Worried about a pullback? I don’t blame you. But you shouldn’t stash your portfolio in cash when you can bank this 10% dividend and be protect yourself from a drop in the stock market.

Rather than buying stocks for their payouts and hoping they don’t crash, you can extract more money from them – and protect your downside risk – by “writing” covered calls. And don’t worry, we’re not going to get into an Options 101 course here.

I’m going to explain the strategy to you – and then recommend my favorite fund which is easy to buy, and will do all of the heavy lifting for you. In fact, you can buy it just as you would any dividend-paying stock. The only difference is its generous 10% yield!

“One-Click” for 10% Covered Call Income

Covered calls are a popular trading strategy that allows investors to generate income primarily in flat and down markets.

Here’s how it works: You sell (write) call options against stocks you own. You receive a payment called “premium” for selling the option, but in return, you’re obligated to sell your shares at a certain stock price should the buyer exercise that option. You keep the premium no matter what, but if your stock doesn’t hit that strike price, you also keep your shares!

Traders use this strategy to squeeze “dividends” out of stocks in sideways markets and protect themselves to the downside during bear moves. And as I mentioned, a number of funds will do all the work for you, and at a low expense.

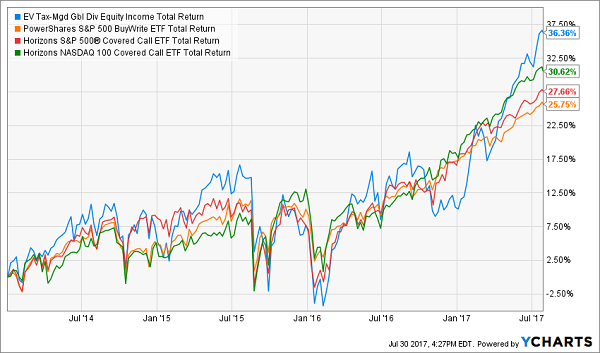

The PowerShares S&P 500 BuyWrite Portfolio (PBP), Horizons S&P 500 Covered Call ETF (HSPX) and Horizons Nasdaq 100 Covered Call ETF (QYLD) are three popular funds that use a simple version of this covered call strategy. The PBP and HSPX do this against the S&P 500, while the QYLD uses the tech-heavier Nasdaq-100 index as its base.

However, while exchange-traded funds can be an excellent source of yield, covered calls aren’t exactly their strong suit. PBP and HSPX typically yield in low to mid-single digits, with both currently throwing off just 3% at the moment. That pushes us toward the QYLD, which has been throwing off closer to 7%-8% over the past year.

This sounds like a good strategy – and it is – but there are a couple of big flaws in QYLD’s execution:

- It’d reap larger premiums by selling covered calls on individual NASDAQ stocks, and

- It should be selling options with even shorter expiration times to maximize the value that expires with each passing day.

Over time, these miscues add up. Since inception, QYLD has been less volatile than the NASDAQ (as you’d expect). But its investors are missing out on most of the index’s upside:

QYLD Gets Killed

If only there were a human at the helm! Fortunately we can upgrade to a living, breathing money manager for a modest fee.

For example, the Eaton Vance Tax-Managed Global Diversified Equity Fund (EXG) closed-end fund isn’t run by computer algorithm, but by managers Christopher Dyer (since 2015) and Michael Allison (since inception). Together, they invest in a basket of U.S. and international stocks – from Alphabet (GOOGL) and Facebook (FB) to Asian insurer AIA Group (AAGIY) and British biotech Shire Group (SHPG) – then sells covered calls on several indices to generate income against those stocks.

Better still, they execute this strategy with an eye on reducing federal income tax liabilities so more cash makes it into investors’ pockets.

The results speak for themselves.

Eaton Vance’s EXG Outruns the Algos

Also know that the nature of covered calls naturally limits upside in bull markets, but that’s hardly an issue for EXG, which has made the most of this generous 2017, and of the broader bull move coming out of the 2008-09 stock market crash.

EXG Has Nearly Doubled UP PBP Since 2008

Yes, EXG’s 1.08% in annual expenses is more than the competition, but in some cases – like this one – it pays to ante up a little more for quality management.

Unlike the other funds and their Groundhog’s Day-esque mandates, EXG isn’t forced to repeat the exact same strategy in perpetuity. Management has the freedom to be flexible, and the global focus means the fund has a whole world of stocks to choose from.

That will keep Eaton Vance’s EXG well ahead of the class going forward, and keep investors hauling in sky-high dividends even when the market tanks.

My only problem with buying EXG today? It trades for roughly its net asset value (NAV), which means there’s no “free lunch” bonus we easily bank by buying today.

(Steep discounts to NAV are another benefit of CEFs – basically free money – thanks to the market inefficiencies in this underappreciated corner of the income world.)

I like free money in addition to my high yields, so I prefer to purchase CEFs when their discounts are high. And I like three funds in particular as my “best buys” for 8% yields right now.

The 3 Best CEFs to Buy Today

CEFs are a cornerstone of my 8% “no withdrawal” retirement strategy, which lets retirees rely entirely on dividend income and leave their principal 100% intact.

Well that’s not exactly right. Their principal is more than 100% intact thanks to price gains like these! Which means principal is actually 110% intact after year 1, and so on.

To do this, I seek out closed-end funds that:

- Pay 8% or better…

- Have well funded distributions…

- Trade at meaningful discounts to their NAV…

- And know how to make their shareholders money.

And I talk to management, because online research isn’t enough. I also track insider buying to make sure these guys have real skin in the game.

Today I like three “blue chip” closed-end funds as best income buys. And wait ‘til you see their yields! These “slam dunk” income plays pay up to 8.6% dividends.

Plus, they trade at generous discounts to their net asset value (NAV) today. Which means they’re perfect for your retirement portfolio because your downside risk is minimal. Even if the market takes a tumble, these top-notch funds will simply trade flat… and we’ll still collect those fat dividends!

If you’re an investor who strives to live off dividends alone, while slowly but safely increasing the value of your nest egg, these are the ideal holdings for you. Click here and I’ll explain more about my no withdrawal approach – plus I’ll share the names, tickers and buy prices of my three favorite closed-end funds for up to 8.6% yields.

Recent Comments