After trading hours Monday, we shorted the S&P 500 again via the futures market – because, well, we couldn’t bare to be on the sidelines anymore.

We had HOPED for a rally that would carry the S&P towards the 1120 or 1130 mark. It did not materialize.

The reversal was sharp and swift. It was painful to hear the deflation bird whistling it’s sweet tune of collapsing asset prices – and not be short the market.

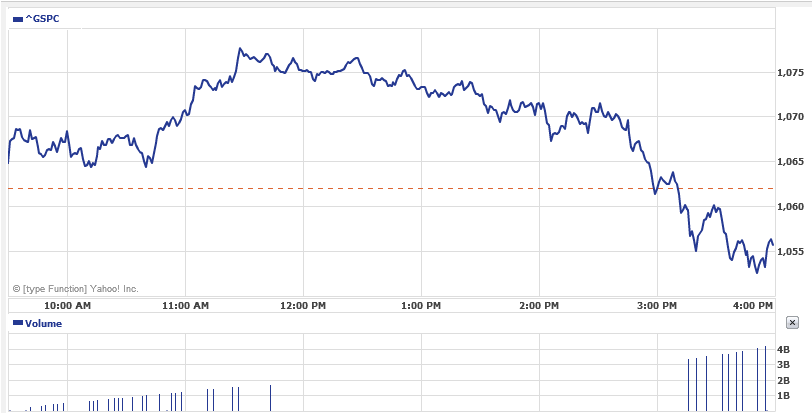

Yesterday, on cue with us going short, the market FINALLY rallied. This momentum carried into today – the S&P 500 made a run at 1180 at one point – until the “reverse skate” music came on, and the market actually finished DOWN for the day.

Is that ALL ya got, S&P 500?

Over the next few days, your guess is as good as mine as to which direction the market will go.

But my thinking is that with the S&P 500 sitting here at 1055, which do we stand a better chance of seeing first – 955, or 1155?

And that is the reason I think “short” is the way to go right now.

Recent Comments