I hate to see everyday folks grinding it out with “has-been” dividend payers like AT&T (T) when there are dozens of safe 7%+ yielders out there, many with incredible performance histories, too.

Trouble is, most people don’t know where to look. But I’ll take you on a personal tour of this overlooked corner of the market (and reveal the ticker of one of the best of these investments, which is throwing off a 10.2% yield as I write this) today.

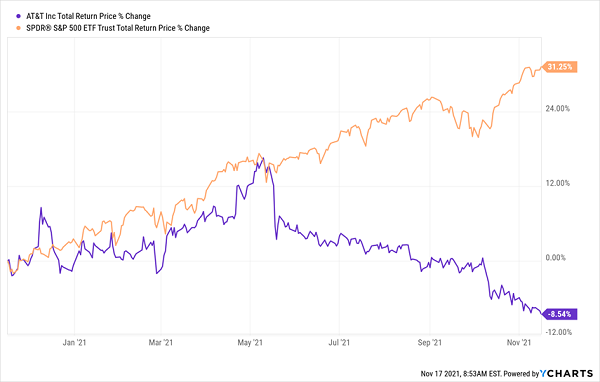

First, back to Ma Bell: sure, she yields a high 8.4%, but the stock is one of the biggest yield traps on the market! AT&T shares have actually posted an 8.5% loss in the last year, with dividends included. This at a time when the S&P 500 returned more than 31%.

AT&T Devours Its Dividend Twice Over

In other words, AT&T’s falling share price has matched its entire current yield! That makes the so-called “high” quarterly cash payouts from AT&T that drop into its shareholders’ accounts feel pretty hollow. At the least, we want our share prices to hold steady so we can enjoy our big dividends in peace.

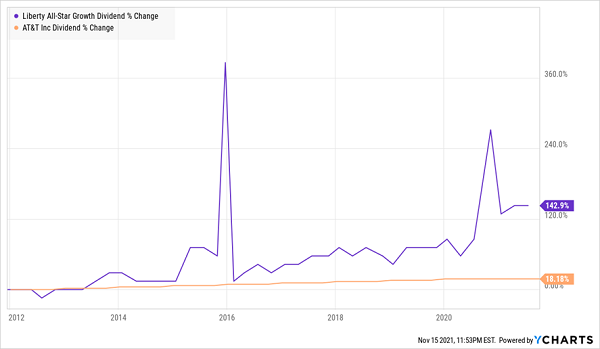

This, by the way, is what the top closed-end funds (CEFs) do. These unsung income-and-growth plays yield around 7% now, on average, but plenty of them, like the Liberty All-Star Growth Fund (ASG), do even better on the payout front: its managers just dropped a monster 34-cent-per-share special payout on shareholders, combined with a 5.9% increase to the fund’s regular quarterly dividend.

That will make 2021’s total yield on ASG a staggering 10.2%! And ASG’s dividend growth has demolished that of AT&T over the last decade, too.

Crushing AT&T’s Tiny Raises

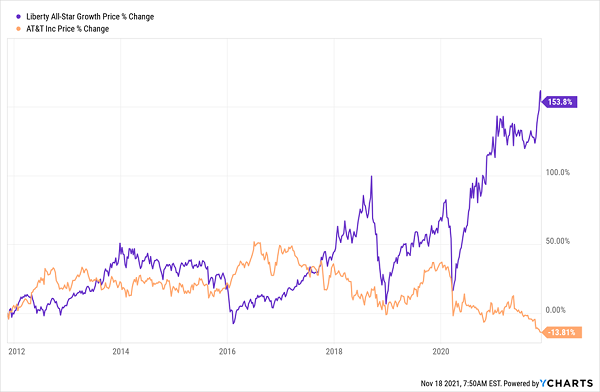

But ASG’s strength isn’t just in its higher yield; it’s also in preserving wealth. Over the last decade, as shareholders have enjoyed an 8%+ yield with ASG, they’ve also seen the value of their holdings more than double, with a 155% gain in the market price. AT&T, for its part, has eroded its investors’ cash:

ASG Shines, AT&T Loses the Connection

When you stop and think about it, this isn’t a big surprise. AT&T is a conglomerate, but it’s still not very diversified, focusing mainly on providing cellular service. But ASG spreads our money across firms like UnitedHealth Group (UNH), Visa (V) and Paylocity (PCTY), which are all top holdings. Unlike AT&T, these companies are in fast-growing sectors (health insurance, payment processing and payroll services, respectively).

This is the power of CEFs: the best ones, like ASG, give you a diversified, expertly managed portfolio. That’s much safer than tying a big part of your nest egg (and your dividend income) to a company that’s anchored in a single industry and can’t pivot to new opportunities as fast as ASG’s portfolio managers can (it’s literally a matter of a few clicks!).

The fund’s big payouts and history of fast gains also dispel the notion that you can have big dividends or a chance at big upside from a single investment, but not both.

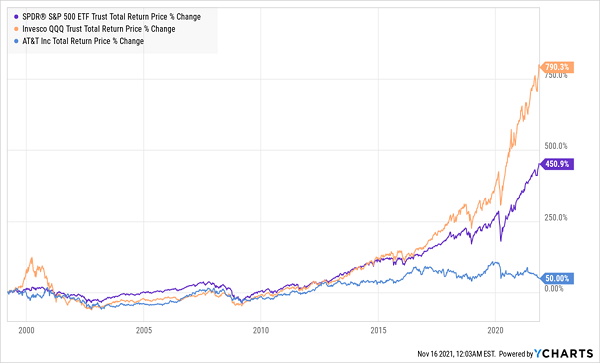

The classic example of this flawed “wisdom” is the Invesco QQQ Trust (QQQ), a NASDAQ 100–tracking ETF. QQQ has crushed the broader market and AT&T for years, but at the cost of lower dividends.

Crushing the Market, with Low Payouts

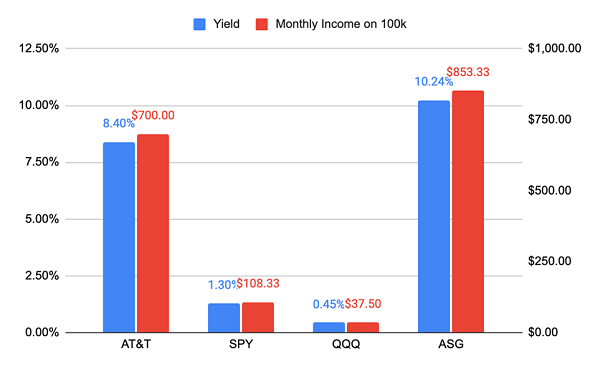

In a case like this, many financial advisors and pundits say would you should bite the bullet: you’re getting higher returns, so just accept that every $100,000 in QQQ gets you $450 a year in dividend income instead of the $1,300 from the S&P 500 or $8,390 from AT&T.

I say no, let’s have our cake and eat it too.

Big Income on the Road Less Traveled…

Source: CEF Insider

With ASG, we can get a basket of high-quality growth stocks and a whopping $853.33 per month (or $10,240 a year) in passive income from their dividend payouts. That’s more than AT&T, without the losses that come with investing in that stock—and it’s miles ahead of what the typical S&P 500 or NASDAQ stock would pay us.

And we aren’t sacrificing gains, either.

…and Big Returns, Too!

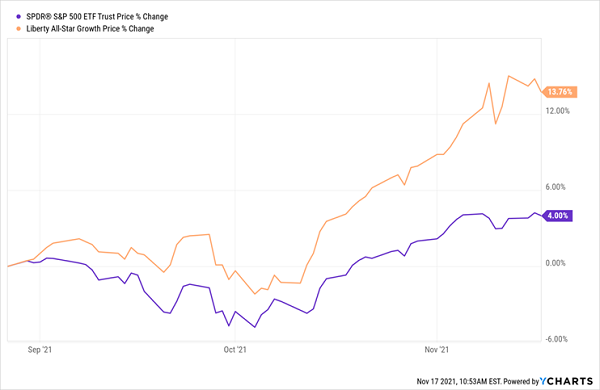

ASG has closely matched QQQ’s big gain over the last five years while giving us most of our return in the form of a dividend stream that QQQ investors can only dream of.

Urgent: Buy These 4 “Next ASGs” for 7.3% Dividends, 20%+ Gains

The only snag with investing in ASG now is its valuation—it trades at an 8% premium to net asset value (NAV) as I write, so investors are paying $1.08 for every dollar of the fund’s assets.

That’s a function of ASG’s popularity—in as much as an under-the-radar investment like a CEF can be popular! But ASG has traded at discounts before, as recently as September, so let’s put it to the side until its discount (inevitably) returns.

These discounts, by the way, are the key to profitable CEF investing. Buying when ASG’s discount hit a recent bottom of 2.2% in late August, for example, resulted in a market-beating 14% price gain as that discount flipped to a premium.

Discount Disappears, ASG Soars

While we wait for our ASG discount opportunity to return, we’re going to jump on 4 other CEFs that rank among my top buys now. They yield 7.3%, on average, but unlike ASG they’re cheap right now, with discounts so deep my forecasts are calling for 20%+ price upside from them in the next 12 months!

I’ve compiled all the details on these 4 income powerhouses in a new FREE report I want to give you now. Click here to get your copy and discover everything you need to know about these 4 cash machines, including their names, tickers, current yields, dividend histories and up-to-the minute discounts to NAV, too.

Recent Comments