All the “basic” investors out there are busy chasing this AI-driven rally. It’s like the crypto and meme-stock messes of 2021 all over again!

We’re not following them. Instead, we’re zeroing in on three dividend growers (including one that’s grown payouts 300% in a decade and another that’s yielding 15% for long-term holders) that have been unfairly left behind.

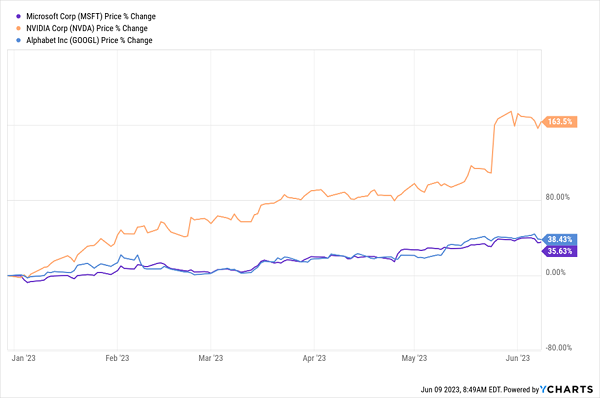

Before we talk tickers, let me say that it’s hard to overstate just how much of this rally is tied to AI. Check out the gains in AI darlings Microsoft (MSFT), Alphabet (GOOGL) and especially NVIDIA (NVDA) in less than six months.

AI Darlings Play Icarus—We’ll Be Waiting to Cash in on the Fall

A 164% gain in less than six months! To be sure, AI has a much brighter future than the crypto, meme and dot-com gambles of years past. But these overcooked gains simply can’t last. And when they unravel, investors will do what they always do—flock back to cheap dividend growers with healthy cash flows and strong businesses.

When that happens, these stocks—the kind of names you can essentially buy and hold forever—will close the gap on their overtorqued tech cousins.

Let’s dive into three “anti-AI” dividend growers that look solid today, with growing payouts, cheap valuations and management teams making smart moves that will unlock value for years to come. Not all are equally appealing, though, so I’ve ranked them in order of dividend-growth potential, from bronze to our gold-medal winner.

Bronze: ExtraSpace Storage (EXR)

Self-storage is a great business—you basically build the facility, hand out the keys and collect the rent. It’s also essentially recession-proof: in good times, people buy too much stuff and need to store it. In recessions, they downsize—and need to store their stuff.

There’s one thing we need to keep in mind when investing in the sector, though: barriers to entry are low, and that’s led self-storers to overbuild from time to time.

That’s why it’s key to buy in through companies with a lot of sway in the market. ExtraSpace Storage (EXR) fits the bill. Its all-stock merger deal with Life Storage (LSI), set to close later this year, will turn it into a juggernaut, with 3,500 locations and 264 million net leasable square feet across the country.

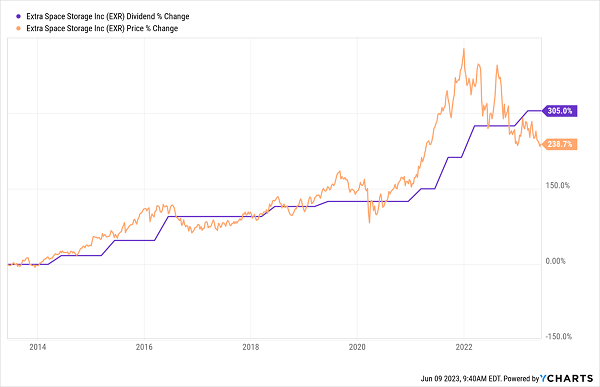

Meantime, ExtraSpace yields 3.2%, more than double the average S&P 500 stock, and has boosted its payout 305% in the last decade. In other words, if you bought back then, you’d be raking in a 15.4% yield on your original buy now.

We can clearly see EXR’s rising payout (in purple in the chart below) pulling its share price (in orange) higher—the pattern is unmistakable. (If you’ve been reading my articles for a while, you know I refer to this as the “Dividend Magnet”—it’s the No. 1 driver of share prices, bar none.)

EXR’s “Dividend Gap” Signals Our Gain Potential

Given that history, we can expect the orange line to “snap back” to the purple line in due course. That is a nice snapshot of our upside here.

Meantime, ExtraSpace’s dividend looks safe, accounting for 77% of the midpoint of its forecast 2023 range of core funds from operations (FFO, the best measure of REIT profitability). That’s reasonable for a REIT with steady income like EXR.

So why the third-place finish? The midpoint of management’s FFO forecast for 2023 is roughly flat from last year, as the company stacks up its 2023 results against a strong ’22. That might prompt EXR to slow its payout growth, at least until it finishes integrating Life Storage.

Silver: Johnson & Johnson (JNJ)

There’s a reason why Johnson & Johnson is a staple in many folks’ portfolios: it yields a decent 3.7% and it’s a consistent dividend hiker. Its latest increase—to the tune of 5.3%—was its 61st straight yearly hike.

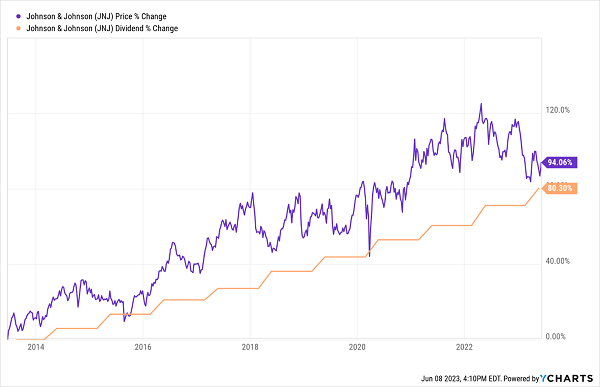

And talk about a Dividend Magnet! This payout-paced share price is about as predictable as they come:

JNJ’s Prescription for Higher Share Prices? Dividend Growth!

True, JNJ’s share price is running a little ahead of its dividend growth. But not too much, and the gap is narrower than it’s been in years.

I’m fine with that—especially when you consider the real catalyst we have here: the spinoff of JNJ’s consumer-products division into a new firm called Kenvue (KVUE), which started trading in early May. JNJ still owns just over 90% of Kenvue and will hand out those shares to its investors, likely as a special dividend, later this year.

This move will unlock value for both companies. For one, there’s little overlap between the pharmaceutical and consumer-products businesses, so the management of each will be free to focus on their core operations.

Second, history is on our side, as numerous studies show that spinoffs tend to outperform. The caveat: the new shares tend to see some volatility in the early days, as the parent company’s investors decide whether to keep them or sell.

Gold: Carlisle Companies (CSL)

Carlisle is the opposite of a flashy AI name, but it is tied directly to a trend that long predates AI and has endless room to run: the move toward making buildings more efficient.

Arizona-based Carlisle is really a collection of companies that mainly focus on the construction industry, including supplying commercial-roofing products and insulation, metal roofing and paneling systems.

But investors either just don’t know about Carlisle or they don’t understand it. That’s fine with us, because it’s why we can pick the stock up now for just 15-times earnings, far below the five-year average of 21. Cheap!

The company saw a revenue decline in the first quarter, but that’s mainly because bad weather and the labor shortage held contractors back. Demand is still strong and will only pick up, thanks to the fact that much of the revenue at its construction-materials division is “baked in”: tied to the backlog of new roofs needed on commercial buildings—work that must be done, no matter what happens with the economy.

Then there’s the dividend, which doesn’t seem like much, with just a 1.3% current yield. But that masks the stupendous payout growth Carlisle has knocked out in the past decade, including a whopping 39% hike last year.

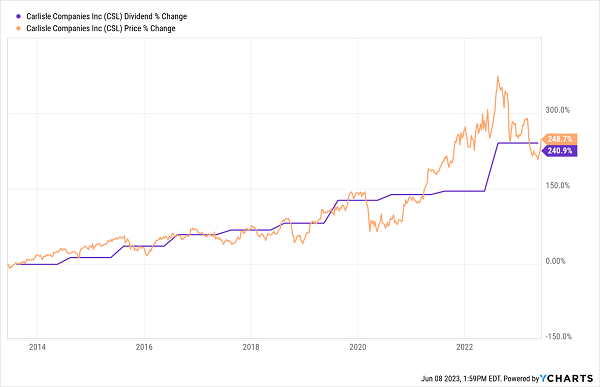

As for the Dividend Magnet, you can see it in action, beat for beat, with Carlisle:

Carlisle’s Industrial-Strength Dividend Magnet

The company has ample fuel to keep that payout popping: in the last 12 months, it’s paid out just 16% of its free cash flow as dividends. In other words, Carlisle could triple its payout tomorrow and it would still be plenty safe.

The time to buy this one is now, ahead of its next dividend-hike announcement, which I expect in August.

5 More “Dividend Magnet” Whose Payouts Surge Every Year

The Dividend Magnet is, hands down, the most powerful indicator of big future profits I’ve seen in investing. And I’ve used it to uncover 5 stocks I see as absolute must buys as speculations like AI (inevitably) hit an air pocket.

One of these 5 cash machines has juiced its dividend an incredible 600% in the last decade, sending its stock up 665%! There’s plenty more ahead for this medical-device maker as the population ages.

It’s just one of 5 incredible Dividend Magnet picks I want to show you.

Recent Comments