Every Thanksgiving, I get together with my in-laws. They’re nice enough people … but if I’m being honest, some of them aren’t particularly interesting.

Conversations are invariably limited to just two or three topics. In fact, some people just have two or three particular stories they trot out.

I just sit there and nurse my second or third glass of wine, and try to look interested.

The stock market is kind of like that in 2022. There simply aren’t a lot of things to say about the stock market – rising rates and inflation have gutted Big Tech and other growth-oriented names, while commodity stocks and defensive plays reign supreme.

You surely don’t need to hear that story again. So here’s one you may not have heard before: There are a few stocks out there that are doing quite well … but don’t fit the mold of the typical bear market plays you’ve been hearing about lately.

Thinking Outside the Box Isn’t Easy

While low-risk dividend stocks have fared better as a group this year, the bottom line is that most assets in this category have simply done “less bad.”

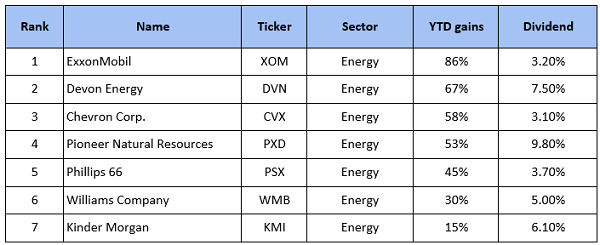

Consider the following list that shows the top 7 performers on U.S. stock exchanges that feature a trailing dividend of more than 3% and a market valuation of $10 billion or greater.

If you want to go all-in on energy, then I suppose this list is useful. But for those of us who care about diversification or are concerned that the sector’s recent outperformance can’t persist in the long term, this screen is about as useful as a hole in the head.

There’s more to life than just domestic energy stocks, and if you have any inclinations towards diversification you should consider a different approach.

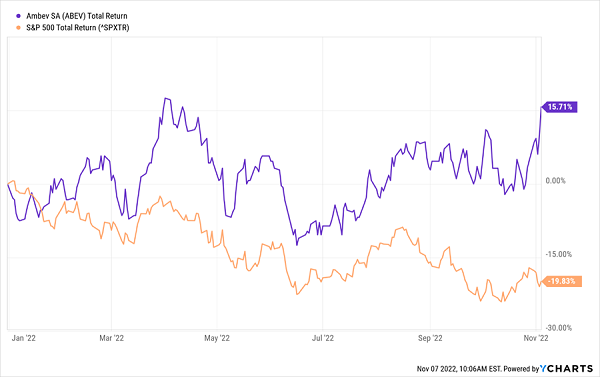

Take one of my favorite outside-of-the-box picks right now, AmBev (ABEV). It’s a consumer staples stock, but it also happens to be an emerging market company based in Brazil.

That’s certainly not the familiar kind of utility stock or MLP. And many investors may be leery of investing in a more aggressive market like South America when even some staples stocks in Western market have had a rough go of it this year.

But AmBev illustrates the power of thinking like a contrarian to unlock outperformance – in any market.

Here are the highlights:

- AmBev is rallying in November after strong Q3 earnings, with positive momentum in its local markets and expectations of more than 15% revenue growth this fiscal year.

- It has a wide moat thanks to lucrative licensing deals with megabrands including Busch, Michelob and Budweiser as well as soft drinks like Gatorade, Lipton and Pepsi.

- Year to date ABEV stock is up 15% from a total return perspective when you add up dividends and price performance.

Sure, Brazil was hit hard by a one-two punch with the pandemic and with political troubles that created uncertainty for businesses.

And it’s also worth noting that ABEV is a bit of a leap of faith. It only pays dividends once per year – but that dividend dropped in December of 2021, and the yield is calculated based on that roughly 11 cent payday at the time.

But this stock actually exited recession in 2022 even as the “R” word is being thrown about elsewhere. So by virtue of having already priced in the mayhem, stocks like ABEV are able to stand on their own merit.

You just have to be willing to think differently to see the opportunity.

Snag 15%+ Like Clockwork in Low-Risk Stocks

A year ago, it may have been wise to build a portfolio out of 10 high-yield MLPs. But there’s a risk that these old dogs won’t be able to learn any new tricks as we enter 2023.

It’s time for investors to start looking to the future, instead of the past. And that means rethinking what’s working on Wall Street.

We are in the midst of a “Great American Reset,” as my colleague Brett Owens likes to say. It’s a megatrend that’s obliterating Big Tech stocks, vanilla index funds and the conventional portfolio of blue chip dividend stocks.

But it’s also unlocking big-time potential for the investors who see this Great American Reset at work – and then adapt.

That includes rethinking domestic stocks like popular Blue Chips, but also taking a hard look at international dividend payers like AmBev.

Let us show you how to change course and reallocate your portfolio to the right stocks, at the right time.

We’ve just updated two important reports that will show you the way — 8 “Old Guard” stocks to SELL immediately, and 7 American Reset stocks to BUY for predictable and consistent returns of 15%+ per year, just like AmBev.

You can’t afford to keep looking backwards, wringing your hands over poor performers or wishing you got into trades that are now 12 months too late.

It’s time to take control of your portfolio, and enter 2023 on the right foot. Tap into the power of the “Great American Reset” and start seizing 15%+ annual returns in these top stocks offering hidden yields.

Recent Comments