There’s been a mini-wave of insider buying in the BDC (business development company) sector. This is worthy of our attention for two reasons:

- These firms pay fat yields (we’ll discuss 3 paying up to 13%),

- Their stocks are trading below book value.

This means we can buy these firms for as low as 71 on the dollar and get their dividend streams (and future cash flows) for free. (Remember when I told you to buy four big bank stocks when they were trading below book? If you followed my advice 18 months ago, you made a lot of money).

We’ll analyze each of these “pennies on the dollar” BDCs in a minute. First, let’s consider why – contrary to popular belief – certain BDCs may indeed be poised to roll higher alongside interest rates.

Traditionally, BDCs suffer as rates rise because they generate income from fixed rate investments. (Bad when rates rise). But that’s changed in recent years, with more BDCs extending floating-rate funding. (Good when rates rise).

Floating-rate income with fixed-rate expenses is a nice combo today, and this “new reality” is reflected in the price action for BDCs. The VanEck Vectors BDC Income ETF (BIZD) has returned 6% over the last twelve months – a period that included three Fed rate hikes.

Unfortunately many BDCs aren’t desirable “buy and hold” investments because, despite their high dividends, their total returns are lackluster over long periods of time (as payouts get canceled out by price declines).

But – that doesn’t mean we can’t bank double-digit returns with timely buys and sells! As I’ve pointed out before, a simple strategy of buying BDCs when (and only when) they’re trading way below book value produces outsized returns because these firms’ assets are “marked to market” every quarter.

This means book value is a pretty good proxy of liquidation value as the margin of safety already “priced in” to the stock. And today, three companies are trading for just 71% and to 98% of their book value. In other words, anyone who buys the stock is getting the assets for just 71 to 98 cents on the dollar.

Ares Capital Corporation (ARCC)

Dividend Yield: 9.4%

Price to Book Value: 98%

Ares Capital Corporation (ARCC) is trading at a slight discount to its net asset value … though it’s far from a screaming bargain right now.

At nearly $7 billion, Ares is the largest business development company on the markets, and it has built a highly diversified portfolio of 325 companies as of the third quarter. While its industry spread is fairly well-rounded, it does gravitate toward healthcare services (21%) and business services (19%) – though the rest of its portfolio businesses run the gamut, from education to food and beverages to power generation.

Ares’ business primarily leans on first and second lien senior secured loans, though the company also provides financing via subordinated debt, direct lending and preferred equity, among others. And it maintains a conservatively funded balance sheet, with ARCC’s average maturity of its investments sitting at or around the average maturity of its outstanding liabilities.

The stock is having a forgettable year, at a slight decline versus 15% gains for the S&P 500 – that’s mostly in line with the 5% industry loss in 2017, as measured by the VanEck Vectors BDC Income ETF (BIZD). That’s because performance continues to sag. For the third quarter, core EPS dropped 16% year-over-year to 36 cents per share, which is in line with the roughly 15% drop through the first nine months of the year. Net investment income came to 36 cents – 18% lower, and worse, shy of covering the company’s 38-cent dividend.

Ares remains a powerhouse within the industry, but it’s far from a can’t-miss investment at the moment.

Ares Capital (ARCC) Is Losing the Profit War

Apollo Investment Corp (AINV)

Dividend Yield: 9.9%

Price to Book Value: 90%

If the name Apollo Investment Corp (AINV) rings a bell, that’s because it is indeed related to alternative investment manager Apollo Global Management (APO).

AINV is a private equity closed-end fund that lends to middle-market companies in a wide range, from SaaS-based data analytics provider Appriss Holdings to iron ore miner Magnetation LLC. The business model is heavily focused on secured debt, which makes up fully 80% of the company’s investments, with the rest of the portfolio financing done via preferred and common equity, warrants, unsecured debt and other means.

A little more than a year ago, Apollo Investment buckled under financial pressure and slashed its dividend by 25%, from 20 cents quarterly to 15 cents. But it did more than conserve cash – it reduced its exposure to the troublesome energy sector and improved its portfolio diversification.

In short, AINV “got religion,” and while its turnaround is taking time, you can start to see roots taking hold. In its most recent quarter, net investment income ticked up sequentially, from 15 cents per share to 16 cents, which was a penny more than it needed to cover its quarterly payout. It also managed to reduce its leverage by 3 basis points to 0.59x as the company continues to reposition its portfolio.

This is very much a comeback story, but it’s one of the more encouraging, if underappreciated, tales in the BDC space right now.

Apollo Investment (AINV) Is Working Its Way Out of the Hole

Triangle Capital (TCAP)

Dividend Yield: 12.7%

Price to Book Value: 71%

A dividend cut isn’t necessarily a sign of doom – otherwise, I wouldn’t look twice at AINV. But Triangle Capital (TCAP) has pushed this idea too far.

Triangle Capital, which provides junior capital debt and equity financing, primarily to lower-middle-market companies, has a portfolio made up of a wide array of investments ranging from agricultural products and waste management to healthcare and aerospace companies.

But TCAP is in serious trouble.

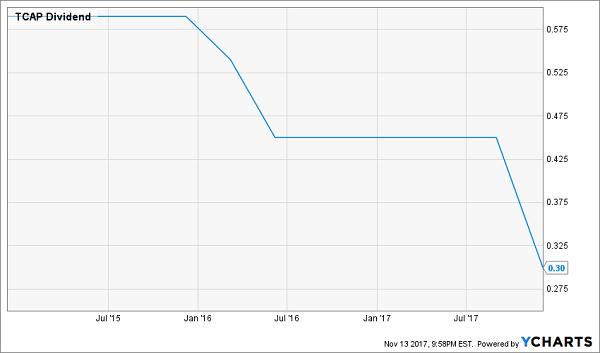

In 2016, Triangle Capital clipped its dividend from 54 cents quarterly to 45 cents, fueled by a shrinking spread earned on its investments in debt. This November, TCAP doubled down on its austerity, hacking its payout by another third to just 30 cents per share.

Triangle Capital (TCAP) And The Incredible Shrinking Dividend!

Triangle Capital has said that the blame for its shortcomings comes from investments made a few years back – specifically, in 2014 and 2015 – and that “TCAP 2.0” holdings should carry their weight. However, a $2 million write down related to one of those newer investments, Passport Food Group, shook investor confidence.

For now, CEO Ashton Poole is looking at all options, saying in its most recent earnings call that “We recognize there might be a long-term partner with whom we might align that could accelerate our transition and, in the process, provide additional value to our shareholders.” In other words, Triangle Capital isn’t getting the job done on its own – and with shares off by nearly half this year, the company is searching for a life preserver.

Don’t get cute trying to bet on Ashton’s next move. There are safer dividends to buy today – like these seven.

7 Dividend Buys Paying 8.4%, on Average

I don’t mess around with BDCs. Nor do I waste time with paltry 2%, 3% or even 4% dividends from “consumer staples.” Or broke has beens like General Electric (GE).

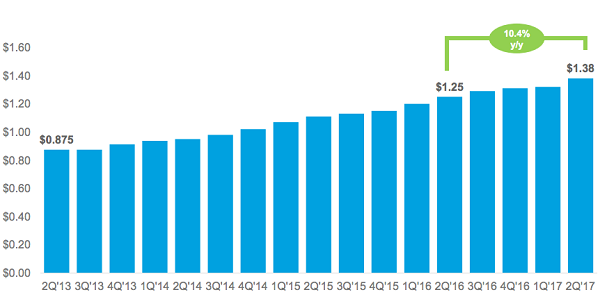

My favorite firm has now increased its payout every quarter for 16 consecutive quarters. And these have been meaningful increases with sustained momentum. The company’s most recent hike represented a 10.4% increase year-over-year:

An Accelerated Aristocrat: 16 Straight Hikes

The best time to buy a dividend grower like this is anytime. But we can tip the odds in our favor even further when we buy at moments like these – when the share price is due to “catch up” to the dividend.

There have been two great times to buy these shares in the last five years:

- Early 2016. Its stock price plunged below its ever-growing dividend, providing opportunistic investors with quick 35% price upside. And,

- Right now.

Stocks tend to appreciate as fast as their dividends. Buy a static payer, and you shouldn’t expect much upside. Buy a 10% annual dividend grower like this, and you should expect 10% price upside to go along with your 7.7% yield.

Remember, total returns are made up of dividends and price appreciation. The latter, price gains, are driven by some combination of:

- Dividend raises (which inspire investors to pay more for the stock or fund), and/or

- A climb towards fair value (a closing of the discount window in a closed-end fund’s (CEF’s) case, or a higher multiple on FFO for a REIT).

All together, my dividend superstar 7-pack yields 8.4%. And each issue has price upside to boot – giving us the potential for 15% to 20% total returns in the year ahead.

Since inception, my 8% No Withdrawal Portfolio has returned 13.6% annualized (and paid 7%+ in dividends) versus just 10.5% for the S&P 500 during the same time period. Proving that you don’t have to choose between yield today and total returns tomorrow – you can have both!

My top seven income buys are poised to deliver the types of outstanding returns – and income streams – we’re used to. But I don’t expect these stocks and funds to remain cheap for long. The “eventually efficient” market will soon find its way to our portfolio, and bid up our names (providing those who own shares today with the 20%+ upside I mentioned).

So don’t miss my latest dividend research. It could be the difference between a comfortable retirement, and a depressing one (ask anyone who thought GE’s payout was safe). Click here to sign up for my 8% No Withdrawal Portfolio on a risk-free basis now.

Recent Comments