Ignore anyone who says share splits have no impact on your portfolio (or your dividends!).

They absolutely do set you up for a nice price bump. I’ve seen it time and time again. It’s easy to see why: when a company—especially a top-notch dividend grower—splits its shares, the move draws in folks who’ve been holding off, seeing the pre-split price as too expensive.

Let’s be honest: we’ve all done this. How many times have you avoided a stock because it trades for $300 a share? Or $500 (or whatever your idea of expensive is)? Never mind the really high traders, like Alphabet (GOOGL), at $2,700, or Berkshire Hathaway (BRK.A), for which you have to shell out more than $438,000 for just one Class A share.

I know this stops folks—I hear it from readers of my Hidden Yields dividend-growth advisory regularly—even though we all know a stock’s price on its own doesn’t have much to do with its value. (At best it’s half the equation: for a real sense of value, we need to stack it up next to earnings or, better yet, free cash flow, a cleaner measure of a company’s cash generation.)

“Cheap” Shares: More Fun, Not More Profitable

There are lots of reasons why folks have this hang-up on price.

Some still think of shares in “lots”—and a lot of 100 was the smallest you could buy years ago (even though you can buy any number now, and even fractions of shares with some brokerages).

And let’s be honest—it’s just more fun to buy more shares! Dropping $15,000 to buy just 36 shares of $407-trader UnitedHealth Group (UNH) just feels underwhelming compared to picking up, say, 272 shares of $55-trader Verizon Communications (VZ) for the same $15K.

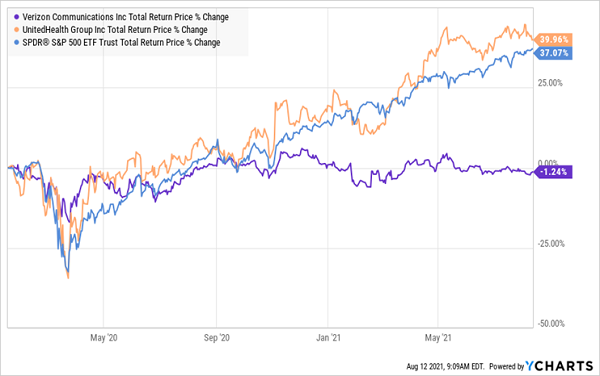

But we need to put this old bias to bed, because high-priced stocks can, and do, outperform: if you sat out UNH (a potential splitter today, as we’ll see in a moment) in January 2020, when it traded at $300, you’d have missed a stock that’s topped the S&P 500 and absolutely crushed Verizon:

UNH Soars Past “Cheaper” Alternative (and the Market)

I’m not pulling this UNH example out of the air—this is the return we bagged in Hidden Yields when we bought the stock in January ’20, “high” price and all. We did it by focusing on UNH’s soaring dividend—a proven gain predictor, as a fast-rising dividend acts like a magnet on a company’s share price.

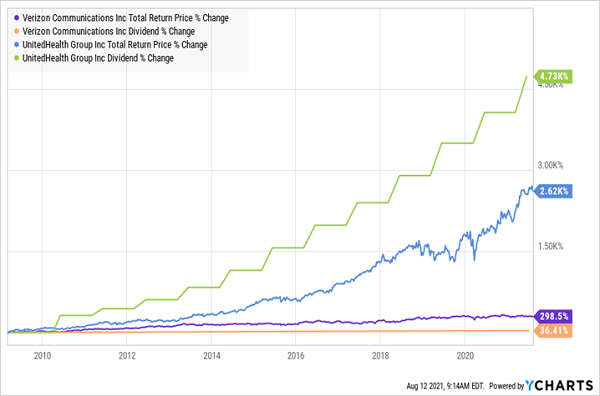

And when it comes to dividend (and share-price) growth, UNH is in a different league. Check out this chart of stock-price and dividend performance from both UnitedHealth and Verizon since the trough of the last financial crisis, in 2008/’09. You can clearly see UNH’s share price getting a lift from its powerful dividend growth, while Verizon’s dividend and stock price troll along at a much lower level:

UNH’s Dividend Ignites Its Stock

Despite this history, UNH’s $300 price at the time still made some folks pause. This is where a split can come into play—and unlock a stock’s value as it pulls in hesitant shoppers like these.

How a Share Split Can Unlock Value

More on UNH in a second. First let’s talk more about splits, which, on their surface, are a wash. Management simply takes every share and splits it on a certain basis—three-to-one, say, or five-to-one. Both the value of your stake and your overall dividends stay the same, even though the number of shares you own multiplies.

We recently saw this happen with another of our Hidden Yields holdings: Canadian Pacific Railway (CP), which we bought in April of 2020 and has subsequently handed us a swift 63% total return.

CP split its shares five-to-one on May 14, 2021. When the markets closed on May 13, our CP shares traded at $400—and when the markets opened the next day, they traded around $80. While this seeming 80% drop can cause a panic attack when you check your account in the morning, it means nothing, as we subsequently owned five times more shares.

That nicely sets the stock up for more growth, as “price conscious” investors take note and buy in. A recent pullback in the shares, due to the company’s struggle with Canadian National Railway (CNI) over control of Kansas City Southern (KSU) also sets it up for further upside (though we’re going to hold on to the shares for now, until the KSU drama plays out fully).

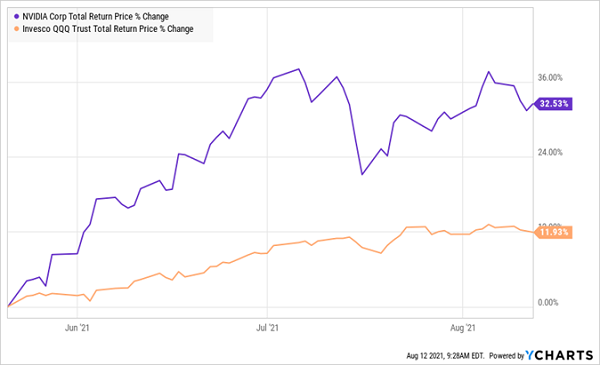

To see the kind of post-split gains we could be in line for, consider what happened to chipmaker NVIDIA (NVDA), which announced on May 21 that it would split its shares four-for-one, with shareholders receiving their new shares as a stock dividend on July 19, 2021:

NVIDIA Crushes the NASDAQ Following Split Announcement

It didn’t hurt that NVIDIA reported record revenue and earnings on May 26, something management was surely aware of when it announced the share split. (That highlights another reason why companies announce splits—to grab attention ahead of good news.)

Stock Splits Are a Bullish Move—But Beware Share Consolidations

Just as share splits are typically a sign of a healthy business, share consolidations are the opposite. This happens when a company’s shares drop so low that management stitches them together to give them a higher price.

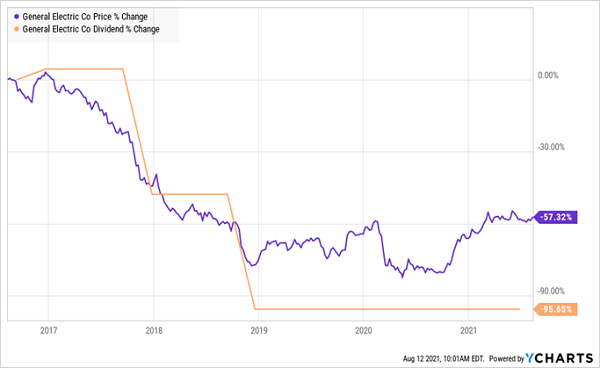

Case in point: serial loser General Electric (GE), a former dividend go-to that slashed its dividend twice in the last five years. That dragged down its share price, showing that the dividend magnet we saw at work with UnitedHealth Group can work in reverse when payouts get cut:

GE’s Dividend Kneecaps Its Share Price

In response, GE’s management resorted to an eight-for-one share consolidation, which became effective on Monday, August 2. This means that on Friday, July 30, GE stock closed at $12.95, then opened trading on Monday at $100.60.

But of course, nothing changed with GE’s foundering business. And in fact, you could see it as management running up the white flag: unable to boost the stock through improved profits, they’ve done so by simply “bundling” GE’s shares together.

Combine Splits and Dividend Growth for a Shot at Big Gains

So what’s the takeaway? While buying on a split (or potential split) is never a good idea on its own, buying a stock with a surging dividend is a proven way to build wealth. And if you buy a potential splitter with a surging payout, you could see a nice “double hit” boost to your overall return.

Let’s wrap with a quick word on UNH, which trades at $407 as I write this, not too far from its all-time high of $425. That’s one sign a split could be in the offing. Another? History: UNH has split its stock five times in the past, with the latest being a 2-for-1 split in 2005—so you could argue that it’s due.

7 “Hidden” Dividends Set to Soar 15%—Year in and Year Out

Dividend growth is the driving force behind the 7 stocks I’m urging investors to buy today. I’ve handpicked these companies to ride their surging payouts (and possible share splits) to 15% returns—year in and year out.

I call these companies “hidden yield” stocks because the herd doesn’t appreciate the many ways they pay us—through a current dividend, dividend growth and price upside, thanks to their bargain valuations.

But I don’t expect these firms to stay off the radar for long, as today’s zero-point-nothing interest rates linger, driving income seekers into these sterling income-and-growth plays.

Now is the time to grab a position. Click here and I’ll give you full details on these 7 outstanding dividend payers (and growers!), including their names, tickers, dividend histories and everything else you need to know.

Recent Comments