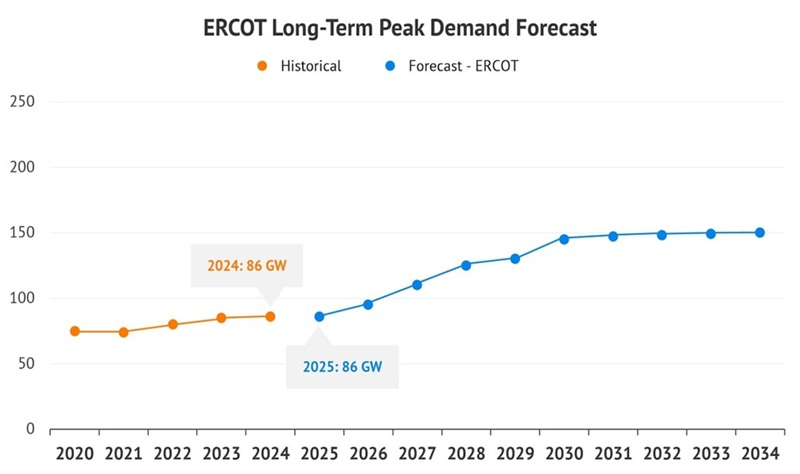

Utility stocks have been on a roll as more people come to see them as a way to play AI’s bottomless power demand.

Let me say off the top that this does not mean the “AI-power trade” is played out. Far from it.

But it does mean we need to pick our spots when investing in the sector. To that end, I’m going to give you my two-part strategy on how to approach utility stocks now.

The first part: We go with 8%+ paying closed-end funds (CEFs) to play this sector. There’s a simple reason for that: Utility CEFs pay far higher yields than individual utilities or ETFs.… Read more

Recent Comments