It probably won’t surprise you to hear that I’m hearing from a lot of investors who are concerned about protecting their portfolios, and their income streams, from the worrying times we’re facing today.

As the strategist of the CEF Insider high-yield investing service, I hear those worries, and I take them to heart with every CEF pick I make. And while talking portfolio strategy may seem a little inconsequential given the tragic events unfolding in the Ukraine, it’s vital that we do everything we can to look out for our families’ needs, especially now.

What’s more, by protecting and growing our income streams, as my colleague Brett Owens recently said, we can use our dividend dollars to help address some of today’s dire needs, whether it’s by donating to a charity helping the people of Ukraine or in the USA, by supporting family businesses that have been hit by the pandemic and, now, soaring prices.

So let’s huddle up and talk about how we’re going to proceed. Then I’ll show you a unique closed-end fund (CEF) with a strategy that helps stabilize its price in volatile markets and supports its high 7.7% dividend payout.

Getting Comfortable With Being Uncomfortable

History tells us that, as difficult as it is, times like these call on us to overcome our emotions and buy more stocks. But obviously we need to buy very prudently, zeroing in on the most oversold sectors with the strongest businesses. The CEF I’m going to show you shortly does just that.

I say that now is the time to buy because history is unequivocal on this point: buying declines like the one we’re facing now has paid off for every market drop in the last quarter-century.

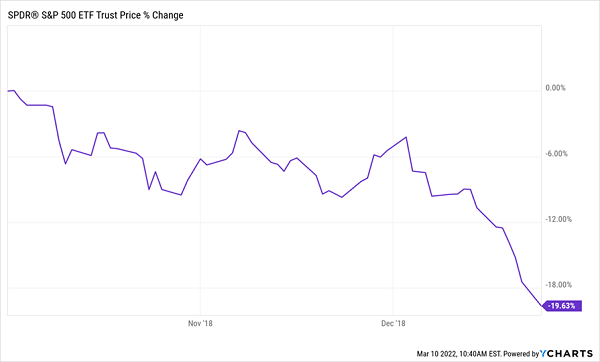

Of those declines, arguably the best comparison to the current situation is the 2018 plunge, which saw the S&P 500 drop 19.6% from peak to trough from early October of that year until December 24. That missed the definition of a bear market (a 20%+ decline) by a whisker.

2018 Plunge Provides a Roadmap

I’m choosing the 2018 drop for a few reasons. One, it’s worse than the 12% decline from the January 3 peak we’ve seen in the market as of this writing. And two, the economic environment then was somewhat similar to what we’re facing now, with the Fed raising rates, inflation starting to tick upward and geopolitical uncertainty rising due to the tensions with China (which was embroiled in a tense trade war with the US) and North Korea.

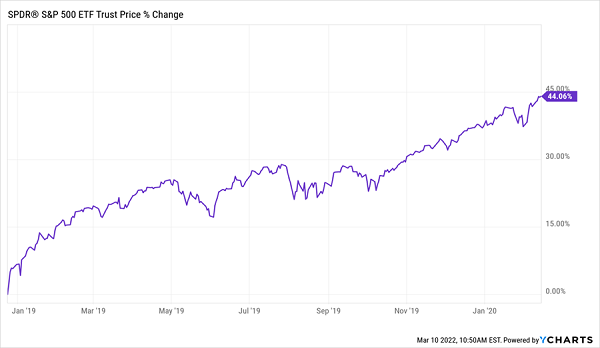

Investors who bought when the market was deeply red back then (small caps were down nearly 30%, the tech-heavy NASDAQ was down 23%, and the S&P 500, as mentioned, was down just shy of 20%) saw profits almost immediately, as you can see below, and the S&P 500 was up about 44% by the time COVID-19 hit a little over a year later.

Quick Profits From Buying the Bear

Fast-forward to today, and these buyers are up 80%, even with the COVID crash and the volatility we’ve seen this year.

It’s worth pausing to reflect on the COVID-19 selloff for a moment because it’s crucial to understanding what to do in a bear market. That’s because, as dreadful as the situation in Ukraine is, its effect on the global economy is small compared to the pandemic. Remember that the entire planet basically shut down and the S&P 500 plunged 35% from peak to trough.

Obviously, stocks recovered quickly as the entire world threw whatever it could at the problem, and with the world arguably more united on Ukraine than COVID-19, there’s good reason to expect that the recovery from this conflict will come faster—and off a higher bottom.

This 7.7% Dividend Protects (and Grows) Our Income Stream in Worrying Times

Of course, until that happens, we’ll want to prioritize two things, as I hinted off the top:

- Protect ourselves from further declines.

- Secure—and increase—our dividend stream so we’re getting more of our return in cash.

We can tick both boxes with the Nuveen NASDAQ 100 Dynamic Overwrite Fund (QQQX). First up, it invests entirely in the US, so we avoid all overseas risk: QQQX holds all the companies in the NASDAQ 100 index, including Amazon.com (AMZN), Apple (AAPL) and Visa (V).

On the payout front, QQQX delivers a 7.7% dividend yield that is exponentially better than the 1.3% we’d get from an ETF that tracks the S&P 500. It’s also less volatile than your typical S&P 500 stock, too.

That lower volatility, and the higher dividend, are possible because QQQX sells call options, a kind of insurance in which option buyers pay the fund for the right to buy QQQX’s portfolio at a later date at a specific price.

This, in turn, provides the fund with an extra income stream and reduces its reliance on portfolio price gains to fuel its return. And we get a bigger dividend out of the deal, so we can stay invested and wait for the long-term gains that history tells us we can expect from buying the dip. Being forced to sell in a bear market is the worst thing an investor can face, and QQQX helps us avoid that with its high 7.7% yield and smart option strategy.

4 More CEFs Built for a Crisis (and Yielding 7.5%+)

I’ve got 4 more CEFs that fit perfectly with QQQX: all are bargains today, which helps them hold up in a rough market while they hand you outsized dividends. As I write, these 4 stout funds yield a rich 7.5%, and all of them pay dividends monthly!

These funds are bargains today, but I expect that to change fast as conservative income-seekers pour in to tap their high, safe yields.

The time to buy them is now! Click here and I’ll give you all the details on these 4 funds: names, tickers, current yields, discounts and more.

Recent Comments