When I talk to investors these days, I hear three main reasons why they’re feeling unsettled. All three fears are interconnected (and none of them will likely surprise you!): inflation, the Federal Reserve and the war in Ukraine.

But the funny thing is, these factors are all actually enhancing the appeal of US stocks right now, particularly if we buy them through our favorite income investments: high-yielding (and often monthly paying) closed-end funds (CEFs).

Let’s take a closer look at each of these fears now, then talk about a CEF that’s well suited to the unsettled investor mood these days. It yields 7%, trades at a particularly attractive 6% discount to net asset value (NAV) and boasts a unique strategy that tones down its volatility and strengthens its dividend, too.

Latest Numbers Give a Hopeful Sign on Inflation

We’re all feeling the pinch of high prices, particularly at the gas station and grocery store. But there is some hope in the latest numbers:

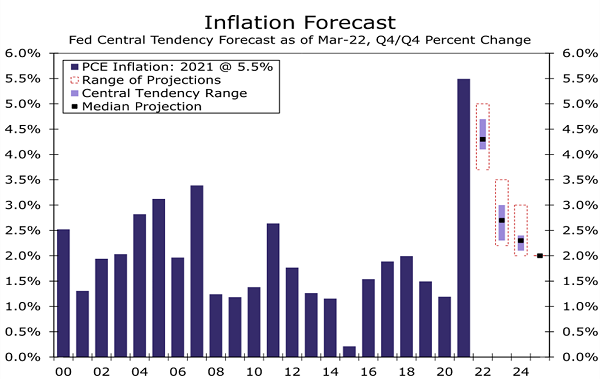

Source: Wells Fargo Economics

To be sure, inflation was high last year, at 5.5%, and forecasts call for 4.2% inflation this year, which, while still high, is down quite a bit from last year—and inflation looks like it will fall further in 2023 and beyond.

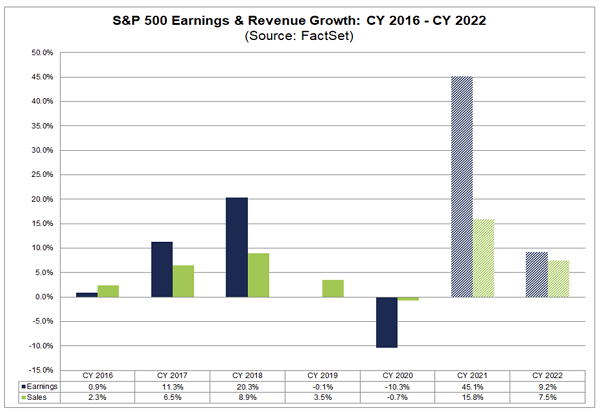

There are several reasons for this, but the most important one is actually bullish for stocks (and by extension equity-focused CEFs): S&P 500 companies have seen earnings skyrocket, even with supply-chain snarls. As you can see below, US corporate profits were up 45% in 2021, which was the best figure in over a decade and far above the norm.

That suggests that some companies are taking advantage of inflation to hike their prices more than necessary. But more people are now saying they’re cutting discretionary spending in response to higher prices, which means there’s not much runway left for companies to keep using this strategy. As the old saying goes, “The cure for high prices is high prices.”

This points to lower inflation going forward, with still-robust profits and sales for US firms as supply-chain problems ease. That’s a healthier, more balanced situation than we’re seeing now, which is all the more reason to buy stocks today (and doing so through a CEF trading at a discount to net asset value, like the one we’ll talk about in a second, gets you two discounts: one due to the discount and the other as a result of the recent market pullback).

Fed Rate Hikes Likely to Hit a Ceiling

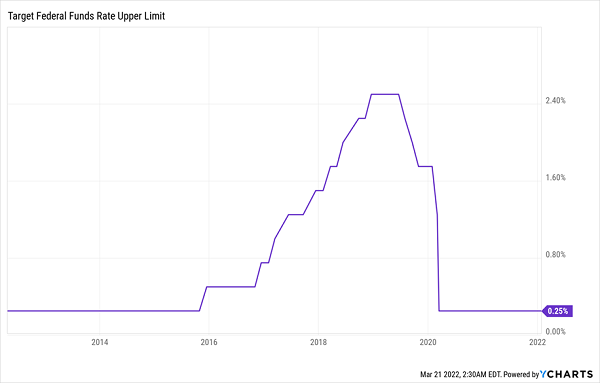

Lower inflation would give the Fed a reason to ease up on rate hikes, making it less likely we’ll see its plan to raise rates to 2% by the end of 2022 and 2.75% by the end of 2023 come to fruition. History gives us another reason why this forecast is aggressive:

A Blast From the (Recent) Past

If rates hit 2% by the end of this year, they’d still be way below where they were in 2018. And while 2.75% is slightly higher than where we peaked in 2019, it’s far lower than the peak in 2006 (5.25%) or 2000 (6.5%).

That gives us a hint that 2019’s rate is a reasonable place for rates to peak this time around, while the peaks in 2000 and 2006 were unsustainably high, particularly when you consider today’s higher consumer, corporate and government debt. The Fed knows this, and realizes it needs to keep rates relatively low, even as it hikes them.

War Highlights the Value of US stocks

Finally, the big one: the war in Ukraine. This is obviously a tremendous humanitarian crisis first and foremost, with plenty of reason to be concerned about the well-being of the three million (and counting) refugees throughout Europe, as well as the brave soldiers fighting in the country.

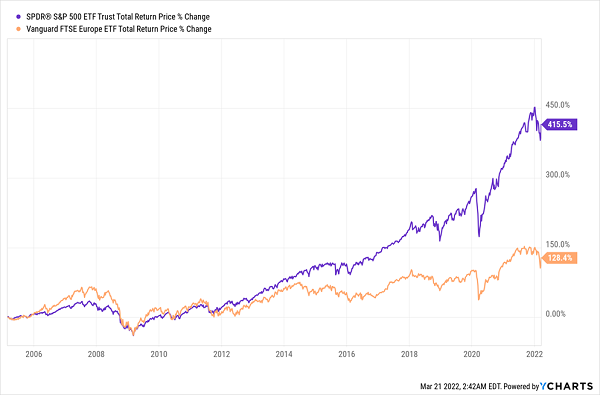

One of the war’s effects on the investment side is that more people around the world are looking for stocks and funds that aren’t closely tied to the volatile situation in Eastern Europe. And that’s leading them to American stocks, which already have a long history of outperforming their European cousins.

US Stocks Offer Growth, Insulation From Geopolitical Risk

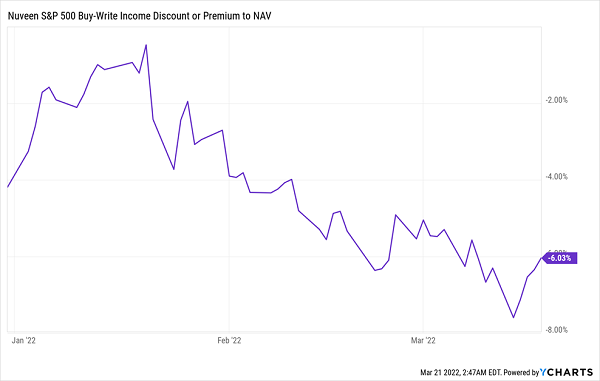

That makes now a good time to buy US stocks, while they’re still attractively priced after the recent selloff. And we can do it while hedging against uncertainty (and giving ourselves that double discount I mentioned earlier) with Nuveen S&P 500 Buy-Write Income Fund (BXMX), which yields 7% today and is cheap, too:

A Bigger Discount Appears

So what about that volatility-reducing strategy I mentioned a second ago? That would be the fact that BXMX sells covered-call options—contracts under which it charges investors for the right to buy its stocks at a higher price in the future. It gets to keep the fees (called “premiums” in option-speak) that it charges investors who buy these options, no matter what happens. That, in turn, gives the fund more of its return in cash, which helps stabilize its portfolio and supports its 7% dividend.

Finally, because BXMX holds the stocks in the S&P 500, you’re getting exposure to the companies least likely to be affected by geopolitical events, like Apple (AAPL), Microsoft (MSFT) and Berkshire Hathaway (BRK.A). Throw in the discount and the 7% dividend and it’s pretty easy to see why this fund is nicely suited to today’s market.

URGENT: My Top 5 Monthly Paying CEFs Just Went on Sale

I just released my top 5 monthly paying CEFs for the next 12 months–and you’ll want to make sure you pick up at least a few of them before their ridiculous discounts disappear.

Together, these 5 CEFs yield 7.9%, and the real story here is their ridiculous discounts, which are so wide they simply can’t last. As they vanish, they’re likely to propel these 5 funds 20% higher on a price basis by this time next year!

And then there’s the income, which you can count on in a crisis. These payouts roll in every 30 (or 31) days, like clockwork. That’s in contrast to BXMX above, which pays quarterly, leaving you to wait three long months for your next payout.

With a fast 28% in dividends and gains on offer here (plus a smooth-as-glass monthly income stream), you do NOT want to miss this opportunity.

But a word of warning: because these 5 monthly payers are smaller CEFs, we can only invite a few investors to take advantage of this opportunity. Too many and we risk moving the price, leaving some folks unable to get in at a discount, which I think you’ll agree isn’t fair.

So make sure you reserve your spot! Click here and I’ll give you full details on these 5 deep-discounted monthly paying CEFs, including their names, tickers, yields, discounts and everything else you need to know.

Recent Comments