The stock market is high, which means yields are low. But don’t worry – we still have places to put new money for 7.5% payouts today with 20%+ upside to boot!

I count ten stocks and funds to be specific with these secure, elite payouts. And while their current yields may say “just” 7.5% on average, all ten are poised for 10%+ total returns in the years ahead.

How is this possible?

Remember, total returns are made up of dividends and price appreciation. The latter, price gains, are driven by some combination of:

- Dividend raises, and/or

- A discount window closing (or at least narrowing).

Let me explain how each event results in rising share prices.

How Dividend Raises Boost Stock Prices

Most savvy income investors know that dividends are to thank for a big chunk of stock market returns. But they often fail to appreciate the dividend hike, which is simply the safest and most reliable way to get rich buying stocks.

Not only do dividend hikes increase the yield on your initial capital, but they often are reflected in a price increase for the stock. And that’s how you turn a 7% yield into a 10%+ annualized return.

For example, let’s look at serial dividend raiser Omega Healthcare Industries (OHI). It pays a 7.3% yield, but we can expect higher returns because the firm is growing its dividend every year.

As OHI grows its dividend, its current yield is likely to remain the same because investors will reward the stock with a higher price as they have over the past three years:

No Coincidence: OHI Price Returns = Dividend Growth

While investors tend to fixate on stocks’ current yields – which are widely published and available – meaningful dividend growth will drive corresponding price appreciation.

How Narrowing Discounts Boost Stock Prices

Despair is our friend. For example, when closed-end fund (CEF) investors throw in the towel, the funds they discard can see their shares trade at discounts to their net asset value (NAV). This is basically “free money” for us.

If a fund trades at a 10% discount to its NAV, it means we’re able to buy its underlying assets for just 90 cents on the dollar. That’s exactly the type of “discount to intrinsic value” that many successful stock market investors strive for.

We’ve used these discounts to bank secure 40% total returns in just 14 months (including safe 10%+ dividends). I’ll show you an example in a moment as we review my three favorite income plays today.

Income Play #1: Recession-Proof REITs for 7%+ Yields, And Growth

Successful REIT investing is pretty simple: Find an overblown headline, and fade it.

We just did this with our purchase of Hannon Armstrong (HASI), which was in the bargain bin thanks to its mission statement to “invest on the right side of climate change.” At face value, this sounded out-of-favor with current political winds. But we looked closer and saw Hannon’s robust project pipeline, plus its active engagement with Trump’s transition team to explore infrastructure projects.

Its stock didn’t stay cheap for long. We’ve enjoyed 20% returns in just three months (more than 80% annualized). And now, I’m seeing mainstream newsletters recommend Hannon!

HASI Rocketed Higher, Quickly

When the herd comes running, we “early adopters” enjoy gains as the newcomers buy at higher prices than we did. And we’ll let them chase Hannon higher right now. Its current 5.7% yield doesn’t meet our 6% threshold.

Which is fine, because I have four recession-proof REITs that I like right now. I’ll share the details in a minute. But first, let’s talk bonds.

Income Play #2: The Best Bonds for 7.6% to 10.1% Yields

Over the past two years, we’ve purchased nine bond funds for an average annualized return of 18.1%.

This isn’t normal. But, as we’ve shown, it’s achievable! The key? Buy high quality closed-end funds (CEFs) when they are out-of-favor for whatever irrational reason.

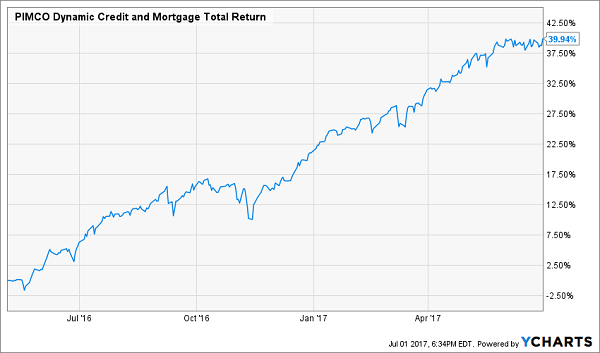

For example, my May 2016 recommendation of the PIMCO Dynamic Credit Income Fund (PCI) initially struck some subscribers as unusual when I presented it. It’s a closed-end fund that invests in mortgage-backed securities (MBSs), which had the lead role in last financial crisis. MBSs blew up the financial system in 2008 and have been outcasts ever since.

Most PIMCO CEFs trade at premiums to the market. Yield hounds will do anything to invest with the best bond firm on the planet – even if it means paying up to a 50% premium, or $1.50 on the dollar! We don’t do that, no matter how good the fund manager is.

Fortunately we don’t have to when we buy a stepchild of the financial world like PCI. Even PIMCO’s name didn’t make this fund palatable for investors, as it traded at a 10% discount to NAV when we bought it. Since then, the discount window has narrowed to 2.4% – and we’ve enjoyed 40% total returns!

PCI Gains 40% in 14 Months!

Sadly, many CEFs are back in vogue today as investors wake up to the fact that rates aren’t going meaningfully higher anytime soon. That’s not news to us. Besides, we didn’t actually care about the Fed knowing that CEFs have performed well during previous rising rate cycles.

Regardless, we now have company. But we still have three best buys today, bringing us to seven 7.5% income plays. Let’s round out the “top ten” with our income unicorns.

Income Play #3: Unicorns for 7.7% Yields, Plus Growth

It’s supposed to be an either/or question – we’re taught we can either have income today, or growth tomorrow.

With income unicorns, we have both. In particular, I like three firms are cash cows with unique business models and competitive advantages that let them:

- Generate gobs of cash regularly,

- Dish most of it back to us as dividends, and

- Grow these cash flow streams (and our payouts) every year.

This Friday: My Top 10 Buys for 7.5% Yields Plus 20%+ Upside

If you’re not yet a subscriber to my Contrarian Income Report, this is the perfect time to sign up (at no-risk) and get full access to my 8% No Withdrawal Portfolio.

This Friday, I’ll break down our Top 10 buys – and they sure are compelling right now.

Since inception, my 8% No Withdrawal Portfolio has returned 14.2% annualized (and paid 7%+ in dividends) versus just 10.7% for the S&P 500 during the same time period. Proving that you don’t have to choose between yield today and total returns tomorrow – you can have both!

My top ten income buys are poised to deliver the types of outstanding returns – and income streams – we’re used to. But I don’t expect these stocks and funds to remain cheap for long. The “eventually efficient” market will soon find its way to our portfolio, and bid up our names (providing those who own shares today with the 20%+ upside I mentioned).

So don’t miss my email update this Friday. It could be the difference between a comfortable retirement, and a destitute one. Click here to sign up for my 8% No Withdrawal Portfolio on a risk-free basis now.

Recent Comments