If you’ve missed out on this market’s roughly 6% gain this year, don’t worry. There’s an easy way to grab that same 6%—and more–and do so in safe dividend cash.

The key, of course, is closed-end funds (CEFs), our favorite high-yield vehicles, specifically the 8%+ payouts these funds offer.

Before we get to a couple of high-yielding CEF tickers (yielding 8.8% and 10.2%), let’s dive into the market’s gain and go sector by sector, because it tells a clear story of how some investors have seen that 6% rise and some have seen even more (or less!).

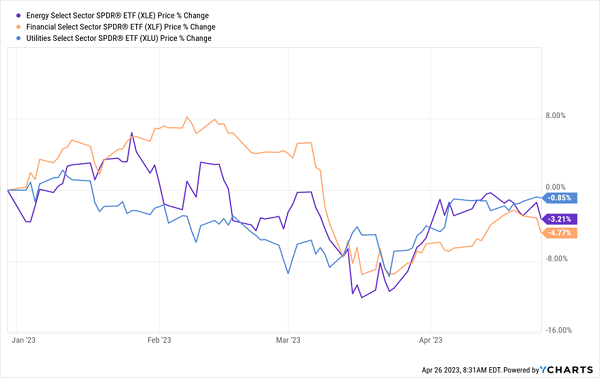

First up, if you’re not holding a significant amount of tech, you’re likely already behind, as the sector, a laggard last year, is up 16% so far in 2023. Meantime, sectors like energy (whose benchmark index fund is shown in purple below) is down alongside utilities (in blue), while financials (in orange) are the hardest-hit, no thanks to the banking scare, which has faded from the headlines (Tuesday’s news about First Republic Bank [FRC] notwithstanding).

Some Sectors Stumble

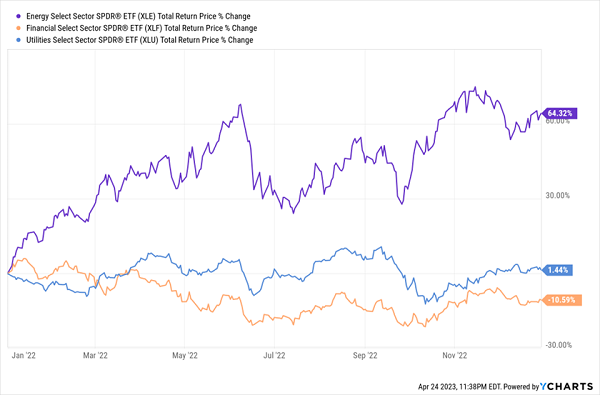

Looking at the pattern of price gains for these three sectors, we can see something interesting. Financials were on a tear before the banking problems emerged, which put them in negative territory. But energy peaked much earlier (in late January) and went into negative territory sooner, while utilities went negative by mid-January and have only recently recovered a bit. Investors who overweighted themselves in energy last year did particularly well.

Energy Soared Last Year, Then “Handed Off” to Tech

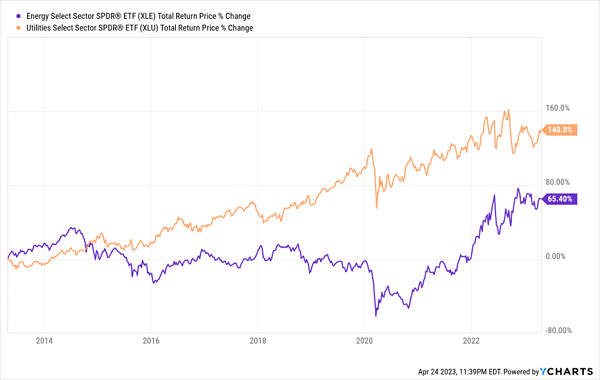

But energy, of course, is renowned for its volatility—a sector you’re best to play for short-term upside. Because over the long-term, energy has been a dud.

The Less Rosy Long-Term Trend

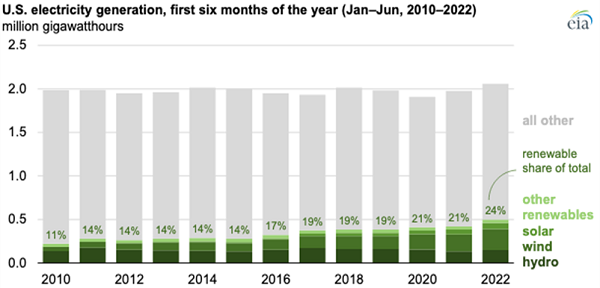

If we compare energy (in purple above) to utilities (in orange), we see the latter is the much better option over the long term. And that’s no surprise; utilities buy oil and gas from energy companies, and oil and gas are commodities, which means the buyer can always seek alternative sources. And they are very much doing that, lowering fossil-fuel demand as fossil fuels become a smaller portion of total energy produced.

Source: U.S. Energy Information Administration

Of course, an investor who knows energy well might be able to choose the right stocks at the right times, but we choose to take a longer view at CEF Insider, which is why we focus on diversified CEFs for the equity portion of our portfolio.

That way we’re minimizing our overall exposure to this volatile sector. And the exposure we do have is placed in the hands of a professional portfolio manager with intimate knowledge of the sectors in which they’re investing.

Diversified Equity CEFs Give Us Income, Gains and Maximum Safety

Two examples of CEFs I keep a close eye on, for example, are the Liberty All-Star Equity Fund (USA) and Liberty All-Star Growth Fund (ASG), payers of 10.2% and 8.8% dividends, respectively. ASG holds just 1.8% of its portfolio in energy; for USA, that total is around 2.2%.

One thing we like about Liberty All-Star Funds is that the firm takes diversification a step further, diversifying its management teams, too.

USA, for example, is run by three managers who focus on value investing and two that focus on growth. ASG has three managers, with one each focused on large-, mid- and small-cap growth stocks. You might think this approach would result in high management fees, but happily that’s not the case, with USA sporting a 0.93% expense ratio, and 1.14% for ASG.

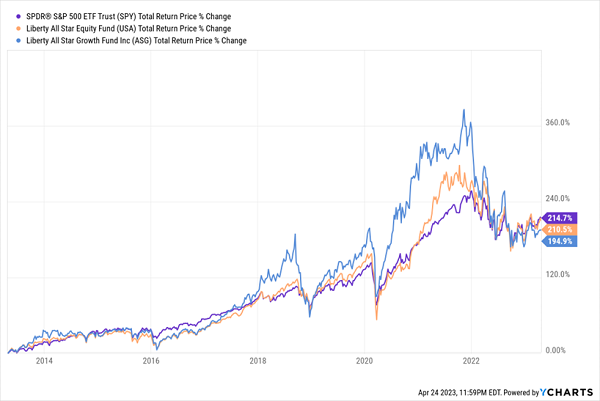

High Yield Pair Usually Beat the Market …

As you can see above, both USA (in orange) and ASG (in blue) have closely tracked the S&P 500’s benchmark index fund (in purple) over the long haul. But notice how before the 2022 selloff, both were well ahead of the S&P 500. The close tracking is no surprise, as USA’s biggest holdings are Microsoft (MSFT), Visa (V) and UnitedHealth Group (UNH). In other words, some of the biggest components of the S&P 500.

Similarly, ASG’s portfolio has these names, as well as other fast-growing firms like Workday (WDAY), Thermo-Fisher Scientific (TMO) and Chegg (CHGG), which have driven the fund’s strong outperformance in the past. That outperformance faded in 2022, but in recent months, we’ve seen the Liberty funds return to their natural tendency to outperform.

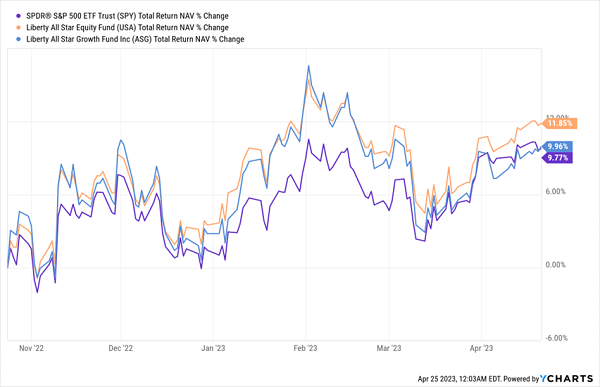

… And They’re Returning to Form

With both funds’ high yields, you’re not only getting big profits over the long term, but you’re also getting strong dividend payouts, too. And if you jump in now, you might get in at the very start of a return to form, where Liberty’s funds outperform the market, while diversifying your portfolio across over 250 positions between these two CEFs.

Get These 5 Monthly Paying CEFs (Average Yield: 9%) While They’re Cheap

There are only a couple of snags with USA and ASG: both pay dividends as a percentage of their portfolios, so those payouts tend to vary widely. Plus neither fund is a great bargain now, with ASG trading at just a 4.6% discount to net asset value (NAV, or the value of the stocks in its portfolio) and USA near par.

Luckily we can dodge both of those problems with the 5 CEFs I’ll show you here: they pay 9% dividends on average, and pay you every single month, too.

That way you don’t have to worry about managing unpredictable (or even quarterly!) payouts—you just sit back as the steady drip, drip, drip of 9% annualized payouts drops into your account every month.

Plus these funds are cheap, giving us a nice buy window to get in—and start tapping those vast monthly payouts without worrying that we’ve bought at the top (far from it!).

Recent Comments