I have no idea why you’d mess around with dividend reinvestment plans (DRIPs) when you can “automatically” bag a 7%+ income stream and 82%+ upside with the strategy I’ll show you now.

Better yet, this outsized cash flow drops into your account—and grows—every single month!

It takes almost no work. (Just one small, but potent, step, which I’ll show you shortly.)

Before we get to that, let’s look at just how easy it is to use this proven strategy to double up—and even triple up—the cash stream your portfolio is throwing off today.

This simple system looks like a garden-variety DRIP, but it has one simple “hack” that amps up our dividend and sets us up for fast 82%+ upside, too.

Making DRIPs Obsolete

The humble DRIP is a no-brainer for most folks: offered by most brokerages, these plans automatically reinvest your dividends back into the company that paid them, That adds to your share count, which bulks up your income stream.

Sounds great so far, right? The best part is that you typically pay zero brokerage commissions on these purchases.

But there’s a costly blind spot in most people’s DRIP strategy: they limit themselves to the household names on the S&P 500. These days, that’s a crowded trade, with the index up nearly 20% in six months. Stocks now trade at a frothy 21.3-times earnings.

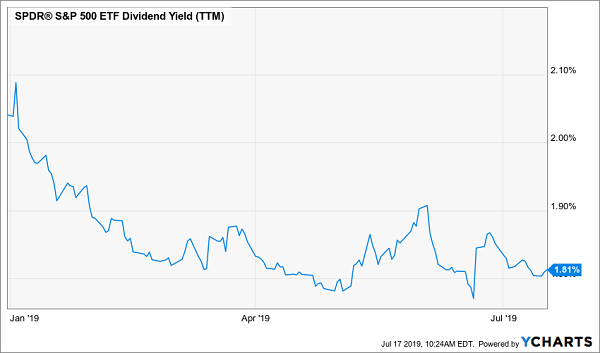

Meantime, the market’s dividend yield has gone from pathetic to truly pathetic as share prices gained:

The S&P 500: A Dividend Desert

The bottom line? Buying your typical S&P 500 stock now—either “direct” or through DRIPs—means locking in a lower yield and less upside on any buy made today.

Talk about a poisoned chalice!

This is where my strategy comes in. Because we’re going to “unplug” our dividends from the stocks that paid them and “redirect” this cash into a group of stout dividend payers yielding that 7%, on average, I mentioned earlier.

The best part?

These sturdy income plays throw off a dead obvious signal when it’s time to buy or sell! All we have to do is wait for that signal to appear, then buy—and keep piling in our dividend cash as these powerful income plays roll higher.

That makes DRIPs obsolete!

Because why would we mindlessly roll our cash into a particular stock every quarter when, at a glance, we can pinpoint exactly when (and where) to strike for the biggest upside?

Here’s the best part: if you build an entire portfolio based on the steady 7%+ payers I’ll show you in a minute, you could easily generate $42,000 a year in income on a $600K nest egg—nearly four times more income than an investor who sticks with the S&P 500.

And if you don’t need all that cash to pay the bills, great! You can funnel it back into these cash-rich income plays and grow your income stream even more. Cherry-pick the highest yielders and you’ll be nicely set up for massive payouts of 8.7%, 8.9% and even 9.2%.

18 “Automatic” Ways to Bag 7%+ Dividends—and 82% Gains—Now

The stocks and funds I’m talking about are the 18 names I recommend in my Contrarian Income Report service (which I’ll show you when you click here).

Right now, these 18 sturdy stocks and funds yield 7%, on average, and five boast payouts above 8%.

I know what you’re thinking: “Brett, how can payouts that high possibly be safe?”

Let me put your mind at ease, because every month, I personally run each one through a rigorous “dividend-safety check,” starting with three things that are absolutely critical:

- Rising free cash flow (FCF)—unlike net income, which is an accounting measure that can be manipulated, FCF is a snapshot of how much cash a company is making once it’s paid the cost of maintaining and growing its business;

- A payout ratio of 50% or less. The payout ratio is the percentage of FCF that went out the door as dividends in the last 12 months. Real estate investment trusts (REITs) use a different measure called funds from operations (FFO) and can handle higher payout ratios, sometimes up to 90%;

- A healthy balance sheet, with ample cash on hand and reasonable debt.

How have we done?

Our subscribers have bagged predictable 11.3% annualized returns since our launch in August 2015. Best of all, most of that steady gain was in cash, thanks to the portfolio’s outsized dividend yield.

Not Your Parents’ Dividend Reinvestment

And as I mentioned above, these 18 investments are perfect for dividend reinvestment because each one gives us a dead-giveaway signal of when it’s time to buy, sit tight—or sell.

To show you what I mean, consider closed-end funds (CEFs), an overlooked corner of the market where dividends of 7% and up—often paid monthly—are common. We hold nine CEFs in our Contrarian Income Report portfolio, mainly larger issues with market caps of $1 billion or higher.

We don’t have to get into the weeds here, but CEFs give off a crystal-clear signal that a big price rise is coming. You’ll find it in the discount to NAV, which is the percentage by which the fund’s market price trails the market value of all the assets in its portfolio (known as the net asset value, or NAV).

This number is easy to spot and available on pretty well any fund screener.

This makes our plan simple: wait for the discount to sink below its usual level and make our move. Then we’ll keep rolling our dividend cash into that fund until its discount reverts to “normal.”

How My 1-Step Buy Signal Drove a Fast 82.1% Win

This is exactly what happened when we bought the PIMCO Dynamic Credit and Mortgage Fund (PCI) back in May 2016.

Fund manager Dan Ivascyn, a superstar in the fixed-income world, taps PCI’s portfolio of government bonds (both US and emerging market), mortgage-backed securities and high-yield corporate bonds to generate the fund’s 8.7% yield (paid monthly).

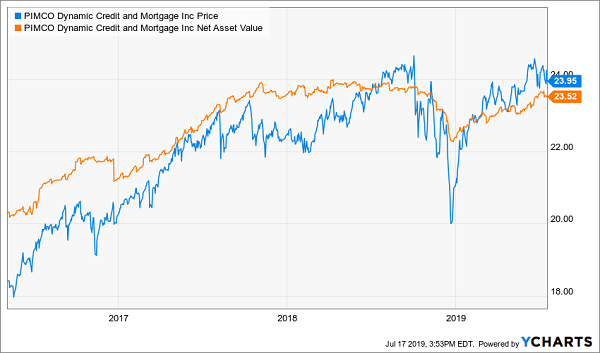

Not only did we collect the fund’s generous dividend, but we won two more ways during the three years we’ve held PCI when its:

- NAV increased (orange line below), and …

- Its discount window tightened as its price (blue line) caught up with—and eventually surpassed—its NAV.

2 Ways to Win for 82.1% Total Returns

We’ve earned 82.1% total returns from PCI, thanks to the dividends we’ve collected, the NAV gains we’ve enjoyed and the discount window closing entirely—and flipping to a premium!

For much of PCI’s run, I’ve had a “buy” rating on the fund when this “twofer” potential remained in place, making it a perfect destination for both reinvested dividends and new cash my members had to invest.

For a period of time, though, PCI has cruised along as a “hold” for us. This happened after its price rallied so furiously that its discount window narrowed completely.

When this happens, it makes sense to bank our PCI dividends (or “redirect” them to our other Contrarian Income Report buys) and wait for our next buying opportunity.

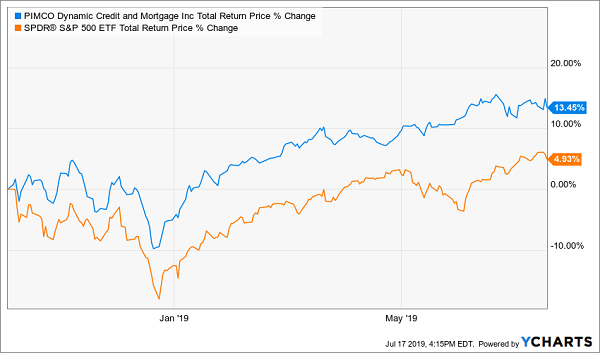

That’s what happened with PCI: its discount window opened again in the late 2018 selloff—on October 5, to be precise—when its market price fell below my $23.50 buy-up-to-level. Investors who got in then picked up a nice 13.5% total return, nearly three times the market’s gain!

Buy Window Opens, Gains (and Dividends) Ensue

As you can see in the orange line above, your typical S&P 500 investor didn’t come anywhere close to those returns in that time—DRIP or no DRIP.

Yours Now: My Next 8%+ (Monthly) Income Buys

As you can probably guess from the chart above, PCI is trading at a premium to NAV now, so I’ve switched it back to a hold.

But it’s only a matter of time before our buy window slides open again—and we can put more cash into this amazing 8.7%-yielder.

When you take a no-risk trial to Contrarian Income Report—full details on that and my complete monthly-dividend strategy here—you’ll be the first to know when the time is right.

Meantime, if you’re looking for some stout monthly high yielders to buy now, fear not! I’ve got you covered there, too.

Those would be the stocks, high-yield REITs and CEFs in my powerful “8% Monthly Payer Portfolio.” With just $500K invested, this dynamic collection of investments will hand you a rock-solid $40,000-a-year income stream. That’s easily enough for most folks to retire on.

The best part is you won’t have to deal with “lumpy” quarterly payouts. Thanks to this breakthrough portfolio’s reliable monthly dividends, you can look forward to the steady drip of $3,000+ in income, month in and month out—on your $500K, give or take a couple hundred bucks!

Full details on these stout income plays are waiting for you right here. You’ll discover:

- An 8.1% payer that’s set to rake in huge profits from an artificially depressed sector.

- The brainchild of one of the top fund managers on the planet that’s giving out a generous 9.1% yield.

- And a rock-steady 6.9% dividend trading at a massive discount to NAV.

Don’t miss your chance to start tapping this retirement-changing dividend stream while you can still get in at a bargain. Click here to get full details on every stock in my “8% Monthly Dividend Portfolio”: names, ticker, symbols, buy-under prices—everything you need to know to buy with confidence.

Recent Comments