Retirement is simple (we stop working). But it’s not necessarily easy (build up a passive income stream that replaces our previous wages).

Retiring on dividends is my jam. Payouts that arrive every quarter—or better yet, every month—are about as passive as it gets. “Mailbox” money.

Which is ideal. We’re not trying to work here, people! We’re crafting an income stream so that we needn’t answer to anyone else.

When our payouts—plus social security and any pension payments (remember those?)—surpass our expenses, we’re there. See ya, Corporate America!

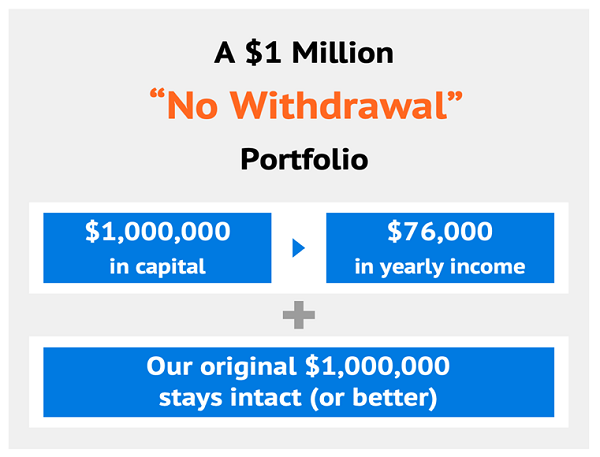

And remember, we employ a “No Withdrawal” Portfolio. We live on dividends alone, which helps us keep our capital intact. Safe from a bear market.

Vanilla investors drive themselves nuts trying to figure out how much money they can safely withdraw each year. Is it 4%? No, it is actually zero.

Just ask the creator of the “4% rule,” William Bengen. An MIT grad and all-around smart guy, poor Billy is watching his nest egg crack under his own strategy. Nine years into retirement, the poor guy concedes he’s “not comfortable”—and even violating his own rule!

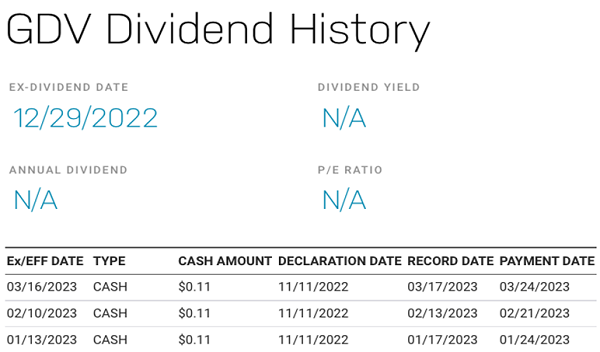

We trust our mantra more. Withdraw nothing, live on dividends. We can accomplish this when we look past common stocks and consider respectable payers like Gabelli Dividend & Income Trust (GDV). As I write, GDV yields 6.3% handed out monthly at the tune of $0.11 per share.

Let’s say we’re trying to retire early on $500K. It’s a stretch, but doable. Our nest egg would net us 23,685 shares in GDV. Which brings us $2,605.40 in monthly income.

GDV typically pays us by the 24th of each month. In fact, here are the fund’s next three payment dates:

- January 24, 2023

- February 21, 2023

- March 24, 2023.

Clockwork monthly payouts. Nice.

Let’s say we have a million bucks saved. Great, our once-a-month income would double to $5,210.80.

Now we don’t really want to plow our entire retirement portfolio into GDV. We actually don’t want to buy it at all until the Federal Reserve pivots and loosens its anti-inflationary policy. GDV owns common stocks and as such, it is a creature of liquidity, which higher interest rates reduce.

We owned GDV in our Contrarian Income Report portfolio from October 2020 to February 2022. The fund rewarded us with 44% total returns (“total” means including dividends) but it’s down 12% (even with payouts) since we sold it.

(Let that be a lesson to all tickers that we kick to the curb. Life without our contrarian coverage is lonely and unprofitable!)

Sure, GDV’s $0.11 per share dividend has continued to show up by the 24th of each month. But that’s not really the point if the price of the fund is falling. Which is why we moved on.

With a true No Withdrawal Portfolio we are looking for relative price stability or, even better, modest appreciation.

And of course we wouldn’t plow into just one position. Our CIR portfolio has 14 holdings paying 7.6% combined. They span safe bonds, cash cow companies and energy stocks. This is how we retire on dividends without having to withdraw capital!

How do these dividends break down by month? Here’s a tally I put together using our Income Calendar tool, based on this 14-position dividend portfolio:

Where’d the data come from? Let’s chat about some online sources that I like. Nasdaq.com does a nice job with a no-frills dividend view. Here’s its payout preview from the GDV example:

I also like our sister site, Dividend Channel, when it comes to actual data. DC gives us a breakdown of GDV’s dividend history all the way back to 2004!

Or we can go “old school” and check out the press release on Gabelli Funds’ website.

All three sources confirm that we’re looking at $0.11 per share every month. This is a reasonable projection for the rest of 2023 and allows us to estimate future income for most dividend stocks and funds we are interested in buying.

If we feared a payout cut, we wouldn’t buy GDV or any other income producer. Dividend raises, on the other hand, are awesome bonuses. But we shouldn’t count on extra income from any source until a hike is announced.

Monthly dividend payers help smooth out bumpy markets like these. GDV has been paying $0.11 per share per month, every month, since 2015. That includes sharp stock market pullbacks in 2016, 2018 and 2020—not to mention the dumpster fire of 2022.

Amazing consistency!

That said, I wouldn’t buy GDV just yet. I’d focus on these monthly payers instead which net $3,300+ in dividends per month on a portfolio as modest as $500K. Click here and I’ll share more including these specific fund names and tickers.

Recent Comments