We contrarians follow Wall Street analysts because we like to fade their opinions!

When most say Buy, we are cautious. There is nobody left to upgrade these shares.

When they slap a Sell label, we are intrigued. So you’re saying the next rating change will be an upgrade?

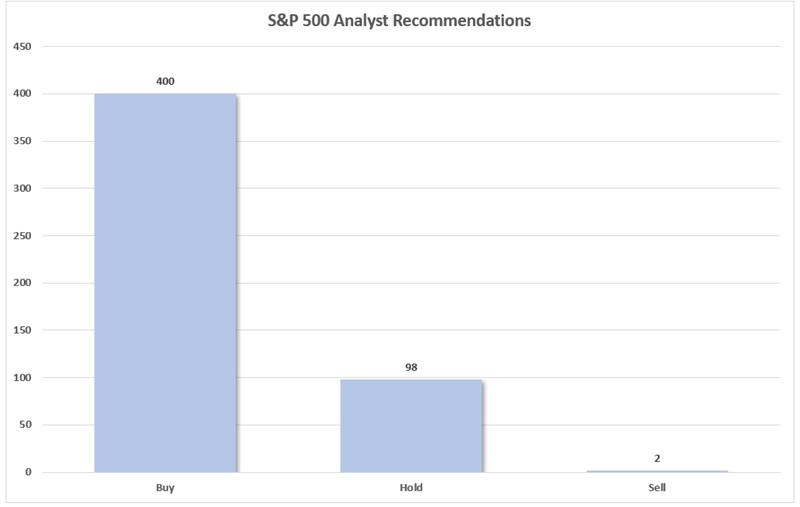

These slippery suits rate most stocks Buys because, well, that’s the business. As we speak, 400 of the S&P 500 (!) is rated a Buy!

Even at All-Time Highs, Analysts Say 80% of the Market Is a Buy!

Source: S&P Global Market Intelligence

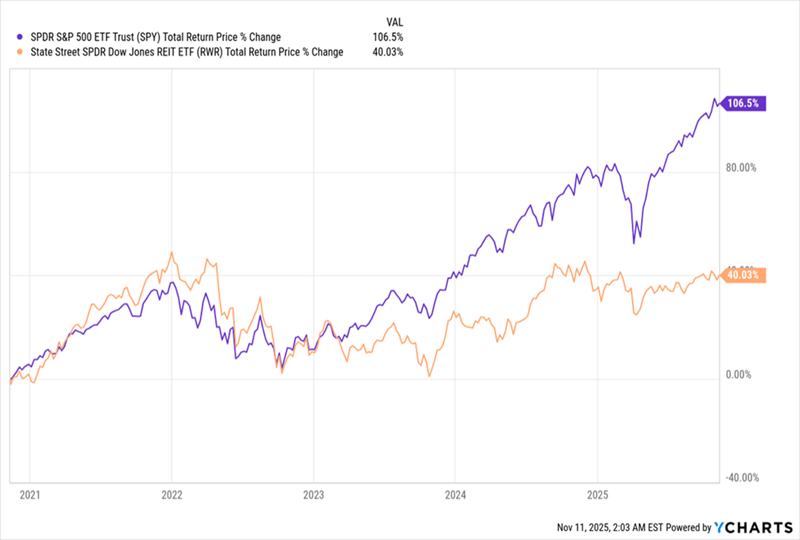

So let’s sift through the Holds and the Sells. Today we’ll sort through a four-pack yielding between 7.9% and 20.6%.… Read more

Recent Comments