What if I told you we’ve got a shot at grabbing 2 cheap funds that kick out huge dividends—I’m talking 7.5% and higher—and those payouts are tax-free too?

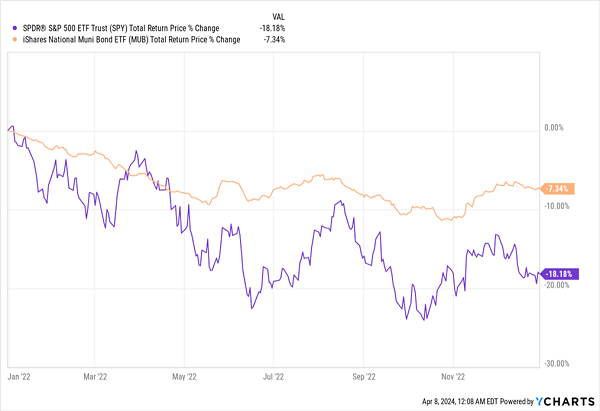

What I’m talking about might be the last bargain available to us in this (overheated) stock market. Stocks’ roll higher since the Liberation Day tariffs were put on hold has meant fewer income opportunities from S&P 500 names (as yields and share prices move in opposite directions).

That’s added even more appeal to the tax-free dividends (two, in particular) we’re going to talk about below. They deal in municipal bonds, which are issued by state and local governments to fund infrastructure projects.… Read more

Recent Comments