Today we’re going to dive into the two “cheapest” corners in the S&P 500. Because with the terrible performance these 2 sectors have put in this year, you could think both are bargains now.

But the truth is, only one of these sectors is worth buying into now (I’ll name 4 specific stocks in a minute). In fact, the last time we saw a market like today’s, stocks in this overlooked pool spiked 41%!

The other sector? A textbook “value trap”—it’s cheap for a reason, and is about to plunge further.

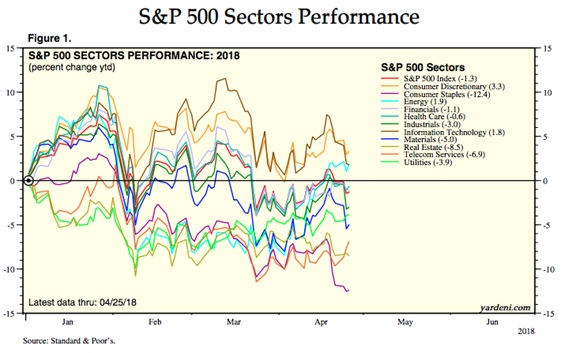

You can see the 2 sectors I’m talking about in this chart from Yardeni Research:

The 2 worst performers, consumer staples (the purple line) and real estate investment trusts, or REITs (beige line) have flopped 12.4% and 8.5%, respectively.

Let’s start with staples, because folks who buy these stocks, which are often considered the pinnacle of safety, are setting themselves up for brutal returns—and even serious losses—as interest rates rise.

Bond Proxies No More

How do I know?

First, look at yields: as I write, the Consumer Staples Select SPDR ETF (XLP) pays 2.98%—practically the same as the 3.0% yield on the 10-year Treasury Note.

So why would you buy staples now and expose your nest egg to a plunge like XLP’s 9.9% year-to-date drop when you could buy Treasuries, collect your 3.0% a year and at least be sure you’ll get your money back?

That’s clearly the decision folks made from July 2004 through June 2006, the last rising-rate period, when the 10-year Treasury yield skyrocketed to 5.1%.

What did XLP do?

It rose a meager 5.8%—and was swiftly routed by the broader market:

Rates Spike, Staples Turtle

Back then, the sector wasn’t dealing with tectonic shifts like the move to fresh from packaged food. Today’s makers of packaged fare, razors and soap are also bleeding sales to online sellers like Harry’s and Dollar Shave Club.

Neither of these trends is going to let up anytime soon.

The Secret to “Front Running” Interest Rates

So if we can no longer lean on our consumer-staple “bond proxies,” where can we turn?

Simple: to stocks whose dividends “outrun” the yield on the 10-year Treasury.

Which brings me to our other “laggard” sector: REITs.

As I write, the Vanguard Real Estate ETF (VNQ) pays an impressive 4.9%. That’s 64% more than consumer staples and the 10-Year. It’s also right around the 5.1% peak the 10-year Treasury yield hit in its 2004–06 rise, a level no one sees coming back anytime soon.

And while we’re talking about 2004–06, let’s check the history and see how REITs fared compared to staples and the broader market back then:

Rates Soar, REITs Go Higher

(VNQ wasn’t around for this entire time, having been launched in September 2004, so I’ve swapped in the iShares US Real Estate ETF [IYR].)

It wasn’t even close. The REIT ETF’s rise was 3.2 times bigger than that of the market and 7 times bigger than the crumbs consumer staples delivered!

So forget what you’ve heard about rising rates hurting REITs. The truth is, higher rates come with a strong economy, and that brings soaring rents and higher demand for space—dwarfing any small uptick in borrowing costs REITs face.

The herd is starting to notice, as REITs report better-than-expected first-quarter results. As I write, 89 REITs, or 35% of the total, now trade above their 50-day exponential moving averages. Which means the sector is starting to trend up, with more stock catalysts (namely earnings reports) on the way this week.

The bottom line? Now is the time to buy, so let’s move on to…

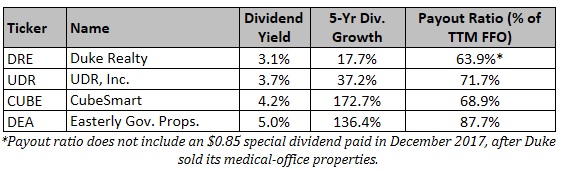

4 REITs Paying Up to 5% With 136% Payout Growth

To arrive at our 4 REIT contenders, I’ve pored over past names I’ve shared with you on ContrarianOutlook.com to come up with a shortlist of the best of the best.

They are: warehouse owner Duke Realty (DRE) which benefits from Amazon, its top tenant; 46-year-old apartment landlord UDR, Inc. (UDR); self-storage firm CubeSmart (CUBE); and government-building owner Easterly Government Properties (DEA).

You can see from the table below that all 4 of our picks boast dividend yields that either top the payouts on consumer-staples stocks and 10-year Treasuries or have dividends that are exploding higher:

You’ll also notice that this chart includes payout ratios (dividends as a percentage of funds from operations—FFO, the REIT version of earnings).

And all of those payout ratios (including DEA’s 87.7%) are more than manageable for these REITs, which benefit from rock-solid tenants and high occupancy rates—DEA’s sits at an unheard-of 100%!

What’s more, there are still some bargains in this bin. You can get CUBE and DEA, for example, at an attractive 17.6 and 18.2 times FFO, respectively.

And while the multiples on UDR (20.1) and Duke (21.9) may look high, they’re actually cheaper in relation to FFO than they were a year ago.

The topper? These 2 REITs have the lowest payout ratios of the 4 I’ve shown you here. Combine that with their surging FFO and you get a recipe for ballooning dividends—which will pull these stocks higher as they rise. Don’t miss your chance to climb aboard.

My Favorite 7.7% Dividend Payer Is Cheap—But Not for Long

My top REIT pick for 2018 boasts a higher dividend than the 5 trusts I just told you about—an eye-popping 7.7% yield—so you’ve got a huge head start on interest rates right off the hop.

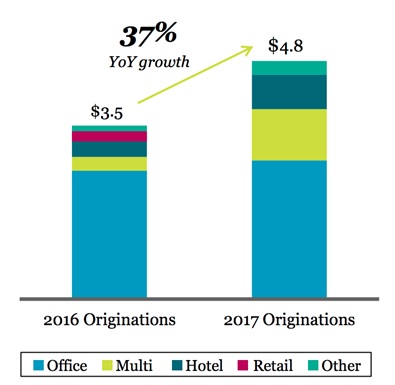

This company is a well-connected commercial real-estate lender that does all the work for us—building a secure, diversified loan portfolio featuring offices, retail space, hotels and multi-family units.

Management then collects the monthly payments, deposits the checks and sends most of the profits our way as dividends!

This REIT’s mammoth 7.7% payout is easily covered by FFO, and its loan growth is soaring, setting us up for massive dividend hikes, too!

Big Loan Growth Today, Big Payout Growth Tomorrow

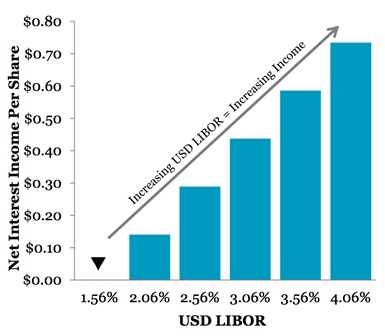

Plus this firm has smartly eliminated interest-rate risk because it uses floating rates. In fact, it’s actually set up to make more money as interest rates move higher!

More Income as Rates Rise

It’s the perfect play for rising rates!

And as its income—and dividend—march higher, they’ll haul the share price right up along with them.

That’s why I’ve made this unsung REIT a cornerstone of my “8% No-Withdrawal” portfolio, a collection of 6 investments from every corner of the market that I’ve assembled to do two things:

- Deliver a safe 8% average dividend, enough to pay you $40,000 in income—enough for many folks to retire—on a $500,000 nest egg.

- Safeguard your retirement stash, letting you fund your golden years on dividends alone without drawing down your nest egg! This insures your retirement against a market meltdown and lets you leave a lasting legacy for your kids (and grandkids).

I’m ready to share the names of all 6 stocks and funds inside this dynamic portfolio with you now. Click here to get the name, ticker symbol and full details on my top REIT pick and all 6 of these perfect rising-rate plays.

Recent Comments