Federal Reserve Chairman Jay Powell is scared. First, it was UK pension funds. Now, the entire banking system has liquidity issues.

Fourteen years of quantitative easing is a tough habit to break! We are one year into the Fed’s attempt to tighten monetary conditions.

Should we buy bargains? Or sell now and go shopping later?

Fellow contrarians want to know! Our Contrarian Outlook customer service line has been hot. Today, we’ll put on our short-term thinking caps and discuss your dividend trading questions.

Q: Do you see any good buys among the regional banks where the “baby got thrown out with the SVB bathwater?” – Charley B

As a regional bank customer and fan, I hate to say it, but I think the big banks are the big winners here, Charley.

Deposits are flowing from regional to “too big to fail.” The small banks are probably too cheap—the big banks definitely are.

However, I’m inclined to buy them as trades, rather than long-term investments. The near term should be volatile. Best to keep a tight leash on any big bank plays for now.

Q: Which of your products would be good to use for separate piles of money? – Steve K.

Dividend Swing Trader is my service for shorter-term trades (weeks to months in duration) that capitalize on the wild market swings created by the Fed.

Tax-advantaged accounts (like IRAs) work well because, of course, we can trade on any timeframe without concerns for capital gains treatment. For example, back in November, I spotted an opportunity in the bond market for a “swing trade.”

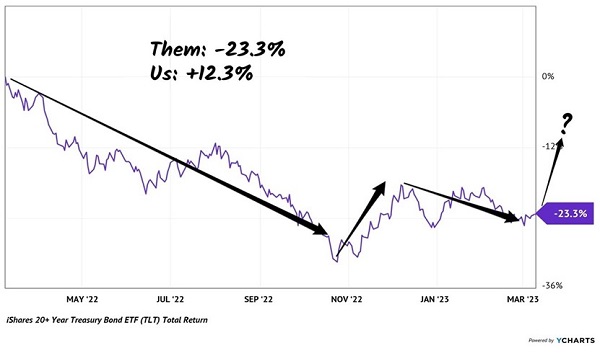

My Contrarian Income Report subscribers bought the iShares 20+ Year Treasury ETF (TLT). New readers thought we were crazy because the fund had been crushed all year.

This is exactly what took down SVB. The bank stretched its own balance sheet and held Treasuries instead of cash-equivalents. Usually a safe bet. In 2022, however, it was a fatal decision for the bank.

TLT was much kinder to us contrarians because, well, we didn’t buy and hold it! We cherry picked it from the bargain bin and flipped it for a quick profit, booking 12.3% gains from TLT though it had lost 23.3% on a one-year basis.

Knowing When to Buy (and Sell!) TLT Was Key

Buying TLT on its “profitable swing” is exactly the type of dividend play we specialize in at Dividend Swing Trader.

Q: Does Dividend Swing Trader utilize alerts like Contrarian Income Report?

Yes, the same Flash Alert process. The only difference is that we send more alerts because we move faster.

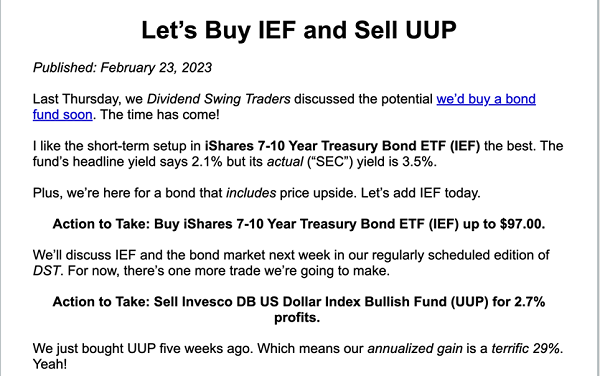

Here’s a recent example from February 23. We booked fast profits in an ETF that annualized to 29%.

In the same Alert, we moved these profits to another bond fund focused on US Treasuries, iShares 7-10 Year Treasury Bond ETF (IEF). This fund subsequently delivered 46% annualized returns to us!

IEF pulled back earlier this week, but we didn’t mind—we had already closed that position profitably.

Q: What’s your favorite closed-end fund (CEF) to buy today?

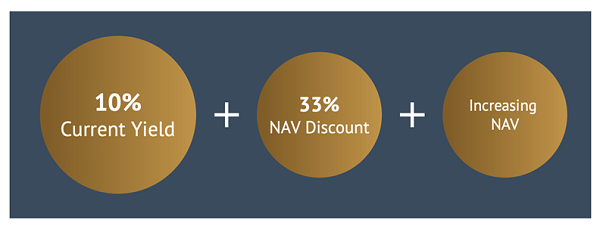

My favorite CEF today could easily return 20% in the months ahead. Especially as interest rates continue to cool off. This CEF is almost “too good to be true” thanks to its:

- Generous 10% dividend,

- Incredible 33% discount to NAV, and

- Likelihood NAV will march higher as rates relax.

It’s a best buy in our Dividend Swing Trader portfolio.

Q: Can you address the direction of the gas market?

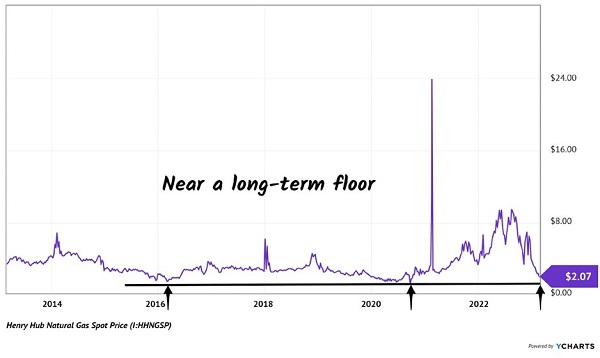

Death, taxes and the cyclical nature of natural gas may be the last guarantees we have. Natural gas is low today but it always bounces back. The cure for low prices is low prices.

As I write, natural gas fetches just $2.07 per million BTUs. This is near a multi-year (really, multi-decade) floor for prices.

Check out the $2 linoleum below. Every time natural gas touches these levels, it promptly bounces higher:

The Natty Naturally Bounces Off $2 Levels

Low prices are already working their magic. Leading producer EQT Corp (EQT) is looking ahead to the next supply/demand imbalance. On a recent conference call, CFO David Khani explained how these low prices will dent supply while boosting demand:

“It’s basically sending a signal to cut production because pricing is forcing your activity off-line. And it’s also going to send demand up.”

EQT sits prettier than most, with a cash flow breakeven price of $1.65 per million BTUs in 2023—more than 20% below today’s levels! Many other producers lose money at $2+ price levels.

Which means other producers will cut back, just when demand is rising (thanks to low prices).

Some gas toll bridges like The Williams Companies (WMB) are solid long-term buys here. Meanwhile, select natural gas producers have serious near-term upside.

Q: Any thoughts about MEGI? Or other pipeline vehicles?

MainStay CBRE Global Infrastructure Megatrends Fund (MEGI) owns some of our favorite energy dividends. Contrarian Income Report readers will recognize ONEOK (OKE) and The Williams Companies (WMB) and smile.

MEGI is a way to buy them for 82 cents on the dollar. It’s a new closed-end fund (CEF) with a noble mandate and bad timing. MEGI launched in October 2021, just as the markets were about to top.

Launching before a bear market means MEGI’s track record is in early trouble, which is why it doesn’t show up on any self-respecting screener. Which is why it trades at an 18% discount to its net asset value (NAV).

MEGI’s market cap is too small for me to recommend here or in CIR. A flood of buyers would eliminate the discount. So, we save our MEGI buys for Dividend Swing Trader.

We don’t own MEGI yet, but DST readers can look forward to a Flash Alert when I see an opportunity to buy MEGI at a near-term bottom.

Q: What about Exxon? – Srini K.

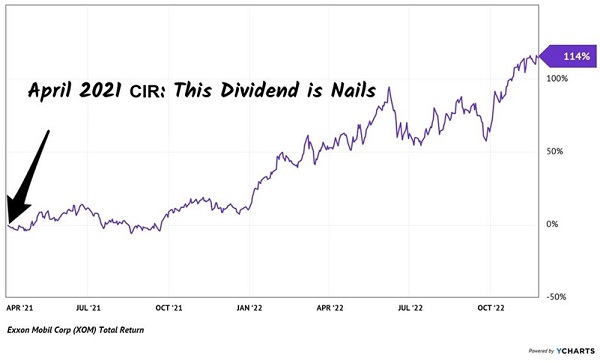

Believe it or not, energy stocks were broadly loathed when we bought Exxon in April 2021 in CIR. Mainstream investors thought XOM’s dividend was in danger of a spill. But we knew better than to accept this “common knowledge” at face value.

XOM’s 114% Run in CIR Portfolio

Purchasing out-of-favor stocks rarely feels good in the moment. There’s pressure to run with the investing herd because it feels safer. But we know the real profits are made by running away from popular opinion. Our “second-level” research revealed that a multi-year bottom was likely in for XOM shares and its dividend was safe.

That’s exactly how it worked out. We bought and held XOM in CIR for 114% gains.

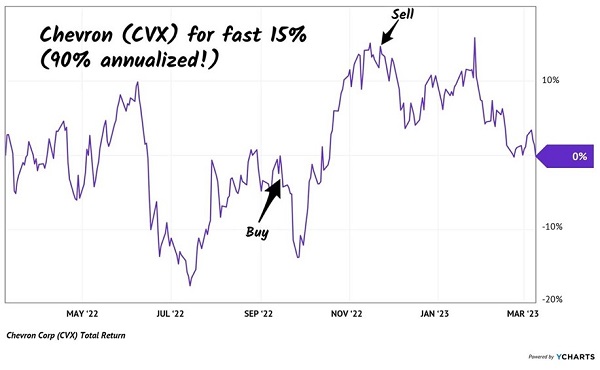

Meanwhile we traded fellow producer Chevron (CVX) in DST last fall. CVX wasn’t an ideal buy and hold because big picture, its shares went nowhere!

But, as we saw with TLT earlier, we had a “swing” to trade and we took it. DST subscribers banked fast 15% profits—good for 90% annualized gains!—thanks to our timing.

Timing CVX for a Fast 15% Swing

Oil producers may trade in a range for a while, which is fine but means we’ll look to “buy low.” Stay tuned for more swing trades and long-term buy opportunities as they appear.

Q: You saved my bacon during this downturn. While my portfolio is down, my dividends have equaled my drawdown. Net-net my portfolio is intact and is a dividend earning machine—many thanks! – Charles S.

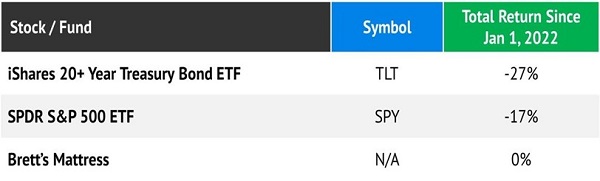

Charles, I appreciate you appreciating! Our large cash position was key to our success.

As income investors we are naturally allergic to uninvested money. It just feels like a waste. After all, why earn nothing when we can earn something?

Well, last year, “nothing” was number one! Our collective mattress saved our bacon in a 15-month period when both bonds and stocks fell out of bed.

That wasn’t supposed to happen: 60 stock/40 bond portfolio high priests said so! Whoops.

Going forward, expect less cash cushion talk and more payout dialogue. That’s how things usually work here at Contrarian Outlook. But 2022 was an exception—bonds and stocks crashed together. So, we took extreme measures to protect capital.

Now, it’s time to put this capital to work!

As I mentioned at the outset, Jay Powell is scared. He wants to fight inflation, sure, but only so much.

The guy doesn’t want to preside over the next financial crisis.

Which means, when push comes to shove, he’s going to choose stability in the markets. Which means the Fed will back off and start printing money again.

Which means it’s time for us to “swing trade” secure dividend stocks and funds for fast profits.

Recent Comments