It’s no surprise to us calculated contrarians—2022 is already looking like a volatile train wreck. With the Federal Reserve shutting off its money printer, cash is flowing away from the most speculative part of the stock market for the first time since early 2020.

Declines are likely to produce winners and losers. While profitless stocks are probably toast, dividend growers are likely to turn into darlings.

This is shaping up to be the year of the “dividend magnet.” If you don’t know what this is, here’s a crash course on the safest, surest way to make money from stocks in the months ahead.

How We Make Money Two Ways From the “Dividend Magnet”

When a company grows its payouts, it also grows its yield over time.

This simple math literally allows us to collect more income while doing absolutely nothing. A 1% yield on cost eventually becomes 2%, 3%, 4% and so on.

That’s a big win on its own. It also means we’re staying a step ahead of inflation.

The other way to win—and win big—is via the “dividend magnet.”

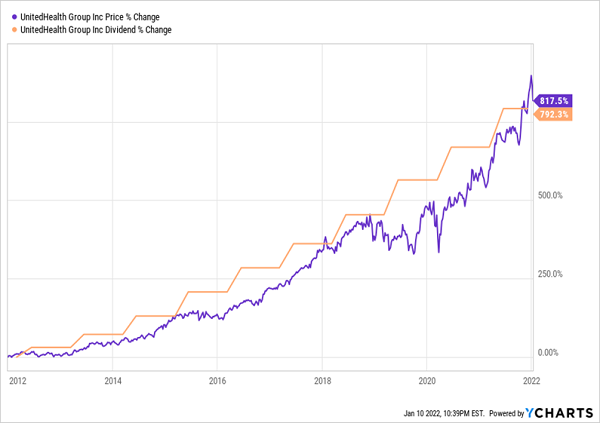

When a company’s dividends go up, so does its stock price. One of my favorite examples is UnitedHealth Group (UNH)—a perpetual outperformer that’s the class of the health-insurance industry. But what really stands out is just how “well” the stock behaves in concert with its dividend. It truly feels like UNH’s dividend is pulling the stock along for the ride.

This isn’t just about tacking on an extra percentage point of yield every few years. This is a way to earn 15% or so per year, bull or bear.

47 Dividend Raises Coming Up

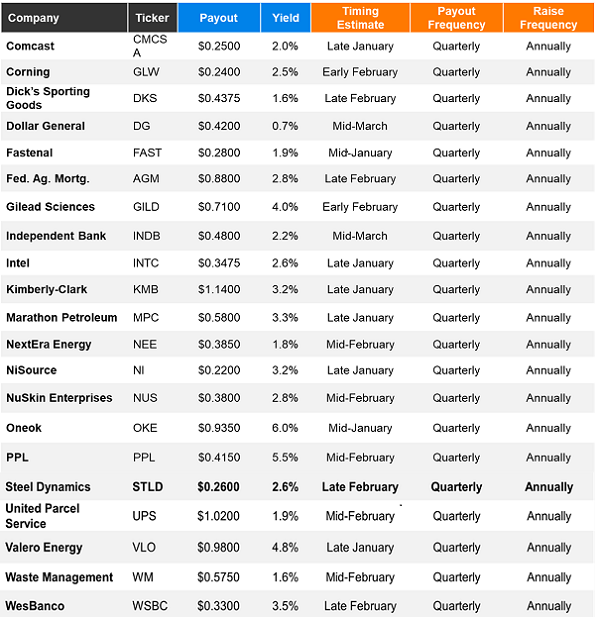

There are 47 firms likely to raise their dividends in the weeks and months ahead. We should start our search for secure returns with this bunch. Let’s review them in four groups: Traditional stocks, predominantly high-yield master limited partnerships (MLPs), real estate investment trusts (REITs), and the dividend-growth kings themselves, the Dividend Aristocrats.

Traditional Stocks

Featured Stock: NextEra Energy (NEE)

NextEra Energy (NEE, 1.8% yield) is a “high-growth” utility. NEE runs traditional power lines, in the form of Florida Power & Light Company, which serves more than 11 million residents in the state.

But NEE is also a green-energy powerhouse. The company boasts that it’s the world’s largest generator of wind and sun power, capable of generating 54,727 megawatts total in 49 states and Canada.

This flourishing business has done wonders for both the dividend and NEE’s share price. The payout has grown at more than 9% annually on average over the past five years, and the stock’s 220% total return over the same time frame is three times the broader utility sector.

Better still: Also over that time, NEE has been far less volatile than the broader markets—so we’re getting another classic benefit of investing in the utility space.

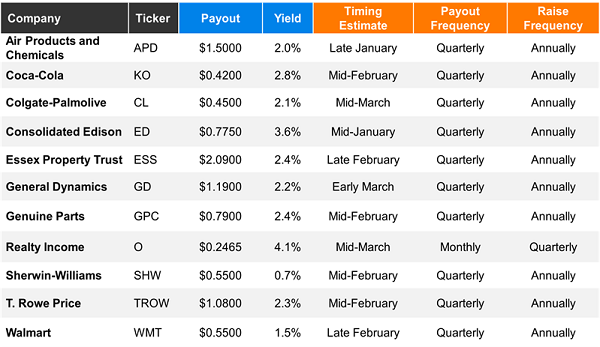

If past is precedent, we should hear about NextEra’s next dividend increase sometime in the middle of February. Here it is nestled in amongst other traditional dividend payers—with my anticipation on when these firms will announce raises:

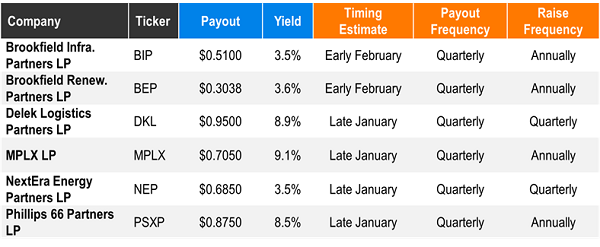

MLPs

Featured Stock: Brookfield Infrastructure Partners, LP (BIP)

Two places to look for relatively calm stock prices and promising dividend growth belong to the Brookfield family: Brookfield Renewable Partners, LP (BEP, 3.6%) and Brookfield Infrastructure Partners, LP (BIP, 3.5%).

BIP is a collection of traditional infrastructure assets. For instance, its transports business includes toll roads, railroad, ports and liquefied natural gas (LNG) export terminals across Australia, Europe, the UK, and North and South America. Its data division has tower infrastructure operations in France, India, the UK and New Zealand, as well as data storage operations in the US, Brazil and Australia. The company also boasts utility and midstream assets.

BIP offers the kind of dividend growth we want: 5% to 9% annually. Plus, it typically pays out only 60% to 70% of funds from operations (FFO). And its 3.5% yield isn’t bad, either.

Expect to hear about Brookfield Infrastructure’s next dividend move sometime in early February—within weeks of these other upcoming MLP raises:

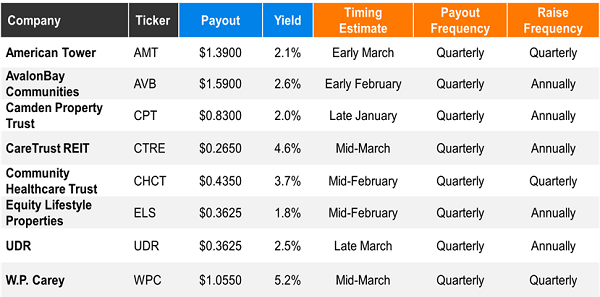

REITs

Featured Stock: American Tower (AMT)

You might rely on AT&T (T) or Verizon (VZ) for your cellular service, but if you have wireless, you might also have American Tower (AMT, 2.1%) to thank.

American Tower is a REIT—but rather than owning, say, malls or apartment complexes, AMT owns telecommunications infrastructure. Specifically, it owns more than 219,000 communications sites—43,000 of which are in the U.S. and Canada, with the much larger remainder spread across 23 countries on five other continents.

Here’s something I like about American Tower. You can think of its towers almost like a strip mall. A single AMT tower isn’t necessarily going to be leased out to just one tenant—these towers can accommodate multiple tenants, which put their own equipment on the tower. As more tenants are added, AMT generates even more money—specifically, AMT says that one tenant produces a 3% return on interest (ROI), but with three tenants, that expands to an outstanding 24% ROI.

The other great thing about American Tower? It constantly ups the ante. This REIT has been raising its payouts on a quarterly basis for years, and investors can safely assume yet another hike is coming soon—best bets are for early March.

Dividend Aristocrats

Featured Stock: Colgate-Palmolive (CL)

If you want stability and safety, with a longstanding dividend-growth profile to boot, it’s harder to do better than Colgate-Palmolive (CL, 2.1%).

When things get tough, and money gets tight, consumers will pull back on all kinds of purchases. But there are a few things they’re probably not going without. Toothpaste. Soap. Deodorant. That means built-in reliability for a host of Colgate brands, which include its namesake Colgate toothpaste and Palmolive dish soap, as well as Speed Stick deodorant, Irish Spring and Softsoap soaps.

And with pets still king in work-from-home America, Colgate’s Hill’s Pet Nutrition brand should continue to sell well, too.

CL’s business is about as bulletproof as it gets, which has allowed the company to build one of the most storied dividend histories in the biz. Namely, Colgate has improved upon its dividend every year for nearly six decades, and the cash checks have been sent out without interruption since 1895!

Calm CL shares should benefit from “flights to safety” this year.

Make 15% Every Year—Even During Recessions!

First-level investors that “buy and pray,” hoping a relentless bull market will allow them to retire comfortably, are hoping against hope that 2022 will deliver the same red-hot returns we got in 2021.

I don’t know about you, but I prefer not to gamble my retirement savings away. I’d rather “dial in” 15% dividend-powered returns every year—bull or bear!

My baseline goal is to generate a minimum of 15% in returns each year, and right now, I’m targeting seven dividend-growth stocks that are capable of delivering at least that, if not more.

In fact, each and every one of these names is flashing all the telltale signs of stocks that are primed to double in just a few years.

It’s a bold claim, I know. But the reason I expect each of these seven stocks to deliver a minimum of 15% in annual returns is because they ace the so-called “shareholder trifecta,” where a stock pays us in three different ways:

- With a dividend today.

- A payout raise tomorrow (which lifts the share price accordingly).

- And by repurchasing shares (less float means more mileage per share on dividends and raises).

These “Hidden Yields” stocks can provide us with a recession-proof retirement. They can even make us as rich as we’d hoped to be in our younger days!

These dividends should pop, pop, pop—and when they do, their share prices will quickly follow. In other words, the best time to buy them is right now—before they soar, not after!

Bull or bear, I don’t care. These seven recession-proof dividend stocks are primed to deliver 15% returns per year, every year. Click now to get their names, tickers and my detailed analysis of why their dividends are about to explode higher!

Recent Comments