Small caps are (finally!) back, but most people are in the dark about how to tap them for serious dividends. But there is a proven way to do that—one that puts a rich 7.1% payout squarely on the table for us.

Everyone has missed this one. We’re going to dive into it today.

The main reason I hate to see people ignore small caps—especially now—is that, well, their time has come.

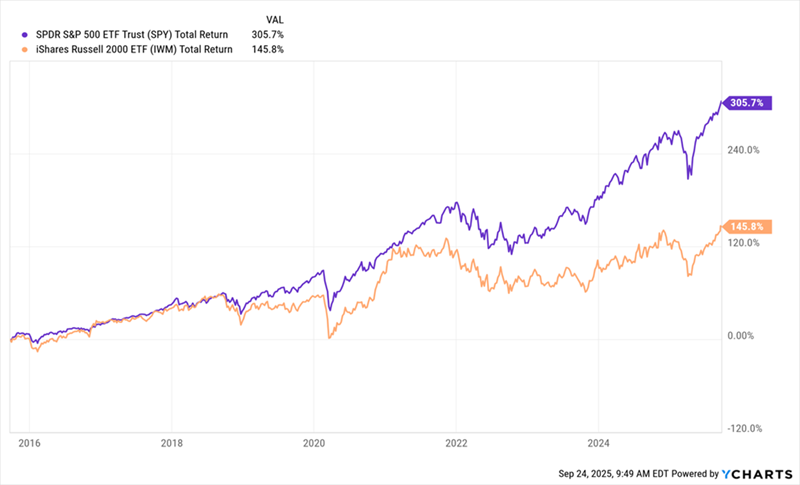

Small Caps Have Lagged for Years—And They’re Due for a Bounce

As you can see, It’s been a solid decade of small-caps delivering, well, small profits to investors. But it’s time for the script to flip.… Read more

Recent Comments