Is it time to buy the dip?

Almost. And when we do, let’s not just “buy” an index fund (or worse, a lame ETF!) and “hope” that we timed it right. No, no, we contrarian income seekers can do better.

Let’s instead choose investments that cash flow. In a moment we’ll talk about one that yields 7.4%.

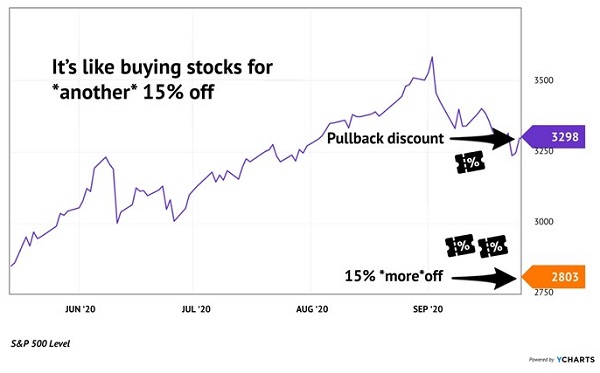

And let’s not buy them at mere “face value” either. Only the unsophisticated first-level types, as our man Howard Marks calls these marks, pay full price! We can, and should, demand discounts in addition to the pullback.

The major indices have officially “corrected” from their September highs (which is typically defined as a 10% decline). But we can do better—by taking a cue from my mom.

Mom never liked paying the sticker price. If there was a coupon somewhere to be found, she’d find it. But her real claim to shopping fame was not simply her coupon clipping. It was Mom’s ability to find— demand, really—the double discount.

“And then,” her shopping stories would often crescendo, “I got the manager out there, and told him he had to approve this coupon too. So I got another 10% off…”

If you didn’t have a “double discount” shopping win to share, you’d better not bring that weak story to Mom. She’d laugh you straight out of the room!

I can’t speak for all of us, but we mild-mannered income investors are mostly past our days of demanding discounts from store managers. It’s just not the same, yelling at someone from a distance, perhaps through a mask. But demanding a further discount from Mr. and Ms. Market is even easier than going to an actual store, and it doesn’t involve any “headache” strategy like selling put options, either.

We simply find:

- Find high-quality stock-focused closed-end funds (CEFs), and then we (here’s the important part),

- Get ready to buy them at a discount.

Some high-qualify CEFs today are selling for just 85% of their “fair value.” Buying them after the recent pullback is a purchase Mom would be proud of:

Buying Discounted CEFs Now: The Double-Coupon of Investing

CEFs are where the “pullback party” is at, because they tend to get dumped when the markets roll over. These are liquidity-driven vehicles that are popular with individual investors. These “weak hands” tend to sell when the storm clouds roll in, and as a result CEFs—which have fixed quantities of shares—can actually trade at a discount to their net asset values (NAVs).

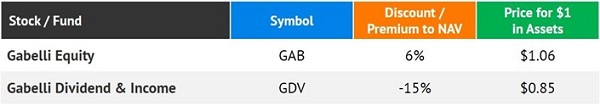

Sometimes, one fund will trade at a discount while its sister fund trades at a premium. This is an interesting “quirk” of the less-than-efficient CEF World. (And remember, less efficiency is better for us. It means we have more opportunities to exploit, more chances to find value and big yields.)

Let’s take the current curious case of Gabelli Equity (GAB), which trades at a 6% premium to its NAV and Gabelli Dividend & Income (GDV), which is discounted 15% below its NAV. They’re run by the same firm (founded by the legendary investor Mario Gabelli), and they even own many of the same stocks. Yet investors are paying $1.06 for $1 with GAB, versus just $0.85 on the dollar for GDV!

Now, both funds have fat yields at current prices. GAB pays an amazing 11.8% while GDV dishes “just” 7.4%. Perhaps the higher headline yield is the reason that investors are overpaying for GAB and underpaying for GDV.

In doing so, investors are also forgetting that CEF yields are, to be blunt, an accounting mirage. No equity CEFs actually generate enough income to pay dividends this large. With your average dividend payer yielding 2%-something, how could they?

Stock-based CEFs are paying their dividends from realized gains. There’s nothing wrong with this when stocks are going up, which is why we do time our entries carefully. CEFs are sweet income vehicles to own in a bull market because we can get paid today and enjoy price gains as we go.

Which brings us back to their actual yields. CEF dividends are paid from NAVs, which rise and fall with their underlying stock prices. When we buy a stock-focused CEF, we are betting that equity prices are going to rise in the future. That’s not a bad bet in an election year and a world where the Federal Reserve Chair has all but said he’s a fan of higher stock prices (and will do what he needs to do to support them).

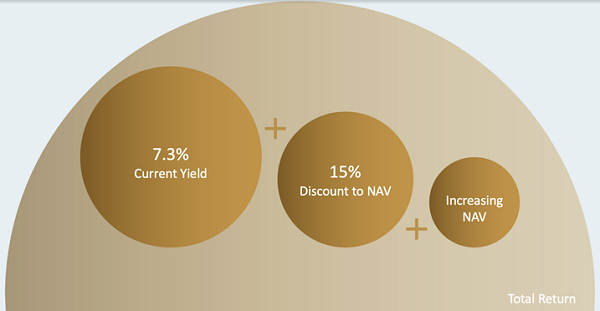

The Fed is our friend, but Mom will laugh us out of the room if that’s “all we got.” To further stack the odds in our favor, when given the choice, we should buy the fund trading for just $0.85 on the dollar. As that discount window closes, it’s like cashing in a double coupon:

Total Returns = Current Yield + Discount Narrowing + NAV Gains

There have been academic studies done to support this. Matisse Capital’s Eric Boughton shared his firm’s research (conducted with the University of Oregon’s Lundquist College of Business) on CEFs at the Inside Fixed Income conference I attended (in person!) in San Diego last December. Boughton explained that if you’d taken the 600+ CEFs in existence since 2008 and simply bought the funds trading at discounts to their net asset values (NAVs), you’d have earned 11% per year.

Another benefit of CEFs is that many pay monthly. For example, the discounted Gabelli fund dishes a sweet $0.11 per month.

It’s going to be a good buy soon, but don’t buy it too soon! Please wait until this pullback is in our rearview mirror. It’d be a shame to lose a year’s worth of dividends in a bad trading week.

Instead, let’s focus on these three “monthly dividend superstars.” I’m talking about 10% yields with double-digit upside. Plus, we can (and should) buy these funds today, because they are more or less pullback-proof. The next time the Fed revs up its famous money printer, these CEFs are likely to soar.

I’ve put everything you need to know about these three funds in an exclusive report, Monthly Dividend Superstars: 10% Yields With Double Digit Upside. Click here to request a complimentary copy of my research.

Recent Comments