five years, which means their prices will rise in tandem. At the same time, we’ll collect their dividend payments today and enjoy an even higher income stream tomorrow.

This dividend growth strategy has produced amazing 27% annualized returns for my Hidden Yields subscribers since inception. In two-plus years, we’ve crushed the broader market (the S&P 500 returned 16.5% over the same time period.)

If you achieve returns of 27%, you’ll double your money in less than three years. So if you haven’t been following this strategy, why not? The best time to get started is right now – before these seven dividend growers begin to move higher. Click here and I’ll share their names, tickers and buy prices with you right now.

Recent Comments