The yield on the benchmark, 10-year U.S. Treasury note has moved above 3% in May, which is the highest it’s been since 2011.

This is notable to REIT investors for multiple reasons. First, higher interest rates (both short-term and long-term) mean that bank CD’s and other lower-risk income investments are offering higher competitive yields.

Of equal note, is the fact that rising long-term interest rates are now factoring into higher discount rates for fundamental valuation models. In other words, investors will now require higher dividends to justify current valuations and be compensated for the rise in rates.

I believe that investors consistently reward growth in stocks, even with more income-oriented groups like REITs. With that in mind, I’ve uncovered three REITs yielding north of 6% with high expected average profit growth in 2018 and 2019, to help combat rising interest rates.

First up is Gaming and Leisure Properties (GLPI), which my colleague Brett Owens wrote about back in February. The REIT owns 38 casino properties, which it leases back to tenants including Penn National (PENN) and Pinnacle Entertainment (PNK).

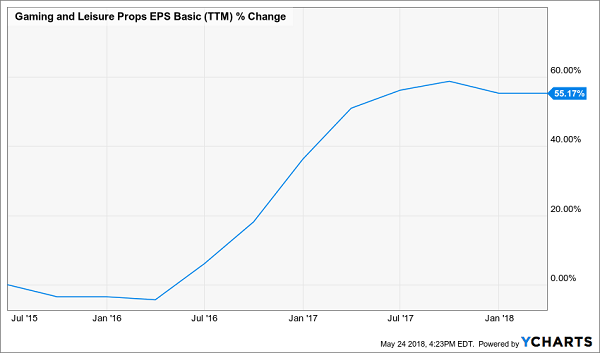

The company is expected to grow annual earnings per share by 13% in 2018 and 15% in 2019. Penn National is currently in the process of acquiring Pinnacle and last December Gaming and Leisure announced a revised lease agreement that will result in $46 million higher rent, once the deal closes.

GLPI’s EPS Momentum: On A Tear 3 Years and Counting

The company is also expected to see its funds from operations (FFO) grow, which could lead to an increase in the quarterly dividend of $0.63 a share (7.2% yield). History suggests the next payout will be in June.

Gaming and Leisure posted 2% year-over-year FFO growth in the first quarter of 2018 and believes that future growth will be augmented by acquisitions, including a $1.2 billion acquisition of six properties from Tropicana Entertainment in April.

It is worth noting that chief financial officer William Clifford is retiring from Gaming and Leisure at the end of August, as this can sometimes be a red flag for investors. That said, Clifford appears to be amicably retiring after 17 years working with the company and its predecessor Penn National and will remain as a senior advisor while his replacement is found.

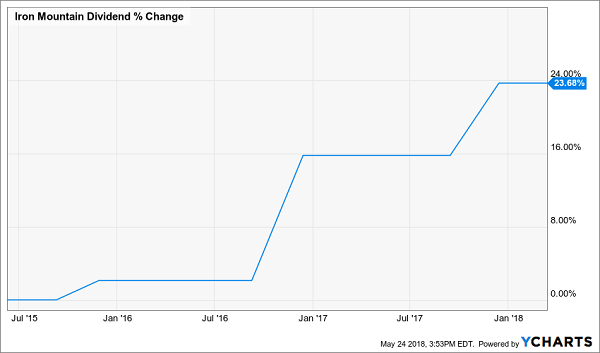

Next, Iron Mountain (IRM) is a REIT that provides physical records storage and data backup. Estimates call for the company to post 3% adjusted FFO growth in 2018 and 6% in 2019.

Management got off to a good start achieving those targets in the first quarter of this year. Iron Mountain posted 3.7% internal storage revenue growth, which exceeded the high end of annual guidance.

The company is driving growth by investing in data center and emerging market assets. New supply is being met by customer demand and these divisions are expected to grow from 20% of total revenue in the latest quarter to 30% by 2020. Iron Mountain also successfully enacted customer price increases in the quarter, which is a positive characteristic that I look for in any industry.

The stock currently pays a quarterly dividend of $0.5875 a share (7.1% yield) that management raised last October. The company regularly increases its payout annually, averaging 7.3% growth over each of the past three years. If Iron Mountain can continue to exhibit pricing power in the coming quarters, I believe the dividend can be increased again in 2018.

IRM Dividend Growth Continues To Climb

Finally, Apollo Commercial Real Estate Finance (ARI) is a REIT that originates and invests in senior mortgages and mezzanine loans that are collateralized by commercial real estate.

The company is expected to post 28% earnings per share growth in 2018 and 12% in 2019. A major reason for this is that Apollo uniquely positioned for rising interest rates, as 89% of its loans are of the floating rate variety. According to management, annual net interest income will increase about $0.05 a share for every 25 basis-point increase in LIBOR.

Apollo currently pays a quarterly dividend of $0.46 a share (9.9% yield) and will likely declare the next payout in June. Management last increased the payout in 2015 and another boost is possible in the coming quarters, if interest rates continue to rise.

While it’s been an attractive market in recent years, it’s worth noting that over one-third of the company’s properties are in New York City. Management is attempting to diversify, doubling its exposure to London in the first quarter of 2018 and entering the San Francisco and Seattle markets.

7 More Rate-Proof & Recession-Proof REITs, Averaging 8.5% Yields (with Upside!)

These three REITs offer above-average growth potential that can help income investors combat the prospect of rising interest rates. These names are offered as an initial starting point for readers to conduct their own research and consider the suitability based on your investment objectives.

If, however, you’re nearing retirement, or have already retired and are living off income from your investments, I strongly encourage you to check out the top 7 REITs from Contrarian Outlook’s Chief Investment Strategist. All seven are key recommendations in his 8% No Withdrawal Portfolio and check both boxes for “dividend growth” and “high current yield” – a must-have for rising rate environments.

As a group, they pay an impressive 8.5% average yield today, which is downright outstanding in a 3% world.

Combine 5% to 10%+ dividend growth with these high-single-digit current yields, and we have a formula for safe 15% to 20%+ annual gains from REITs, with a significant portion of that coming as cash dividends.

And thanks to the new tax plan, there’s never been a better time to buy REITs and live off their dividends.

(REIT investors will benefit from the tax breaks that “pass through” businesses will receive in the new code. Investors will be allowed deduct 20% of their REIT dividend income, which means the 37% tax bill will drop to 29.6%.)

But it’s important to choose your REITs wisely.

Don’t buy a low-yielding static payer. Don’t buy a retail REIT, either (with that entire industry in a death spiral, future rent checks will be dicey for years to come).

Instead, focus on recession-proof firms, such as those that rent hospitals, business lodging and warehouses filled with Amazon packages. Landlords that own properties that will be in high demand no matter what happens to interest rates or the economy from here, in other words.

I’d love to share Brett’s seven favorite recession-and-rate-proof REITs with you – including specific stock names, tickers and buy prices. Click here and we’ll send Brett’s full 8% No Withdrawal Portfolio research you to right now.

Recent Comments