Bull or bear? Who cares when we can collect dividends between 10.1% and 11.8%.

That’s not a typo. The S&P 500 pays 1.7%. The 10-year Treasury yields two points more at 3.7%.

That’s better—but it ain’t 11.8%!

The same million-dollar retirement portfolio can either generate $17,000, $37,000 or $118,000 per year. Tough choice!

And better yet, the double-digit dividends I mentioned aren’t penny stocks. We’re talking about diversified funds, with dozens of holdings, managed by skilled advisors that often have decades of experience at the helm.

How Do You Spell “Massive Income”? C-E-F.

A couple of weeks ago, we discussed CEFs versus ETFs:

“If I can give you just one piece of advice to start 2023, it’s this: do not trust your dividend income to ETFs!”

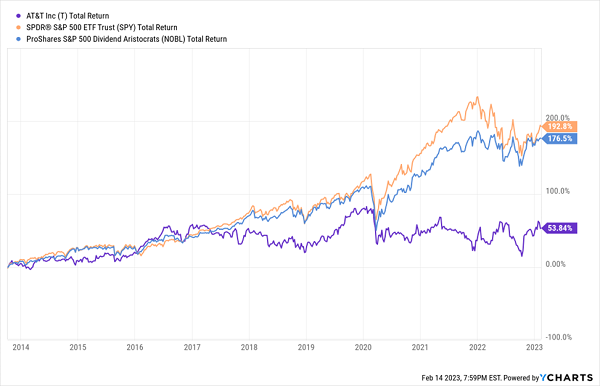

The reason is pretty clear-cut: Most ETFs are index funds, and many index funds are run by rules that force them to fight with one arm behind their back. The example I gave was AT&T (T), which dragged down popular dividend ETFs like the ProShares S&P 500 Dividend Aristocrats ETF (NOBL) for years.

You Can Absolutely Chalk Up Some NOBL Underperformance to T

But, you ask: “AT&T flashed warning signs for years.” Why didn’t NOBL just drop it?

It couldn’t. NOBL is forced to own the Dividend Aristocrats. So it held and held and held AT&T until it finally was kicked off the throne.

But closed-end funds (CEFs) don’t have that problem—and they have a lot to love, to boot.

Closed-end funds are similar to mutual funds and exchange-traded funds in that they allow you to hold dozens or even hundreds of assets in one product, helping you spread your risk around.

Like ETFs, they trade on major exchanges, but virtually all of them are actively managed, meaning if they see future trouble for any of their holdings, they can dump them. It’s just that easy.

But what really makes them special is …

- They can trade at steep discounts to their own net asset value (NAV): ETFs have a creation/redemption mechanism that basically ensures they always trade pretty close to their net asset value. Not CEFs: When they go public, they have an initial public offering, so they trade with a fixed number of shares. So sometimes, CEF prices move out of sync with their NAVs—sometimes they’re more expensive (avoid buying them then!), but sometimes they’re cheaper, allowing you to buy a dollar’s worth of assets for, say, 90 cents on the dollar.

- They can use leverage. With mutual funds and ETFs, what you see is what you get. If one of those funds has $1 billion in assets to play with, it invests up to $1 billion, and that’s that. But closed-end funds can actually use debt leverage to buy more than what their assets would allow them. So, a $1 billion CEF might use 30% leverage, allowing it to invest $1.3 billion in its managers’ carefully selected picks. CEFs can potentially juice both returns and payouts with this leverage—though, conversely, it can amplify losses during downturns.

- They have other tricks up their sleeve. CEFs also can use other strategies, such as trading options within the portfolio, to further generate income and drive returns.

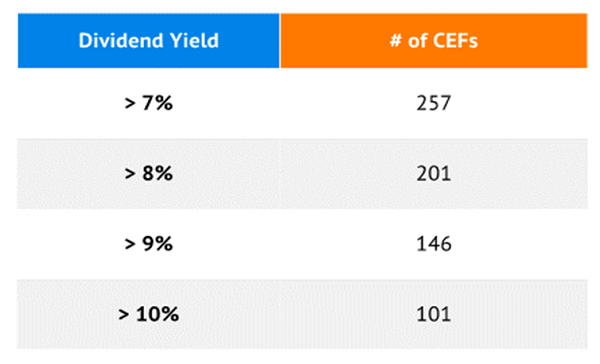

The result? Super-high-yields aren’t an outlier in the CEF community—they’re the norm:

I Spy More Than 250 Monster CEF Yields Right Now

Note: U.S.-listed CEFs, Source: CEFConnect

And five funds have hit my radar of late given both their sky-high yields topping out at 11.8%. Again, that’s $118,000 annually on a million dollars invested!—plus sizable discounts to NAV. This potential for deep value warrants a closer look…

Chuck’s Fund

First up is an eye-opener of a CEF. It’s a fund that seeks out value … among the market’s smallest stocks. Sounds crazy, but 29-year manager Chuck Royce himself says that’s the goal of the Royce Micro-Cap Trust (RMT, 11.7% distribution rate):

“Our task is to scour the large and diverse universe of micro-cap companies for businesses that look mispriced and underappreciated, with the caveat being that they must also have a discernible margin of safety. We are looking for stocks trading at a discount to our estimate of their worth as businesses.”

I will say this: Micro-Cap’s holdings aren’t that tiny, averaging about $650 million in market value, so RMT is more small-cap than micro-cap. Still, these are far from everyday names. Top holding Transcat (TRNS), for instance, provides calibration services; Circor International (CIR) specializes in pump and valve systems.

Chuck’s not flipping these names, either, looking for the next rocket ship to the moon—turnover is a modest 26%. He’s buying. And he’s holding.

But his strategy works, and he’s not afraid to let people know it. Most fund provider pages bashfully paste a performance chart or two and hope you see how well they’ve done. Not Chuck. Chuck’ll just tell you:

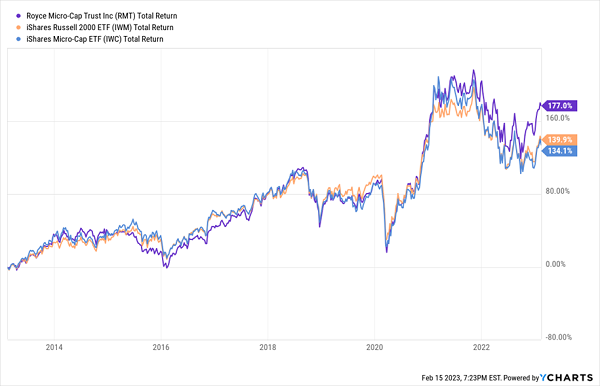

“Outperformed Russell 2000 for the Quarter, Year To Date, 1-Year, 3-Year, 5-Year, 10-Year, 15-Year, 20-Year and since inception (12/14/93) periods as of 12/31/22. Outpaced Russell Microcap for the Quarter, Year To Date, 1-Year, 3-Year, 5-Year, 10-Year, 15-Year and 20-Year periods as of 12/31/22.”

Don’t Let Chuck Beat You. He’ll Let You Have It.

Believe it or not, RMT is a little “overpriced” right now. Yes, it trades at a 10% discount to NAV, but that’s not out of the ordinary—in fact, its five-year historical average discount is actually greater, at closer to 12%.

A Hedge Closed-End Fund

The Calamos Long/Short Equity & Dynamic Income Trust (CPZ, 10.1% distribution rate) has a much, much different strategy. This isn’t a long-only fund, nor is it an equity-only fund.

Instead, Calamos is looking to deliver hedged market exposure via a long/short equity strategy that incorporates multiple assets—specifically, preferreds and fixed income, which helps bulk up its monthly distribution.

Currently, for instance, CPZ has roughly 70% of its assets invested in long/short common equity trades (and is currently net long, at 31%). Another 15% is dedicated to preferreds, and the remainder sits in bonds. Management is particularly bullish on industrials, which make up roughly a third of its entire long exposure.

This Calamos fund went public in late 2019, so it doesn’t have much of a track record. But naturally, you’d expect it to thrive in downturns and lag during recoveries—and that’s largely true. Well, CPZ has outperformed during the current bear market, but it lagged during the COVID bear, and that, combined with the expected drag during upturns has led to considerable underperformance in its short life thus far.

Calamos Long/Short? Well, Mostly Short.

It is trading at a slightly wider discount to NAV than its three-year average, but CPZ only really makes sense if you expect a prolonged period of continued market downside—and even then, it’s hardly a guarantee.

Three Forward-Looking Equity Funds

The next three funds aren’t carbon copies of one another, but they’re all dedicated to various technological and other innovative trends. And they not only all yield 10% or more, but like CPZ, they pay monthly, which is catnip to income investors like you and me.

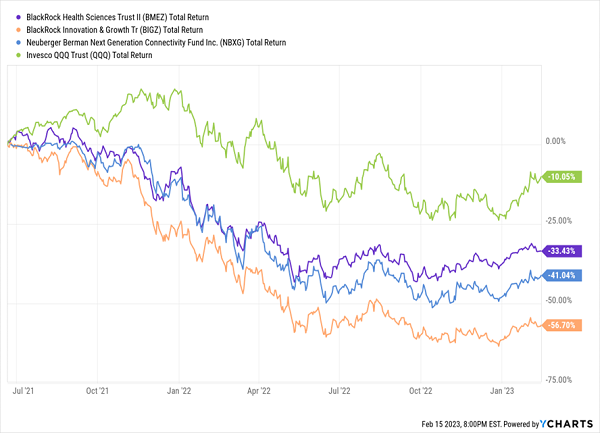

- BlackRock Health Sciences Trust II (BMEZ, 10.7% distribution rate): This is largely a biotechnology and health-sciences fund, holding the likes of Vertex Pharmaceuticals (VRTX), ResMed (RMD) and Penumbra (PEN). It’s trading at a nearly 15% discount to NAV that’s much deeper than its 9% three-year average, it uses minimum leverage, and it engages in options writing to generate income.

- BlackRock Innovation and Growth Trust (BIGZ, 11.2% distribution rate): BIGZ deals in primarily mid- and small-cap companies that are on the cutting edge of their industry. That often involves tech stocks such as cloud contact center software provider Five9 (FIVN), but also names like advanced materials firm Entegris (ENTG) and even gym chain Planet Fitness (PLNT). It too trades at a deep discount of 21% to NAV vs. its short 1-year average of 17%—the fund went public in March 2021. It’s also low on leverage, and it engages in options writing.

- Neuberger Berman Next Generation Connectivity Fund (NBXG, 11.6% distribution rate): As you might guess from the name, this NB closed-end fund holds equities that deal in next-generation mobile network connectivity and technology. For now, that largely includes 5G—until it becomes 6G, 7G, and so on. Top holdings include chipmaker Analog Devices (ADI), electronic test and measurement specialist Keysight Technologies (KEYS), and Amphenol (APH), which deals in cables, sensors, antennas, and fiber-optic connectors. And this’ll sound familiar: NBXG has a deeper-than-average discount to NAV of about 20%, it doesn’t use much leverage, and it too utilizes options.

All three of these CEFs have significant potential in bull markets for high-growth stocks that harness many of today’s most emergent trends. And they allow investors to tap into that potential while also enjoying fat, monthly yields.

Unfortunately, all three of these funds are young, and in their short lives, they’ve known mostly bear markets and difficult times for tech and tech-esque stocks.

These CEFs Haven’t Yet Hit Their Stride

As I said just a couple days ago, tech and other high-growth stocks won’t bottom until rates top. I’m not sure they have just yet.

But get ready. We’ll get an even better opportunity to buy these kinds of funds at a better value later this year. When rates top, P/Es crater and nobody wants to own these things other than calculated income investors like us.

Smaller in number are we contrarians, but larger in mind.

But fear not: If you’re looking for monthly dividends, we have them—and with lower risk, no less. They’re still extremely high yielders, paying 7%+ per year, and they’re currently in the bargain bin, too. Let’s grab them now—while we still can!

Recent Comments