There’s one question I’ve been getting from a lot of folks lately. You may have wondered about it yourself.

It’s simply this: “Is the stock market even safe anymore?” Or another, less anxious, variation: “How can I bank fast returns while slashing my risk?”

I have great news. As I wrote back on February 8, this selloff was way overdone, and now is the time to be buying—not selling!

Better still, there’s a class of totally ignored funds that fits the bill, and many of them are screaming bargains now. That puts us in line for a big, quick price pop while they pay us up front with a massive income stream.

How massive? How do payouts of 9%, 10% and even 13% sound?

To find these “unicorns,” we need to dig deep into the world of closed-end funds, or CEFs.

Haven’t heard of CEFs? Don’t worry, you’re not alone (in fact, I’ve got you covered there, too, with an easy-to-read primer on these unsung cash machines).

The reason why CEFs fly under the radar is that the whole market is worth just $250 billion—a pittance compared to the $4 trillion in ETFs and $16 trillion in all mutual funds.

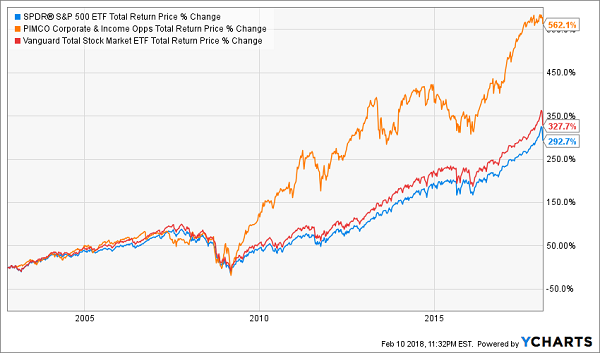

It’s a shame so many folks miss out on CEFs, because there are many that crush both mutual funds and ETFs. For instance, the PIMCO Corporate & Income Opportunity Fund (PTY) has obliterated the benchmark S&P 500 SPDR ETF (SPY) and the Vanguard Total Stock Market ETF (VTI) since PTY’s IPO in 2002.

Boom! PTY Crushes the ETFs

I haven’t even mentioned the best part: PTY yields 9.8%, while VTI and SPY pay less than 2%!

But that doesn’t mean PTY is the best buy now. Sadly, this fund is no longer a secret, which is why it trades at an 8.4% premium to its net asset value (NAV), or what its assets would be worth if the fund sold them all today.

It wasn’t always like this, though. PTY traded at a discount in 2008 and, except for a couple days in 2015, has traded at a premium since. Investors who bought PTY at a discount made a quick gain when it switched to trading at a premium, which happened in a matter of days both in late 2008 and late 2015.

Buying PTY at a discount would be smart, but we’ll probably have to wait years until that opportunity shows up again. However, if you’re looking for CEF ideas to tide you over till then, here are 4 terrific candidates.

CEF #1: A 9.1% Dividend That’s a Bargain in Disguise

While you wait for PTY, you could pick up its sister, the PCM Fund (PCM), which has also crushed the “dumb” index ETFs for years, as you can see in orange below:

Another Clear Winner

This fund also yields 9.1%, a massive income stream that’s boosting investors’ total returns and handing them cash while they wait for PCM’s normally big premium to come back.

That’s right, PCM usually trades at a serious premium to NAV. But the selloff has slashed the premium to its lowest point in nearly a year—3.3%, versus 16% three months ago:

Snapshot of a Buying Opportunity

You can buy PCM now and sell when its premium returns to, say, 15%, for a nice 12% gain. Meantime, you’d get a 9.1% income stream paid out monthly.

CEF #2: $13,380 a Year in Cash on a $100k Investment

The largely unknown Virtus Global Multi-Sector Income Fund (VGI) has been making shareholders rich for years. That’s why the market priced this 13.4% yielder (not a typo) at a huge premium to NAV a few months ago.

And who can blame investors? A fund that pays out $1,115 per month ($13,380 a year) in income on just a $100,000 investment sounds like a premium product to anyone!

Yet in the last few weeks, that premium has vanished, and VGI now trades at a big discount:

An Opportunity Appears

As with PCM, getting in now and waiting for the recent premium to NAV to return could pay off with a big gain in a short time—18% in this case, on top of the 13.4% income stream!

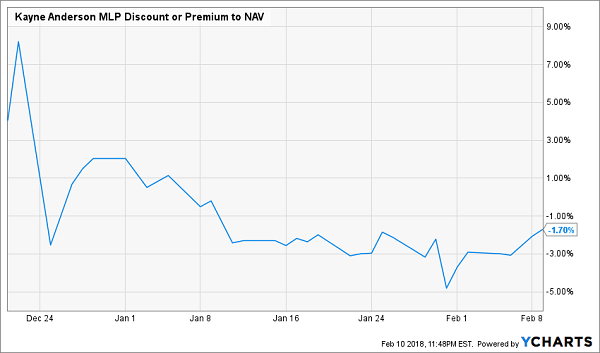

CEF #3: A Cheap Energy Fund With a 10.1% Dividend

The Kayne Anderson MLP Investment Co. (KYN) is managed by one of the world’s smartest specialist energy-investment firms. Based in Texas, Kayne Anderson only does energy, and they do it well. That also gets them access to a lot of private investments that people outside the industry don’t even know about.

Which is why KYN is more than worthy of your attention now.

It’s also a fun investment, which may sound like a strange thing to say about a CEF. But what’s more fun than getting 10.1% dividends while watching the price grind higher? The fund also makes investing in MLPs easier, since owning KYN means you won’t have to deal with the complicated tax documents required from investors who own individual MLPs.

But there’s more to KYN than just dividends.

A Sudden Discount

We see from this chart how the fund’s December premium is now gone. But this makes no sense. The premium showed up in the first place because a mix of cold weather, strong economic growth and the recent tax reform bill mean MLPs have become more profitable than they’ve been in a long time.

KYN will earn more income and see more NAV growth than it has in years, thanks to these tailwinds. But the market has forgotten that, which is why buying at the recent discount could mean locking in 10% capital gains in no time flat.

CEF Pick #4: Beat the Taxman (Legally) and Get 5.5% Dividends

Municipal bonds are one of the best investments a retiree can have. Tax-free income, almost no defaults (the default rate for “munis” is less than 0.001%) and a reliable, low-volatility market value that doesn’t go up or down much.

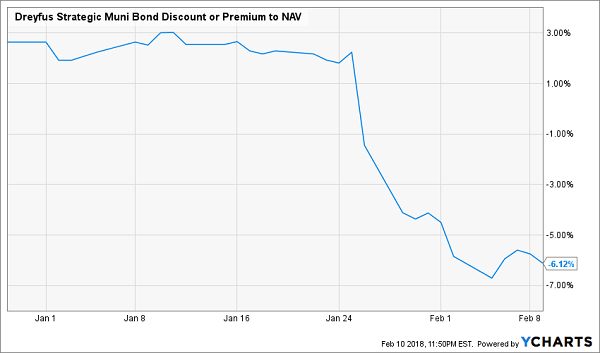

That’s why, if you’re in or near retirement, the Dreyfus Strategic Municipal Bond Fund (DSM) could be a great option.

And that’s also why the fund was trading at a modest premium to NAV a few days ago. That premium has now vanished, turning into a sudden 6.1% discount.

DSM: The Fire Sale Is On!

It’s rare that a 9.6% capital gains opportunity appears in municipal bonds, but that’s what DSM offers. On top of that, it’s paying 5.5% dividends that the federal government cannot tax. This is a great way to make a lot of money fast—without increasing your tax burden!

Another “Stealth” 10%+ Dividend You Won’t Hear About on CNBC!

Funny thing is, if you look at the wrong chart for any of the funds I just told you about, you’d miss out on all 4 of these CEFs entirely.

Take one of my favorite CEFs for 2018, which isn’t among the 4 I just shared with you. This unsung fund boasts an even bigger dividend than KYN—an eye-popping 10.4%!

But if you judged this powerhouse fund by its price chart alone (which millions of folks do), you’d think it was a disaster!

A “Hidden” Winner

Now let’s add that massive dividend payout back in:

Dividend Delivers Big Return

That’s a huge change—from a 53% loss to a 49% GAIN! And keep in mind, that return was all in CASH.

Funny thing is, even after that big gain, this perfect retirement buy—whose rock-solid portfolio is anchored by some of America’s safest blue chip stocks—still trades at a BIG discount to NAV!

The bottom line? We’ve got plenty more upside left to go along with that life-changing 10.4% dividend. But most folks have no idea! They simply look at the price chart I showed you earlier and run the other way.

That’s our cue to buy with both hands NOW.

I’ll show you all the details on this fund and my 3 OTHER favorite CEFs to buy now when you CLICK HERE.

Throw them all in their own “mini-portfolio” and you’re looking at a safe—and growing—8.1% average payout and, thanks to their silly discounts to NAV, easy 20%+ upside in the next 12 months!

The whole amazing story is waiting for you. Simply click here to get these 4 funds’ names, ticker symbols, buy-under prices and my complete research on each one now.

Recent Comments