Many investors are betting on social unrest, soon.

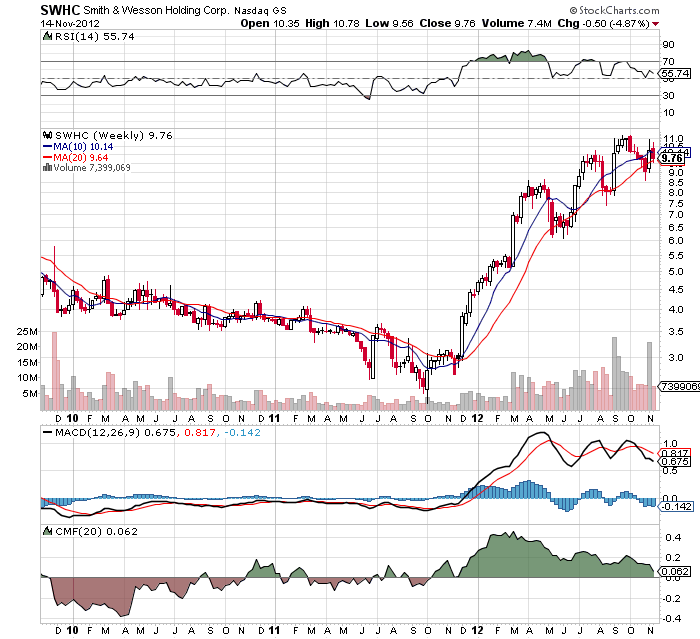

Gun manufacturers Smith & Wesson (SWHC) and Sturm, Ruger & Company (RGR) are close to new breakout highs – check the trend on the multi-year charts:

These two charts correctly predicted US election results long before the final votes were tallied. (via StockCharts.com – click to enlarge)

If you’re picking one to “go long” now, RGR probably looks better from a price perspective (it’s hitting new highs) and a money flow perspective (there’s a weak buying bias per the CMF). However the selling pressure on SWHC is subsiding. Both stocks were up big on the news of Obama’s win, and both are rising on high volume days.

Choose your weapon…either might be a fine choice (via StockCharts.com – click to enlarge).

One glaring difference between the two is the option premium being afforded SWHC. Check out these PHAT December premiums on puts and calls!

SWHC December 2012 option prices – whoa! (via Google Finance)

SWHC December 2012 option prices – whoa! (via Google Finance)

So you could buy SWHC for 9.76, and simultaneously sell the 10.00 calls and put 1.20/share in your pocket. That’s a gaudy return 12.3% in just 38 days(!) and it’d lower your cost basis to 8.56. Are you kidding me!?

But wait, there’s more – the 10.00 November calls expiring this weekend have a bid/ask of 0.55/0.70. Two more trading days to go, and you could pocket this yield and then put on the December trade.

The zombie apocalypse may be upon us – either way, it appears there’s a profitable way to spend our time waiting!

I have not yet executed this trade, but plan to take a serious look at it tomorrow morning.

Recent Comments