Thank you to our 1,405 Contrarian Income Report subscribers who attended our “VIP” Q4 webcast a couple of weeks back! We chatted about bond funds paying 9%+, Federal Reserve “fueled” funds for 54% yearly returns, and more.

Prior to the webcast, we collected over 30 questions from thoughtful subscribers. We addressed most of these on the call. However, during the session, 70 more great income questions came in!

As promised, I read everyone one. Let’s chat about the most common questions today.

Q: I’m 64 years old and am just concerned about retiring on dividends. I own PCI which pays a high dividend but trades at a high premium. Any reason I shouldn’t buy more PCI? –Robert

Q: Do you have any thoughts on PCI (PIMCO fund)? –Michael

Q: I hear PCI, PDI and PKO are merging together at PIMCO. Good or bad? –Allen

Q: PCI merger? Dividend change? –Rod

Legendary bond shop PIMCO recently announced plans to create a “super-CEF” by merging our own PIMCO Dynamic Credit & Mortgage Income Fund (PCI) and sister fund PIMCO Income Opportunity Fund (PKO) into PIMCO’s Dynamic Income Fund (PDI).

We added PCI to our CIR portfolio five years ago. If you bought PCI then, you’ve enjoyed $12.53 in dividends off an initial entry price of just $18.42. That’s a 68% “cash return” on our investment already!

PCI is more popular now than it was then. Back in the day, shares traded at a discount to their net asset value (NAV). Today, they fetch a 7% premium.

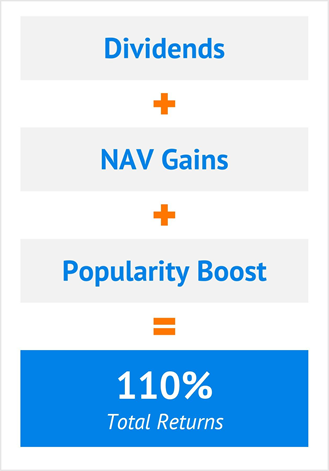

Its NAV sits higher today, too. The monthly payouts plus the NAV gains plus PCI’s popularity mean 110% total returns (and counting) for us!

We won’t add money to PCI—or the new “mega-fund”—unless it dips to a discount. But there’s no reason to sell a modest premium either when PCI’s dividend (9.6%) is so much better than most bond alternatives. Also, most substitutes do not have the quality of management provided by PIMCO.

The future dividend should be fine. Sister funds PKO and PDI both pay more than 9%, so they are bringing plenty of yield to the party.

Q: Why promote NRZ when they crashed their dividend from 50 cents to 5 cents last March? –Dale

Q: What is (Jim) Cramer’s argument against NRZ? –Oliver

When we bought New Residential Investment (NRZ), we understood the potential risk. NRZ is the largest non-bank owner of mortgage service rights (MSRs) in the world. MSRs aren’t the loans themselves; they are the rights to service these loans—a subtle but important difference.

MSRs typically earn 0.25% of the payments that they collect. My wife and I recently refinanced our house and our mortgage service company, Truist Bank, is making easy money for the right to service our mortgage. We already have our account on autopay!

The potential risk to MSRs is that interest rates go down. If so, then homeowners like us will consider refinancing yet again and the mortgage (and service rights) will be “called away” early.

It’s a longshot, however, with interest rates already near historic lows. Sure, they could fall through the basement floor, but we’ll bet they won’t.

Since our July buy, NRZ has already hiked its dividend by 25% (from $0.20 per quarter to $0.25). For a brief moment, shares paid 10%+, but investors have scrambled to bid the stock’s price up and yield “down” to 8.7%.

But that’s nearly nine percent in a 1% world! We’ve also enjoyed 10% price pop in NRZ’s price. There’s more upside—plus fat payouts—to come.

I understand the hesitancy after March 2020 and (briefly) plummeting rates, but today is a different world with rising rates. NRZ’s portfolio is nicely positioned for profits while mortgage rates continue to rise.

Now with regards to Jim Cramer, I didn’t see the segment but kindly received this note from one of our CIR CNBC correspondents:

Brett. Watching CNBC and Cramer today. Somebody just called this second about NRZ. He said stay away. NRZ is risky. I stick with you… but why would he say what he did?

Jim Cramer is a kick. He also has more than 4,000 publicly traded stocks to keep track of. Super smart guy. But c’mon, how many of us can remember what we had for breakfast, let alone the quarterly twists and turns of 4,000 stocks?

Our CIR portfolio is laser focused by comparison. We have only 23 stocks and funds to keep track of; we know them in detail others can only hope to. C’mon Cramer, we’ve got room for you on the NRZ bandwagon!

Q: How Can I Build a “No Withdrawal” Portfolio to Retire on 7.6% Dividends?

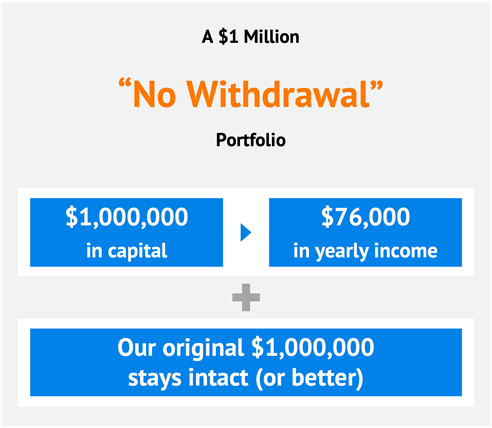

As you can tell by the quality of our questions, our CIR subscribers are smartly building 7% “no withdrawal” retirement portfolios.

Rather than taking out 3% or 4% annually, and hoping that the principal lasts, they are taking a smarter approach. With average yields of 7.6% for our top 12 holdings, CIR subscribers are capturing $38,000 in dividend income on a $500K portfolio (or $76,000 yearly on a million!)

And that million-dollar nest egg isn’t a “lame duck” either! Using this strategy, the capital not only stays intact but also grows over time—as evidenced by CIR’s 11% lifetime returns since inception.

You can learn more about my 7% No Withdrawal Portfolio—and get instant access to my favorite dividend buys right now—by signing up for a risk-free trial to CIR.

Recent Comments