Is it time to buy the dip on these dividends—which by the way yield between 5.3% and 7.6%?

Yes, the market-at-large has bounced quite a bit. But these payers remain mired in the bargain bin.

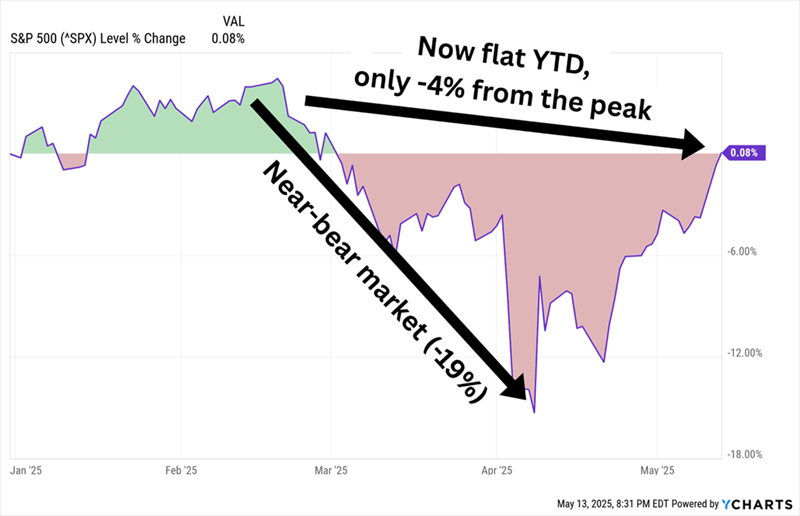

Vanilla investors who only focus on the S&P 500 have serious FOMO. They worry that they missed the pullback. The best buying opportunity, at least in terms of the plain “SPY” ETF owned by most of America, lasted only a week or two:

The S&P 500 Dip Didn’t Last Long

But there are still cheap dividend payers that haven’t rallied alongside the popular names. At least not yet.… Read more

Recent Comments