What are we dividend investors to make of this presidential election? Are we supposed to buy now or wait to see what happens in November?

Before we get into that—and discuss a 10.7% dividend that’s very appealing pre–E-Day—there’s one thing we must do: set aside our personal politics and stay laser-focused on the investing angle here.

With that said, there are two things I see as likely no matter who wins this thing:

- A post-election rally: According to Deutsche Bank global chief strategist Binky Chadha, stocks typically rally 5% from Election Day until the end of the year when an election is close, regardless of the result. Chadha looked at the 10 close elections since the end of WWII, including the last five votes, and saw a rally every single time.And this vote is close. As far as the prediction markets are concerned, it’s a toss-up. So we should invest assuming that the November results will be a coin flip (perhaps a slightly weighted coin, but a spin of the wheel nonetheless).

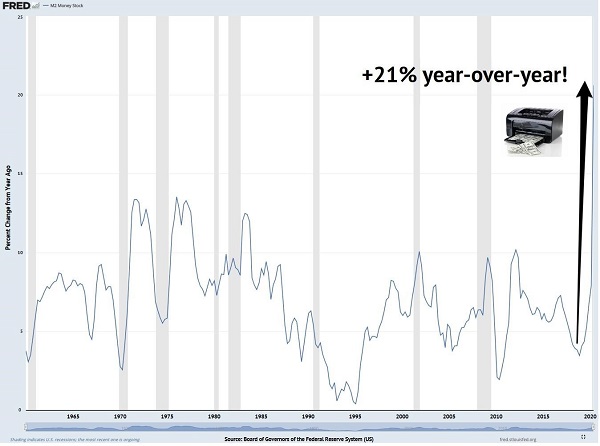

- More Fed money printing bond buying: The Fed has been boosting the money supply at an unprecedented clip to keep the economy alive. And no Republican or Democrat would try to influence the central bank to do otherwise with unemployment sitting at 11%.That means, with fiat money piling up, we could see an inflation surge in 2021. Most folks just aren’t ready—they were lulled into a false sense of security after inflation fizzled following the ’08/’09 crisis. But Jay Powell’s binge makes Ben Bernanke’s look like a church bake sale!

Who Spiked the Money Supply?

So where does that leave us?

With a particularly good setup for one of my favorite dividend investments: high-yielding closed-end funds (CEFs)—particularly CEFs trading at big discounts.

CEFs are great buys at times like these, for two reasons:

- CEFs’ discounts stabilize their share prices: These funds often trade at discounts to their net asset value (NAV, or the per-share value of their portfolios). Those discounts support the share price in a pullback and set us up for outperformance in a rising market—like the one we could see post-election.

- They pay us in cash: There are about 500 CEFs out there, yielding 7% on average. And the vast majority (381, to be precise) pay dividends monthly.

A Discounted CEF “Amps Up” Your Post-Election Gains

To see how a well-chosen CEF could deliver strong gains (and income) post-election, let’s look at what one group of investors pulled off with the Gabelli Equity Trust (GAB).

Run by famed value investor Mario Gabelli, GAB holds many of the stocks you likely own today, Mastercard (MA), American Express (AXP), Texas Instruments (TXN) and Berkshire Hathaway (BRK.A) among them.

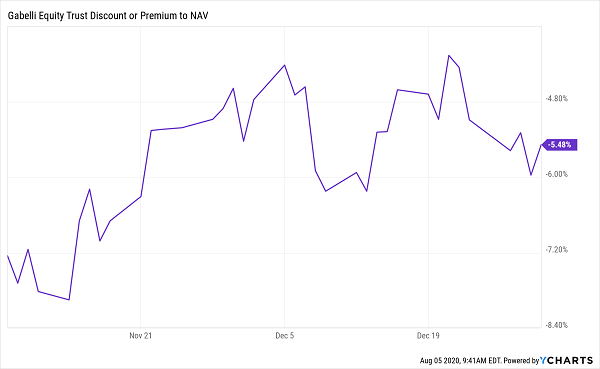

On Election Day 2016, GAB traded at a 7.2% discount to NAV. By December 31, that discount had narrowed to 5.5%.

GAB’s Discount Narrows …

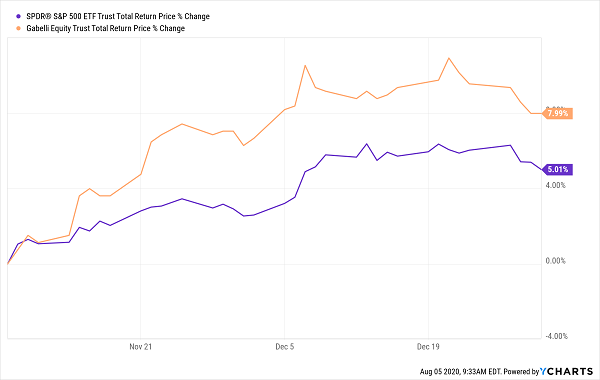

This contraction may not seem like much, but it was enough to easily propel GAB’s market-price return past that of the S&P 500’s from E-Day to December 31, 2016:

… And Lights Up Its Market Price

Fast-forward to today and GAB looks great on the dividend front, with an 11.7% yield.

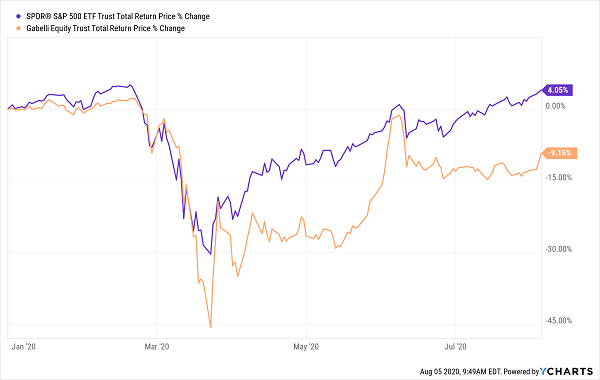

Trouble is, plenty of other folks have caught on—no doubt spurred by Gabelli’s frequent media appearances—so his fund now trades at a 1.6% premium to NAV. That’s undeserved, since GAB has trailed the market year to date; the premium will undoubtedly cap the fund’s upside in any late-year rally:

GAB Investors Overpay for Underperformance

Instead, let’s flip the script with another CEF, the Liberty All-Star Equity Fund (USA).

Like GAB, USA gives us a collection of portfolio mainstays—in this case Microsoft (MSFT), Amazon.com (AMZN), Visa (V) and Facebook (FB), as well as other pandemic-resistant plays like Equinix (EQIX), a real estate investment trust (REIT) that owns corporate data centers.

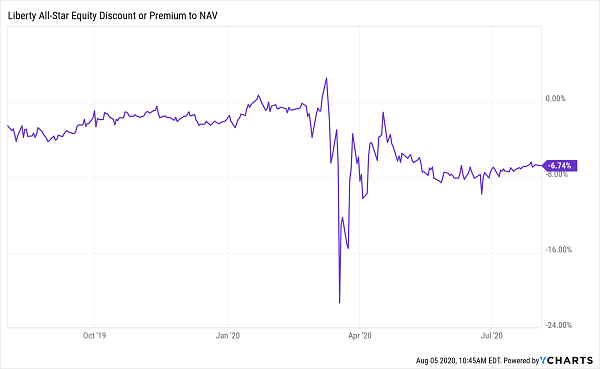

Unlike GAB, USA trades at a discount, 6.7% in this case. And, with the exception of a fleeting moment in June, it hasn’t been this cheap since the depths of the March selloff:

Microsoft and Amazon—for 7% Off the Market Price

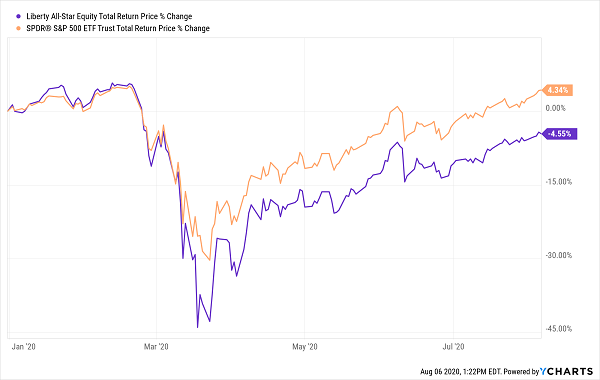

At this point, you might point out that perhaps USA’s discount just may be deserved, as the fund has also underperformed SPY this year—though it hasn’t trailed by nearly as much as the overpriced GAB.

USA’s Underperformance Hides a Critical Truth

But remember that we’re looking at USA’s return based on its discounted market price in the chart above. When we look at USA’s NAV-based return—the real measure of the fund’s portfolio performance—the gap drops in half:

USA’s True Performance Paces the Market

That amounts to hardly any difference on seven months of returns, and USA’s market price has a secret weapon the market lacks: a narrowing discount, which will pull the fund’s price higher as it moves toward par—and eventually into premium territory.

And don’t forget that you’re getting a monstrous 10.7% trailing-twelve-month dividend yield with USA, so most of your return is in cash here. That’s a big difference from your typical S&P 500 investor, who must scrape by on a meager 1.9% average payout and here-today, gone-tomorrow paper gains.

Your Election Profit Plan: 10% Dividends Paid Monthly

Big dividends like USA’s monster 10.7% payout are the answer to surviving pandemics, economic crises, unpredictable elections—just about any market worry you can imagine.

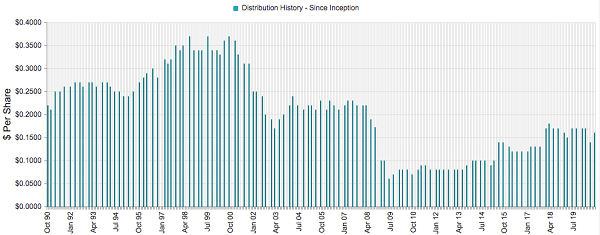

But there’s just one knock on USA that makes me just a little hesitant to put it on my buy list: a quarterly dividend that can fluctuate pretty wildly:

USA’s Moody Dividend

Source: CEFConnect.com

True, the overall trend in the last decade has been up, but it’s pretty tough to plan your retirement income on a payout that changes so frequently.

This, by the way, is not the case with my NEW “10% Monthly Dividend Portfolio.” It’s a collection of proven income plays from across the economy that I’ve hand-picked to do one thing: let you live on dividends alone—and tune out the daily market (and, let’s be honest, political) noise.

Invest $500K in this powerful new portfolio and you’ll trigger a $50,000-a-year cash stream, easily enough income to retire on in many parts of the country. And because these stocks are monthly payers, you don’t have to wait three months for your next payout.

A steady drip of $4,167 (give or take a bit) flows into your account every month!

Plus, you’re nicely positioned for 10% price upside, or $5,000 on your $500K, year in and year out!

The time to buy these incredible income plays is now—before November 3, when history tells us the next rally to start. Go here for full details, including names, tickers and complete dividend histories on the stocks and funds in this cash-spinning retirement portfolio now.

Recent Comments