In this uncertain geopolitical environment, give me the sure dividend bet—like Texas running out of juice.

The state’s grid operator, ERCOT, has dished a record number of “conservation alerts” this year. Texans crank their air conditioners while new neighboring data centers guzzle electricity around the clock.

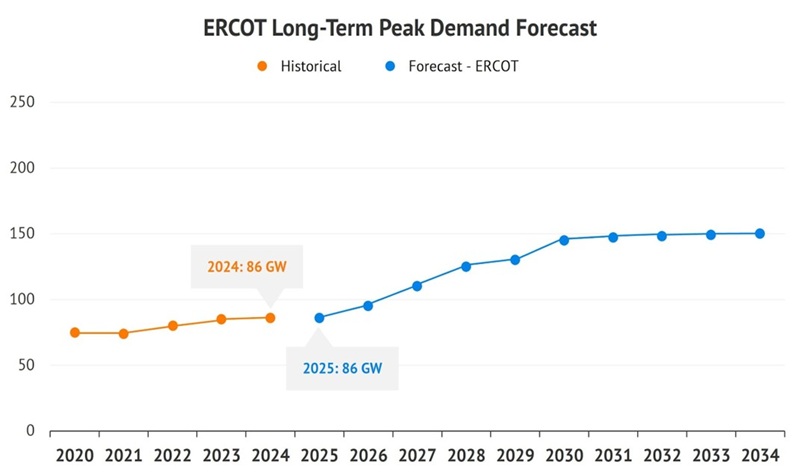

The grid is strained. The population is popping. New residents, factories and AI campuses are all plugging into the state’s aging grid at once. The math is no longer “mathing” and it’s about to get worse. ERCOT projects power demand will jump 62% by 2030—yikes!

And Oncor, the state’s largest utility, believes that is way too conservative.… Read more

Recent Comments