The time to panic is behind us. And perhaps (way) ahead of us.

This is the time to buy, my fellow contrarian. Let’s grab bargains for maximum profits and payouts while they are still available!

Have $50,000 to invest right now? Here’s how to “put it to work” for maximum upside and profits.

- Buy a nice dividend payer. Receive income…plus joy when these stocks pop!

- Be careful not to fall in love with your new money maker. There will be a time to sell and book gains. Probably in January.

If we can keep our cool and not marry ourselves to our new holdings, we’re looking at double-digit gains in a few months. At which point, we can step aside and let the next pullback take place.

Which we can then enjoy from our new perch atop a higher pile of cash than we’re investing right now.

What dividend stocks specifically should we buy right now? I’ll get to that in a moment. First, let’s appreciate the timing aspect of this strategy because it is more important than stock selection.

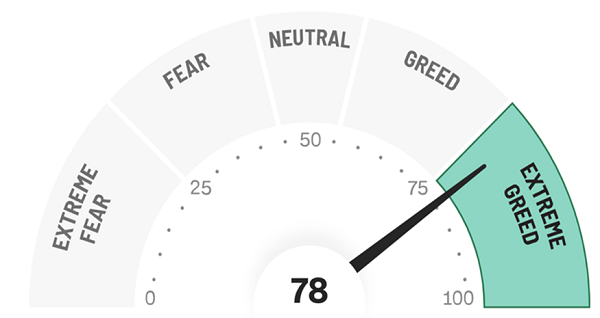

The financial market is one giant pendulum. As recently as August, investors were giddy with greed. Check out this commemorative photo of CNN’s Fear and Greed Index (FGI) that I snapped for our August 3 edition of Dividend Swing Trader to capture the moment:

Just Two Months Ago: Extreme Greed

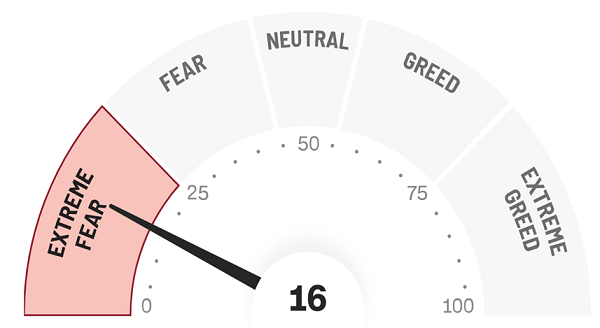

Fast forward to last week, and I could feel the tension coming from our customer service lines. Our subscribers are a smart, even-keeled bunch. As a group, we stay laser-focused on dividends.

That said, some stray from their belief in their portfolios when prices drop day after day. Our phones ring the most at market bottoms.

I was doing my best to calm our publisher. This is the time to buy. Hasn’t been this good since March.

CNN’s FGI dipped into the Extreme Fear zone for the first time since March. Which, incidentally, was the last time I was this bullish.

Tuesday: Extreme Fear

Those March lows were a terrific time to back up the truck and buy everything. In a couple of months, the mainstream suits will be singing about the Santa Claus rally that nobody saw coming.

You see, the entire September swoon (which spilled into early October) was based off a false premise. We must take advantage of it, before sanity returns to the markets.

The 10-year Treasury yield soared to 4.9%.

On its journey to the stars, the higher 10-year clipped equities. A high benchmark rate upsets every applecart in finance.

But here’s the thing. This is not a sustainable move.

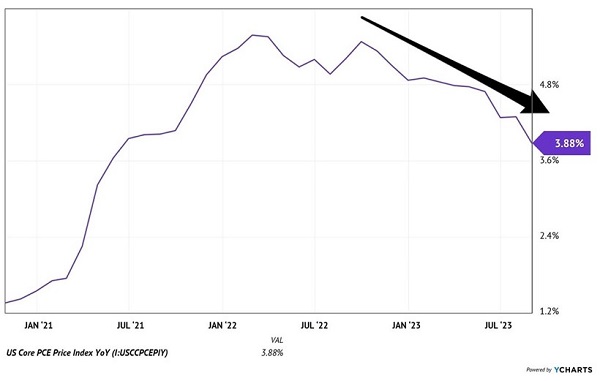

Inflation isn’t really in a spiral higher. In fact, it’s the opposite. Core PCE (personal consumer expenditures)—the Federal Reserve’s preferred measure of inflation—is dropping like a rock:

Fed’s Preferred Inflation Measure is Falling Fast

Note, this excludes food and energy prices. Which, some argue, is not appropriate because oil prices are high again.

I’ve been an oil bull since the spring of 2020 and I disagree that high oil is worrisome for inflation. Future inflation, that is.

High oil prices are a tax on the consumer. Yes, a drag on the economy, as are high interest rates.

High crude slows the economy. It likely already has. And the Fed’s rate hiking mission will bring a recession. Then, when the economy slows, Jay Powell’s Fed will ease rates.

And rate-sensitive stocks—like dividend payers—will rip higher off with the lows.

Federal Reserve Bank of San Francisco President Mary Daly admitted this on October 5th.

If financial conditions, which have tightened considerably in the past 90 days, remain tight, the need for us to take further action is diminished.

Fed Vice Chair Philip Jefferson backed up Mary on Monday, saying officials can now “proceed carefully” thanks to the recent rise in Treasury yields.

Fedspeak translation: The bond vigilantes did our dirty work for us by tightening monetary conditions. We don’t need to hike again.

On cue, our boy the “Bond God” Jeffrey Gundlach weighed in Tuesday with simple advice:

His point: The 10-year rate is high. It won’t be this high for long. Take the deal and the generous distribution.

Mark my words. We’ll see “safe havens” like utilities and telecoms bounce back in a big way. They’ll rally relentlessly for a multi-week to multi-month period. And then—only after they are up big—will we hear from pundits that it’s safe to buy bonds and their proxies. Later, gator!

Kinda like the August highs, when we heard that stocks had cleared “key technical levels” and the “all-safe” sign was in.

Not!

We saw danger in August because the crowd couldn’t have been greedier. Likewise, we see safety in October when the vanilla types couldn’t be more fearful.

Got that $50K? Good—then I’ve got the “payout plus pop” portfolio for you.

For the first time ever, I’m revealing my Perfect Income Portfolio so that we can take advantage of this dip. With your permission, I’d like to send you a free copy — with my top 3 “buy” recommendations today.

Recent Comments