I’m annoyed with this bubbly stock market. It’s making it nearly impossible for regular people to find decent dividends.

Sure, we’ll always take upside, and despite overdone drops due to the coronavirus, the market has handed us a 4% total return since the New Year, building on the 31% it delivered last year.

But where the heck do we invest our gains?

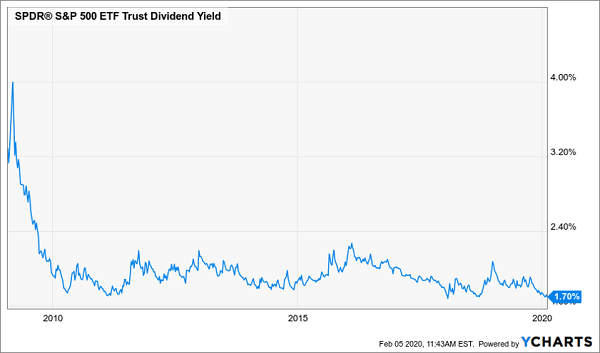

Truth is, if you want to deploy cash into higher payers, you’re in for a tough slog: the S&P 500 yields just 1.7% today, a low we’ve only seen a couple times since the financial crisis.

US Stocks Rarely Pay so Little

Treasuries?… Read more

Recent Comments