Get ready, my fellow contrarians—QQQ “amateur season” is approaching! If you watch as much March basketball as I do, you’re about to hear this repeated hundreds of times:

This quote, my fellow “March Madness” fans, is from a commercial for Invesco QQQ Trust (QQQ). Within weeks, it will be played nonstop. The ad features flashy camera angles with average investors “dropping knowledge” about the tech stocks they are proud to own via this ETF.

In the spot, the investor humblebrags about her “volumetric” video technology investment. English translation: The use of many cameras at different angles to make a sporting event look three dimensional on TV. (Last year, ESPN broadcast a professional basketball game for the first time using this slick technology.)

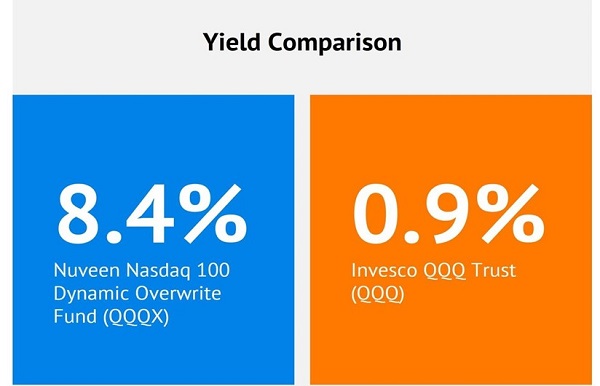

In the 30-second spot, our QQQ fangirl did not mention the fund’s dividend. Which is no surprise, because QQQ doesn’t pay much. Over the past twelve months, this one-click way to buy “volumetric video” yielded just 0.9%.

Good luck retiring on dividends with that yield. A $1 million stake in QQQ throws off just $9,000 in annual dividend income. Crumbs.

I can hear the counterargument now. “But Brett, you’re a software guy. Tech businesses are capital efficient. They are laying off humans left and right, which will boost future profit margins.

“Plus, Federal Reserve Chair Jay Powell sounded as dovish as can be last week. With Jay pillow-talking the bond market, doesn’t that mean lower rates? Which would be bullish for the QQQs?”

Yes and no. First, I don’t think the job market will cooperate with the Fed’s inflation cleanup efforts. Wage growth remains hot. Which means, despite Jay’s hopes, we must remind him (and Wall Street at large) that hope is not a strategy.

Profitless tech stocks will be challenged for months and likely years. They take on debt to fuel growth, but their borrowing costs are going up.

QQQ is full of money losers, which is why it lost 33% in 2022. Thirty-three percent! That’s a volumetric decline if I’ve ever seen one.

And yeah, that sad 0.9% dividend doesn’t help. We’re trying to retire on payouts here, people! Let’s say we have “only” a million to invest. I understand that a million bucks isn’t what it used to be, but QQQ only nets us $9,000 in annual dividend income on that million!

Fortunately, there’s an easy fix. Let’s add an “X” to the end of the popular ticker, and we have a better play.

One that pays, too.

Nuveen Nasdaq 100 Dynamic Overwrite Fund (QQQX) sells (“writes”) covered call options on individual tech stocks. Writing covered calls can be an effective way to generate income, especially in volatile markets like these.

A covered call option is an agreement to buy or sell a stock at a higher price. Option premiums—what you rake in by writing a covered call—are high when stock prices swing wildly. In today’s volatile market, David Friar, QQQX’s portfolio manager, is very happy to buy tech stocks and then sell covered calls on his positions.

Why do we care? Because it’s how David generates an 8.4%% dividend.

Plus, he doesn’t have to get stuck in the profitless pit of the QQQs. David cherry picks his tech positions, and he smartly prefers money makers like Apple (AAPL), Microsoft (MSFT) and Alphabet (GOOG). Rate hikes mean nothing to them because they don’t rely on debt.

David is a savvy market timer, too. He ups the percentage of covered calls when Nuveen’s indicators look bearish (to protect on the downside) and holds more “uncovered” positions when tech looks bullish (to maximize upside).

My long-time Contrarian Income Report subscribers can attest to this team’s skill. We had a fulfilling foray with QQQX a few years back, flipping the fund for 42% returns in just 15 months. To play a tech rally, we prefer QQQX because it pays us.

Unfortunately, as I write, QQQX trades at a 7% premium to its net asset value (NAV). Which means shares are selling for roughly 107 cents on the dollar.

(Back in January 2017 we were able to snag it for our CIR portfolio at a sweet 6% discount, or 94 cents on the dollar. It was the closing of this discount window and subsequent “pop” to a premium that helped our 42% gains.)

For my fellow contrarians who always demand a discount, let’s keep our eye on QQQX for a future discount. It’s a better retirement bet than the vanilla QQQs—I just don’t want to pay a premium for it.

My Perfect Income Portfolio strategy demands a discount! After all, we want to pay 90 cents on the dollar for our dividends… 95 at most. Certainly not more than 100!

This is why I’m finally giving away my top investing secret for collecting big dividends with a bulletproof history. Let’s forget gambling on crypto or profitless stocks – those days are done, lost in the past of “easy money.”

These perfect dividend stocks are the future – please click here and I’ll explain more.

Recent Comments