There’s one word that strikes terror into the hearts of mainstream investors: leverage.

But it really shouldn’t—and today I’m going to show you how to make sure you’re using leverage the right way, while minimizing your risk and tapping into some of the biggest gains (and dividends!) available to us today.

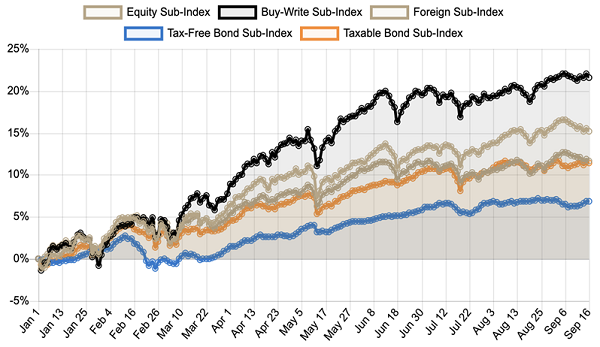

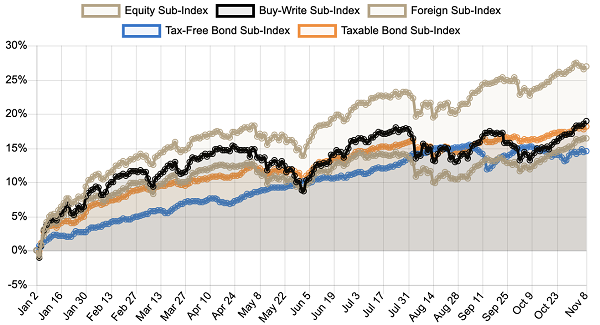

As you probably know, closed-end funds (CEFs) commonly use leverage to amp up their investment returns (and their dividends, which yield 6.5%, on average, as I write this). That’s fed their strong gains this year, as the Federal Reserve has kept interest rates low:

CEFs on a Tear

Source: CEF Insider

The CEF Insider Index Tracker has shown double-digit gains everywhere except in municipal bonds (which is normal, as we buy munis for their stability and tax-free dividends).… Read more

Recent Comments