With market volatility kicking into high gear, now is the perfect time to talk about one of the biggest questions CEF investors face: how do you know when it’s time to sell a closed-end fund (CEF)?

Unfortunately, there’s no simple answer to that question—and often investors who use conventional sell signals, like a falling market price, will end up selling at the worst time.

That leads me to my cardinal rule with CEFs: it’s easier to know when to buy than when to sell. If the fund is well managed, has a strong track record, is deeply discounted and has a relatively safe dividend, it’s generally a screaming buy. Signs to sell aren’t always so obvious, but they are still there. You just need to know what to look for.

With that in mind, here are three key points to consider when deciding whether to sell a CEF.

No. 1: The Premium is Too High

The first clue that it’s time to sell a CEF is the most obvious: when the fund is overbought, it’s time to dump it.

For instance, take the BlackRock Enhanced International Dividend Trust (BGY), which I recommended to members of my CEF Insider service in March 2017. I chose BGY at that time because its discount had suddenly widened, despite the fact that changes in its portfolio indicated it was well positioned to surge.

The fund did this over the following eight months:

A Fast 20% Return

A big reason for this return: BGY’s unusually large discount of 12% in March steadily closed to a more normal 6.7% in November, when I urged subscribers to sell.

After my sell call, the fund did this:

A Steady Drop

The lesson? Keep track of the discount, and when it gets too narrow (or becomes a premium) relative to its historic average, it’s time to get out of this crowded trade.

No. 2: Pressure on an Entire Sector

Sometimes some outside force will pressure the type of assets the fund invests in. When this happens, sell as fast as possible.

The great thing about CEFs is that, in large part because of their small size and retail-investor base, they react more slowly and over a longer period to bad news than more popular ETFs. This means anyone who keeps up with the news and invests in CEFs has more leeway to respond to the market and sell.

A clear example of this happened with a municipal-bond fund in late 2017: the Invesco PA Value Municipal Income Trust (VPV).

I recommended this fund to CEF Insider members in March 2017 for familiar reasons: a great and reliable dividend yield, strong management and an unusually big discount. And the fund delivered over the next few months, even outperforming the municipal-bond index ETF that tracks VPV’s benchmark:

Cheap VPV Beats the “Dumb” Index Fund

Then a major news event happened in September 2017 that prompted me to release a sell alert: S&P Global Ratings downgraded Pennsylvania’s bonds, and the state did not immediately respond to the market’s concerns.

The combination of a downgrade and lawmakers’ refusal to address it was a crystal-clear sell signal. VPV did this in the five months after we unloaded it:

VPV Takes a Fast Dive

For a municipal-bond fund, this is a big move in a short time. And all it took to avoid this short-term pain was to follow the news and react in a timely way.

No. 3: Get Defensive in a Bear Market

My third point is something that hasn’t yet happened since we launched CEF Insider, although I do believe it is a couple years away: a recession and bear market.

Every investor dreams of avoiding plunges like 2008/09. No one can steer clear of losses all the time, of course, but it is possible to defend your portfolio while continuing to collect the 7%+ dividend streams our CEF Insider picks hand us.

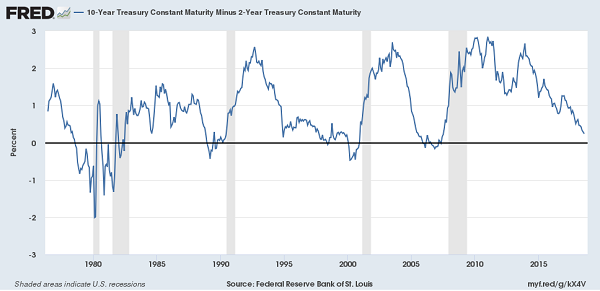

The key is to keep a watchful eye for four economic warning signs: rising unemployment, slower wage growth and consumer spending and, above all, the so-called “inverted yield curve.” That’s when the spread between 2-year and 10-year Treasury yields goes negative; in the past, it’s correctly indicated a recession within the following 12 months.

Below the Black Line Means Danger Ahead

The financial press has spilled a lot of ink about the inverted yield curve recently, because in the last year it’s tanked to its lowest point since just before the 2008/09 meltdown.

But we haven’t seen an inverted yield curve yet. When we do, it’s time to emphasize defensive CEF sectors, especially if it’s accompanied by rising unemployment and falling wages. The appearance of an inverted yield curve is also a very good time to prune weaker CEFs from your holdings, such as those with flaws like the ones I showed you in points 1 and 2.

Fortunately, we’re not in this situation now: incomes are rising at an accelerating pace and unemployment remains below 4%. But I’ll keep a close eye on all the vital economic numbers and keep you updated (including giving you clear instructions on how to respond) in CEF Insider.

My Top 5 Buys for 28% Returns (and 8% Dividends) in 2019

Right now I’m pounding the table on 5 CEFs trading at such ridiculous discounts—made even more ridiculous due to the selloff—that they’re “spring loaded” for 20%+ gains in 2019, as these bizarre markdowns (inevitably) snap back to normal.

That’s not all, though.

Because my top 5 CEFs for 2019 also pay 8% average dividends as I write. Tack that onto our expected 20% gain and we’re looking at a 28% total return by the end of 2019!

Now with the way the markets have been behaving lately, I know what you’re going to say next: “Michael, what happens to these 5 funds if the market tanks in 2019?”

That’s the best part.

Unbeatable Nest Egg Protection

You see, my top 5 funds’ huge discounts also let us sleep well at night. Because if the market falls on its face next year—which, as I just mentioned, is the opposite of what I expect—these funds are already dirt-cheap, so they’ll have plenty of built-in downside protection … and we’ll still collect their 8% average dividends!

These are exactly the kinds of investments you need in times like this, when the Dow regularly drops 2% or more in a single day.

Don’t miss out. Click here and I’ll give you instant access to my top 5 CEFs now, including their names, current yields, ticker symbols, buy-under prices and more!

Recent Comments