Bad news for your friends who only own “America’s ticker”—the S&P 500. We’re set up for a September swoon that could easily send the SPDR S&P 500 ETF (SPY) down 5% or more from current levels.

Good news for us income investors—we’re going to have a great dip to buy some of our favorite dividend payers.

We’ll talk about the best dividend stocks for September in a moment. We’ll specifically highlight two “low-drama dividends,” too.

First, let’s discuss why we need to get ready for a pullback.

History Points to a September Swoon …

For one, if we look back to 1945, as the folks at CFRA Research did, we’ll see that September has been the worst month for stocks, with positive returns just 45% of the time. The reason why is simple: the Wall Street guys return from their Hampton homes and sell everything that rallied in August.

That’s our opportunity—before the bounces that usually come our way in November and December. Those months mark the start of “stock season,” which runs through the end of April, traditionally a period of strength. (This is where the “sell in May and go away” saying comes from—but unlike most investor slogans, this one has a ring of truth.)

… As Does the Greed of the “First-Level” Crowd

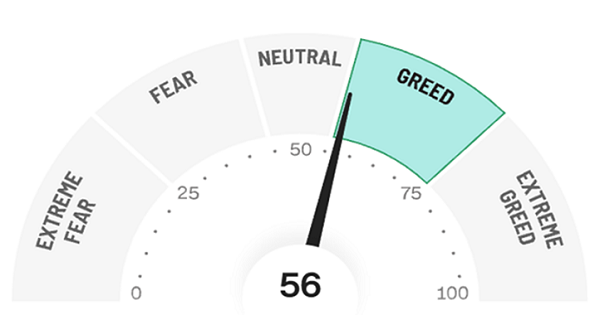

The other reason we’re getting ready for a September shopping spree is that mainstream investors are greedy again, according to the CNN Fear & Greed indicator:

Source: CNN

Of course, we canny contrarians know that Joe and Jane investor are usually the worst at timing the markets: they jump in too early and sell too late! That’s another reason why a pullback is likely on the way.

When it comes, it’ll be a prime buying opportunity for us. So what kinds of stocks are we going after? I’ll give you three things we demand in a market like this, and two tickers worth your consideration, now.

Relative Strength, Big Payouts and Pricing Power: Our “Dividend Trifecta”

When hunting for reliable dividends, we primarily want stocks that have held up better than their peers in the dumpster fire that has been 2022. It only makes sense—if they’ve stayed strong now, they’re likely to keep doing so.

A low P/E ratio helps, to be sure. But we mainly just want stocks with resilience that are backed by strong societal trends. Finally, we want companies with the pricing power to pass their rising costs on to consumers, letting them not only survive inflation, but thrive during it.

Let’s get started with …

September Buy No. 1: An Oil Stock With Accelerating Dividend Growth

Oil majors like Chevron Corp. (CVX) are probably the stocks to own for the 2020s, for many good reasons. Those, of course, start with the (favorable—for us dividend investors) oil market itself.

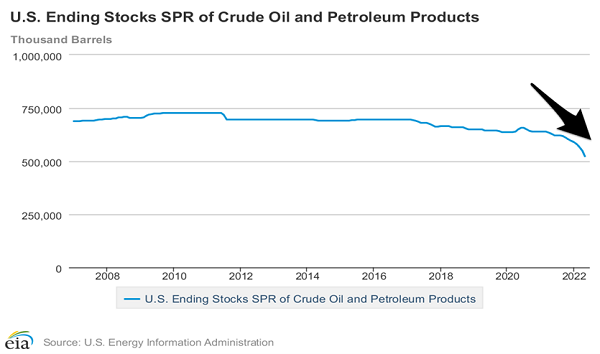

First up, let’s tune out the ever-changing daily headlines of a potential Iran nuclear deal or whatever. Here’s one of the only charts that matters now when it comes to the goo:

That’s the Biden Administration’s drawdown of America’s “emergency reserve” of oil—100 million barrels in the last 12 months! That can’t go on forever, and when it stops, oil prices will likely bounce.

In theory, these barrels should be replaced by higher global production. But even if that happens, the (artificially) lower prices the SPR drawdown has helped create will result in higher oil demand—they already are!

Sure, oil is dirty and it produces carbon, but we need it to build clean energy infrastructure. Someday, oil majors’ business models will be obsolete. Between now and then, Chevron and its ilk are going to make a boatload of money—and that cash will flow straight to us!

The stock trades around $159 as I write. The company earned $14.99 a share in the last 12 months. That gives CVX a P/E (price-to-earnings) ratio just over 10. There’s nothing else to say here except that this is a dirt-cheap growth stock.

Quarterly revenue is up an unbelievable 81% year-over-year. EPS (earnings per share) has nearly tripled since last summer, while free cash flow (FCF) has nearly doubled. Yet the stock still yields 3.5% and trades impossibly cheap.

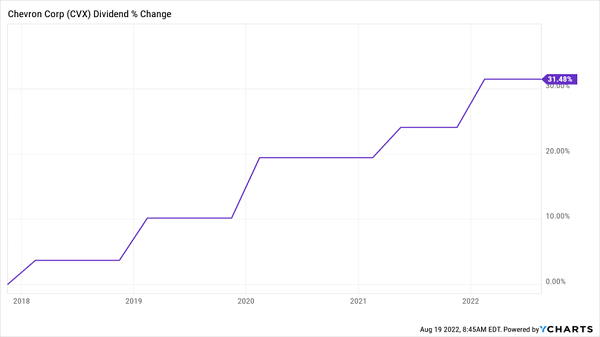

That dividend is on a tear, too, up 31% in the last three years, with payout hikes starting to accelerate, as you can see in the chart below.

CVX Hands Its Soaring Cash Flow to Investors

Meantime, the dividend takes up just 35% of CVX’s free cash flow (FCF)—a percentage that’s getting smaller and smaller as FCF soars, throwing another lift under our payouts.

The bottom line? The oil party is just getting going. Over the last few months of the year, the first-level crowd will begin scooping up CVX. A September pullback will be a nice opportunity for us to front-run them.

September Buy No. 2: A 5.7% Yielder That Charges Whatever It Wants

BCE Inc. (BCE) isn’t a stock many folks in the US are familiar with, but they should be, because the Canadian telecom provider has pricing power in spades!

It, along with Telus Corp. (TU) and Rogers Communications (RCI) form an oligopoly, with an iron grip on Canada’s telecom market. That’s why Canadians pay the highest cell phone rates in the world.

Pricing power? Check!

Now let’s talk dividend growth. As you can see below, BCE has sent its dividend up 62% (in Canadian dollars) in the last decade. That has fired up its Dividend Magnet, which has pulled the stock higher in lockstep.

BCE’s Dividend Magnet Powers Up

This is no surprise—Canadian investors tend to be a dividend-focused lot, and those hikes have been a shiny lure for them. Which is why BCE is a mainstay in Canadian portfolios, and should be on your list, too. (The good news is that the stock is easy to buy stateside, trading on the NYSE under the BCE ticker.)

One other key point about the chart above: as you can see, every time BCE’s share price deviates from its dividend, it’s a buying opportunity. And we see another lag now—that gap represents our upside and means we could buy BCE now and not wait for September. But I expect an even wider gap then.

A True “Battleship” Dividend

Throw in a nice 5.7% dividend and a record of strong and steady payout growth and you have all the makings of a “battleship” dividend payer. BCE’s 5-year beta rating of 0.49 (meaning it’s 51% less volatile than the S&P 500) helps anchor the stock price—and lets us collect our payouts in peace.

One final note: because BCE pays dividends in Canadian dollars, your payouts won’t show the clean line of growth you see in the chart above. But the Canadian dollar has been relatively stable against the greenback for the last couple of years and is likely to remain range bound, so you shouldn’t see wild swings here.

At the end of the day, BCE one is a good, stable way to add diversification and high yields to your portfolio—while sticking with a stock you can buy here in the USA.

Don’t Wait ’Til September: Buy These 7%-Yielding Monthly Payers Now

The stocks in my “7% Monthly Payer Portfolio” are so cheap that you don’t need to wait until next month—they’re all terrific buys now.

This collection of stocks and funds does exactly what the name says: pays you a 7% average dividend yield and shovels payouts your way every single month!

They’re ripe for buying because they’re well below their typical valuations—so if you’re still sitting on cash you’ve been stockpiling since the start of the year, this is where to deploy it. I expect this portfolio to post 10%+ price gains year in and year out, which pair up very nicely with your 7% dividends.

Let me give you a guided tour of this diversified dividend portfolio now. Click here and I’ll tell you all about these stocks and funds—including how they could set you up to retire on much less than you think you need, and on dividends alone, too!

Recent Comments